Pulses production at a record 26.96 MMT Import dependency of pulses came down from 19 percent in 2013-14 to around 9 percent in 2021-22; projected to drop down further to around 3 percent by 2030-31

Pulses are an important group of crops in India, due to their high protein levels and consumption demand. They are also important for trade as they yield profit and financial gains, being a large part of exports.

| Indian pulses at a glance | ||

|---|---|---|

| India’s pulse production | India is the world’s largest producer of pulses (25% of global production) | |

| Pulse consumption | Largest consumer with 27% of global consumption | |

| Pulse imports | Largest importers accounting for 14% of global trade of pulses | |

| Major pulse crops | Gram (41% share), Tur (16% share), Urad and Moong are the major pulse crops grown in India | |

| Top producing states | Rajasthan, Madhya Pradesh, Maharashtra, Uttar Pradesh, and Karnataka are the top producing states of pulses in India | |

| Geographical conditions | Temperature: 20-27c, Rainfall: 25-60cm, Soil Type: sandy - loamy soil | |

| Cropping pattern | These crops are mostly grown in rotation with other crops | |

| Government schemes | National Food Security Mission for Pulses, Pulses Development Scheme, and Technological Mission on Pulses | |

India is inching towards Aatmnirbharta through sustained efforts by the government. India is the leading producer, consumer, and importer of pulses in the world. In recent years, the government has initiated several measures for boosting pulses production in the country with the aim of reducing the dependence on imports. As a result, the pulses production is steadily growing. There has been an increase in production from 19.26 million ton in 2013-14 to 27.81 million ton in 2022-23

Area, production and productivity

India is the largest producer (25 percent of global production), consumer (27 percent of world consumption) and importer (14 percent) of pulses in the world. Pulses account for around 20 percent of the area under foodgrains and contribute around 7-10 percent of the total food grains production in the country. Though pulses are grown n both Kharif and Rabi seasons, Rabi pulses contribute more than 60 percent of the total production. Gram is the most dominant pulse having a share of around 40 percent in total production followed by Tur/Arhar at 15 to 20 percent and Urad/Black Matpe and Moong at around 8-10 percent each. Madhya Pradesh, Maharashtra, Rajasthan, Uttar Pradesh and Karnataka are the top five pulses producing states. Productivity of pulses is 764 kg/ha.

Imports

| Pulses (Qty in Million Ton) | ||||

|---|---|---|---|---|

| Year | Imports | Exports | Production | |

| FY’23 | 2.52 | 0.77 | 27.81 | |

| FY’22 | 2.77 | 0.41 | 27.3 | |

| FY’21 | 2.46 | 0.29 | 25.46 | |

| FY’20 | 2.97 | 0.23 | 23.03 | |

| FY’19 | 2.59 | 0.28 | 22.08 | |

India imports dry peas and lentils mainly from Canada and the United States of America. Australia and Russia are the major suppliers of chickpeas to India. Large share of pulses, including urad bean, mung bean, pigeon peas is imported from Myanmar. Importers favour Myanmar because it offers varied pulses with qualities similar to those produced domestically, low freight rates, and relatively fast delivery.

During the last five years, an overall declining trend in the import of pulses has been witnessed. The volume of imports fell to the lowest level of around 2.46 MMT in 2020-21, which is the lowest in the last ten years. The government has put a huge focus on the import of tur and urad amid fears of a fall in their production. According to the second advance estimate of the agriculture ministry, the tur production for 2022-23 (July-June) is at 37 lakh ton compared to the actual production of 42 lakh ton last year. India meets nearly 15 percent of its domestic demand for pulses from imports. India is in advanced talks with Brazil for the import of urad, to boost domestic supply and keep prices under control, and also reduce its dependency on Myanmar.

Free import policy for key pulses extended by a year

To ensure adequate domestic supplies of pulses, the government extended its decision to keep a ‘free-import’ policy for two varieties – tur and urad by a year, till March 31st, 2024. The government in March 2022 had extended the ‘free-import’ policy for two varieties of pulses by a year. Under the regime, introduced in May last year, specified pulses can be imported without any quantitative restrictions.

In 2021 India signed an MoU with Mozambique for import of 0.2 MT of tur annually for five years. India also entered into a MoU with Malawi for the import of 0.05 MT tur per annum, till 2025. According to a notification issued by the Directorate General Foreign Trade, import of pulses are allowed through five ports – Mumbai, Tuticorin, Chennai, Kolkata and Hazira. However, all the import consignments need to have the ‘certificate of origin’ issued by the respective countries.

Exports

There is a lot of demand for Indian pulses, especially desi chickpea, kabuli chana and lentils among others, from countries such as Bangladesh, Sri Lanka and Nepal. During the April-January period of the current financial year, pulses exports in terms of volume were up 80 percent at 5.39 lakh ton(lt). In the same period a year ago, exports were 3 lt. India’s pulses exports for the financial year will likely scale a new record on rising demand for chickpea and lentils from countries such as China, United Arab Emirates (UAE) and Bangladesh. Along with the rising preferences for vegetarian and vegan foods globally, and being the largest producer of varieties of pulses, India can cater to meet the increasing global demand for pulses.

Government intervention in pulses production

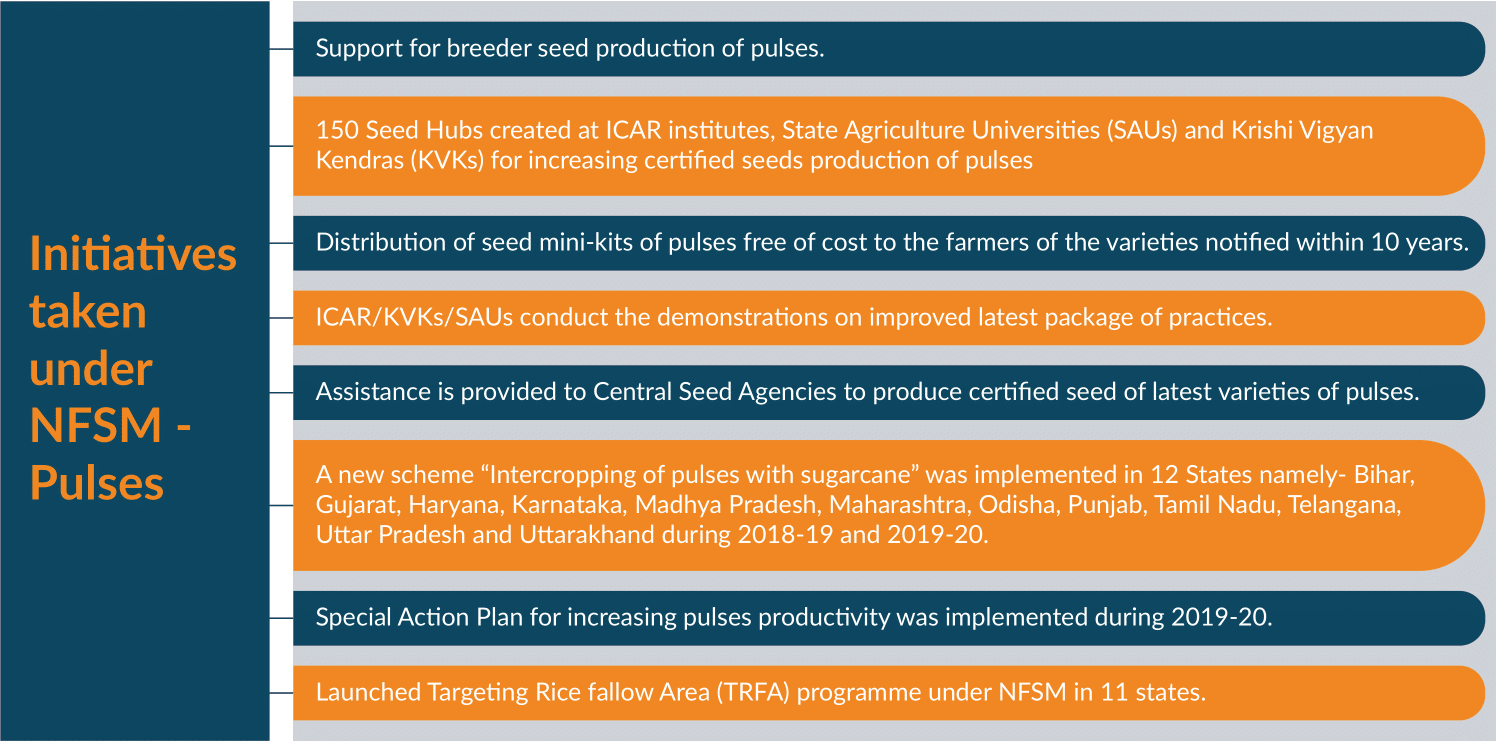

To increase the production of pulses, the National Food Security Mission (NFSM) -Pulses programme is being implemented in 644 districts of 28 States and Union Territories (UTs) of Jammu & Kashmir and Ladakh. Under this program, incentives are given to the farmer for cluster demonstration, seeds distribution and production of certified seeds of High Yielding Varieties (HYVs), farm machinery/ tools, efficient water-saving devices, plant protection chemicals, nutrient management, soil ameliorants and training to the farmers.

Global availability in the coming year is expected to be better with the increase in production expected from Myanmar, where arrivals have started. Additionally, the intentions of sowing pulses in African countries indicate an increase in coverage area, making produce available from August 2023 onwards. This will keep the flow of pulses imports, consistent and can address concerns related to availability. There were a few suggestions related to speedily increasing domestic pulses production i.e. port clearance, exploring new geographies to minimise import dependency on a few countries, extension of a stable policy regime. The government conducts regular interactions with pulses associations in India and at major exporting countries to assess the pulse of pulses industry and initiate necessary policy measures.

The GOI also makes use of a variety of interventionist measures to manage the domestic pulses market situation in the name of farmer support, self- sufficiency, and food security. In an effort to control its domestic pulse market, India has continued to maintain politicised export controls, minimum support price, export subsidies, and a highly restrictive import regime consisting of quantitative restrictions and tariff hikes. All of these government measures, in conjunction with a thin market dominated by India’s domestic situation where production is dictated by monsoon rains and weather conditions, make for a highly volatile market both domestically and internationally. This has been seen most recently with India’s continually changing trade policy for pulses over the past few years.

Going forward

The demand for pulses is projected to grow at about 2 percent per year on account of the increase in population and growth in direct demand. This growth rate is almost four times the growth rate experienced in the domestic production of food grains including pulses during the last decade. This has created serious imbalances between domestic production and demand, which for some time was met by liquidating stocks and cutting down on exports. If the growth rate of domestic production of pulses fails to rise to the required level, it would result in an increase in dependence on imports to meet the domestic demand. Policy initiatives must lead to efficiency and help in maintaining a balance between domestic production and demand. If we strive to achieve these potential yield levels, then the increasing demand requirement of the country can be met in the future. To give the much-needed fillip to pulses production and increasing the production by about 5 million ton over the next seven years, diversion of area from rice may be necessary. If this expansion of area has to come in irrigated areas, a concerted policy is required to ensure remunerative price signals for pulses. Therefore the government is giving emphasis on pulses through various developmental programs and has been significantly increasing the minimum support price for most pulses. While the government and industry have come a long way in the sustenance of pulses, more will need to be done to ensure long-term sustainability.