The Novel Coronavirus (COVID-19) pandemic has had severe health and economic impact in almost all countries. In the immediate aftermath, India and several other nations have prioritized citizen health over economic activity to contain the spread.

The COVID-19 pandemic surfaced in India and sparked off a crisis of significant proportions. By the third week of March 2020, this began impacting economic activity with the announcement of a nationwide mandatory and complete lockdown.

Economic activities have come to a standstill and are returning to the new normal in a staggered manner since April 20, 2020. It is expected that any kind of demand recovery will take many months as overcoming challenges in the form of getting migrant labourers back into manufacturing / construction zones, resetting disrupted supply chains and overcoming liquidity constraints of particularly towards working capital needs, cannot be accomplished overnight.

The lockdown, which undeniably was the need of the hour, was also one of the severest responses to Covid-19 worldwide and has singularly led to depressed demand across sectors.

- STEEL SECTOR

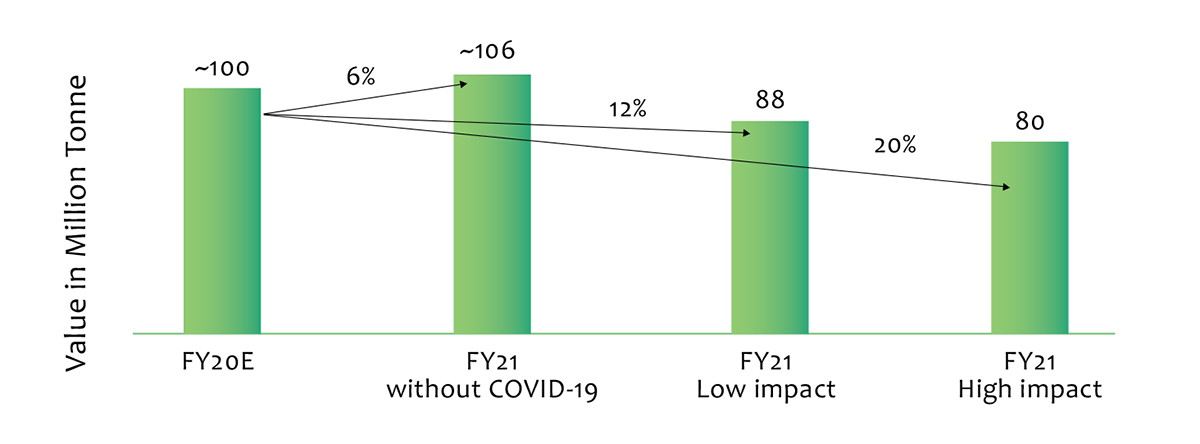

Plummeted demand in end-use segments has impacted the steel industry and trade estimates show a slump in domestic steel demand in the range of 12% to 20% in FY 2020-21. The slowdown in economic activity in key-end use sectors, primarily construction, infrastructure and automotive, which accounts for nearly 72% of total steel consumption, has led to a sharp fall in steel demand.

Fig. 1: Steel Demand Forecast

With the decline of domestic consumption, Indian steel mills are focusing on exports for at least six months and are currently producing exclusively for exports taking advantage of the drop in local iron ore prices and imported coking coal rates, together with a weaker Indian currency will make exports more competitive.

Mills are gearing up for an increase in demand from overseas buyers as the COVID-19 outbreak has choked supplies from global steel producing companies especially China.

China is recovering from a brutal lockdown and has been slowly returning to full- scale production of crude steel. So non-integrated steel mills in China and southeast Asia that depend on Chinese crude steel are now turning to imports. In China and South Asia, there’s a lot of demand for semis while in markets in Europe, where the entire steel industry has stopped functioning, there’s a demand for finished products.

| MAJOR INDIAN STEEL EXPORTS | |

|---|---|

| COUNTRY | CARGO |

| China & South East Asia | Pig Iron,Billets |

| Europe (Germany, Denmark, Italy, Spain) | Plates, Billets, Rail Blooms, Coils (CRC) |

| Middle East | Plates, Billets, Rail Blooms, Coils (CRC) |

- CHALLENGES FOR EXPORTS

1. Realisation Decline

Currently, steel makers are exporting at prices they are able to clutch, as keeping cash flow is more important in the current scenario and companies are not looking at the margins over exports. Trade estimates, the realisation to fall about 15% Y-O-Y as export prices are down about 25% compared to FY 2019-20.

2. Congestion At Ports

As more manufacturers focus on exports, there is higher traffic congestion at the ports which are already operating under reduced capacity due to lockdown restrictions.

- JMB LEVERAGE - STEEL EXPORTS

The J M BAXI GROUP’s multipurpose terminal at Paradip Port, Paradip International Cargo Terminal (PICT) is completely geared up to handle the increased traffic. The terminal has a quay length of 450 meters and depth of 17.0 meters capable of handling Cape-sized vessels upto 1,25,000 DWT.

- FERTILIZER SECTOR

Fertilizer sector falls under the Essential Commodities Act and hence was exempted from lockdown restrictions. But the lockdown posed a number of challenges for the continuous operation of fertilizer plants as listed below :

- Operations with limited manpower and sourcing of raw materials.

- Availability of labour at plant sites for loading and unloading at destination points.

- Limited storage capacity resulting in pressure on the evacuation of material.

- Availability of consumable materials such as bags and chemicals.

- Ministry of Finance put monthly and quarterly restriction on the disbursal of funds as part of its cash management measures. Industry was already starved of its working capital due to huge unpaid subsidy dues.

- SALES

Despite lockdown measures, the demand for fertilizers had peaked predicting the considerable monsoon and demand from dealers to stock up in anticipation of kharif season. Further, migrant workers who have returned to rural areas are also the participants of the agrarian economy and are expected to engage in more farm activities thus pushing for more fertilizer demands.

This trend is expected to continue increasing, with offtake set to remain strong through the kharif season, (April to September). Fertilizer sales increased by ~ 45% in April, 2020. (Refer table below)

| ALL INDIA FERTILIZER RETAIL SALES (LAKH TONNES) | |||

|---|---|---|---|

| Month | 2018-19 | 2019-20 | %Growth |

| October | 48.37 | 45.17 | -6.62 |

| November | 63.26 | 73.84 | 16.72 |

| December | 70.86 | 87.08 | 22.89 |

| January | 58.04 | 64.5 | 11.13 |

| February | 30.39 | 46.61 | 53.37 |

| March | 24.6 | 28.96 | 17.72 |

| April | 14.17* | 20.56** | 45.1 |

| *April 2019, **April 2020 Source: Department of Fertilizers | |||

The industry managed with the supplies in Q1 (FY 2020-21) due to carried forward inventories of Q4 (FY 2019-20) which was an off-season period.

- IMPORTS

With manufacturing units working on lower capacity and fertilizer sales in India typically peaking in July-August with the onset of the monsoon season, Imports are expected to surge through Indian ports.

Paradip International Cargo Terminal has geared up to meet the challenges faced due to the lockdown and expected to handle imports of 1 million MTs of finished fertilizer for bagging and onward dispatch to the hinterland.