- eBL vs Paper BL

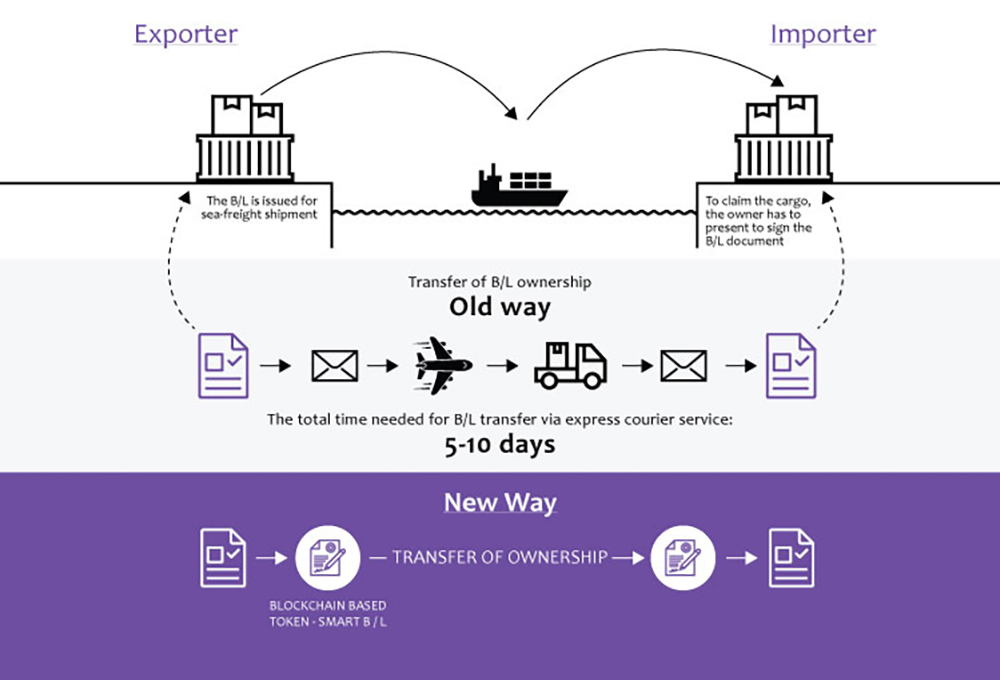

The Bill-of-Lading (BL); the backbone of global trade documentation; has three important roles - receipt of goods, contract of carriage, and document of title.

This critical document helps trade contracts be executed through a complex series of steps (hops) that it must undertake along its journey from shipper to receiver, and undoubtedly causes beginners and professionals alike a few sleepless nights learning what is often depicted as a 12+ step process. Taking the process out of the classroom and into the real world, where 3 original Bills of lading traverse each of these steps across continents, legislative and regulatory frameworks and countless stakeholders, does NOT make things easier!

This is where electronic Bill-of-Lading (eBL) providers are hoping to make a difference. The Cambridge Business Dictionary and Longman Business Dictionary defines e-Bills simply as “a B/L that is sent and stored by a computer rather than on paper”. BL is only one of the several documents though that must be implemented in an electronic format to bring full digitalisation to the shipping and logistics industry. Such digitalisation will benefit all parties involved: customers will see a significantly improved experience; regulators – and especially customs authorities – will benefit from improved targeting; container carriers will become more efficient; and vendors will be able to sell their solutions to many more industry participants.

HUGE Value benefit - Research indicates the total cost of processing paper bills is almost three times that of eBLs. At a global economic growth rate of 2.4% through 2030, one study forecasted that the industry can potentially save more than $4 billion per year if just 50% eBL adoption is achieved.

- Is this a ‘Futuristic’ or ‘Utopian’ idea?

Over 20 years ago global carriers attempted to move to ecommerce and digitising the Bills of Lading. Some third party technology providers even spent years trying to get the solution right; but alas it was an idea whose time had not come.

Even today though we talk casually about eBLs and eDOs - both documents are still printed either in the carrier’s office or (at best) printed remotely in the shipper’s office. Despite huge risks with paper as a medium for such critical documents that can be lost, tampered with, delayed in transit, carry contagion, add to carbon footprint etc., we have thus far cited legal and policy framework as a reason not to digitise the BL and other trade documents; but its certainly not a futuristic vision; colleagues in global trade have been trying in vain to make this happen for over two decades now.

The COVID-19 pandemic in this context is proving to be a catalyst for the carriers, banks, governments and trade in general reigniting the need to move to a paperless regime for documents.

- Legal, Liability And Policy Framework

Carriers liability and Legal recourse of the title owner.

With coverage of the IG P&I (International group of P&I clubs) which underwrites liability for 90% of the global maritime tonnage, electronic documents and its transfer has been legally protected for over ten years now.

There are however only six globally recognised independent providers of digital documents who have liability cover from IG P&I clubs. essDocs, Bolero, eTitle, edoxOnline, Wave, and CargoX. There are also a couple of Carrier owned platforms like Tradelens, and GSBN that are gearing up to offer wholly digital documents and document transfer.

The United Nations Commission on International Trade Law (UNCITRAL), plays an important role in developing a framework in pursuance of its mandate to further the progressive harmonization and modernization of the law of international trade.

In the field of e-commerce, UNCITRAL has released four texts in the last two decades or so. The first legislative text was the Model Law on Electronic Commerce (1996). Subsequently, Model Law on Electronic Signatures (2001), the Electronic Communications Convention (2005) and more recently, the Model Law on Electronic Transferable Records (2017). These texts intend to facilitate e-commerce transactions by establishing rules to allow the electronic equivalent of paper-based documents to be legally recognised, thereby removing obstacles encountered by the use of electronic means.

On the lines of the UNCITRAL model laws each nation was expected to prepare its own framework and the Information Technology Act was enacted in 2000, by India, as amended to the Information Technology (Amendment)Act 2008. An Act to provide legal recognition for transactions carried out by means of electronic data interchange and other means of electronic communication, commonly referred to as “electronic commerce”, which involves the use of alternatives to paper-based methods of communication and storage of information, to facilitate electronic filing of documents with the Government agencies and further to amend the Indian Penal Code, the Indian Evidence Act 1872, the Bankers’ Books Evidence Act 1891 and the Reserve Bank of India Act 1934 and for matters connected there with or incidental thereto.

CHAPTER III of the Information Technology Act details about Electronic Governance and provides interalia non discrimination to electronic documents as long as the document is

- Rendered or made available in an electronic form; and

- Accessible so as to be usable for a subsequent reference.

Chapter 111 also outlines the legal recognition of Digital Signatures. The various provisions further elaborate on the use of Electronic Records and Digital Signatures in Government Agencies.

And so at least from the year 2000 India has had the base legal framework to support electronic commerce and electronic documentation and electronic contracts of carriage. Other relevant Acts- Indian Contract Act 1872, Sale of Goods Act 1930 and the Indian Evidence Act 1872 - all have landmark judgements citing that electronic documents, contracts and evidence have admissibility and will be carefully assessed by the courts for authenticity just as paper documents and evidence is assessed.

Indian Customs also is progressive and moving closer to a paperless system, and right from the start there is no demand for original paper B/L for customs clearance in India.

- Emergence Of Blockchain As A Secure Transfer

A public blockchain-based B/L platform not only inherits advantages over existing e-Bills but also overcomes most of its disadvantages. It consistently hits all of the tests for electronic document exchange.

Neutrality, immutability therefore transparency; authenticity and validity of electronic signatures as well as coverage under the legal framework.

Further several blockchain - based fintech platforms are being created by consortiums of global banks who have integrated to receive digital documents and run their trade finance divisions with them.

- Portall And The Digital Documentation Drive In India

As the first lockdown hit; and cargo was stuck in ports across the country due to documents being held up at various points - Portall joined hands with Indian Ports Association (IPA) and with the various trade associations to play an important role in solutioning. For obvious reasons ie., carrier’s liability in the scenario of three original paper BLs - only a few carriers were able to offer the above solution and not for the long term. Portall thereon undertook to study the global options available and signed on with CargoX, one of the six global companies who offer wholly digital documentation exchange platforms for trade. One more of the top six will shortly join us in our curated marketplace P-CaSo which has been latched on to PCS1x.

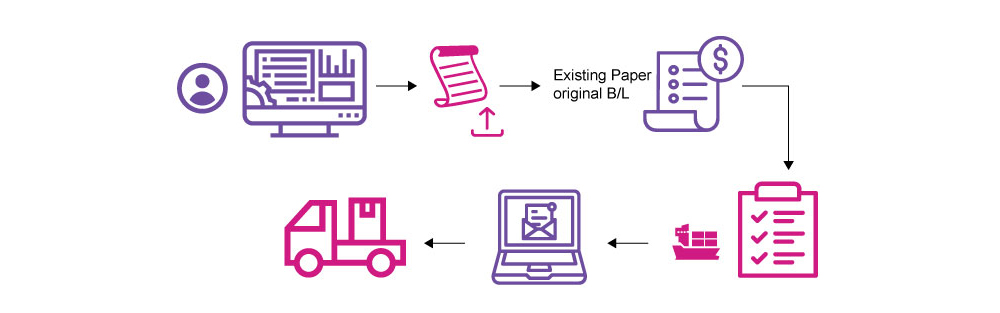

Key critical changes were effected in the PCS1x as requested by Brihanmumbai Custom Brokers Association (BCBA), Federation of Freight Forwarders’ Associations in India (FFFAI) and other trade bodies, in order to create new functionality quickly - for customs brokers to upload the scanned paper Original Bill of Lading (OBL) front and reverse and submit with a request for e-invoice and eDO

Carriers can verify and (with the Know Your Customer (KYC) related security of the PCS1x user) release goods to the Customs Broker (CB) against a Letter of indemnity or letter of assurance - which can also be uploaded and shared via PCS1x.

- P-CaSo Latch-On Services Offered Via PCS1x

-

eBL - Public neutral block

chain based BL and trade document exchange, for use by Carriers and

Exporters.

eBL - Public neutral block

chain based BL and trade document exchange, for use by Carriers and

Exporters.

-

Trade Documents - Trade

documentation drafting and sharing – for use by banks, importers

and exporters.

Trade Documents - Trade

documentation drafting and sharing – for use by banks, importers

and exporters.

-

Certificate of Origin -

Certificate of Origin services with authentication for use by Chambers

of Commerce and Exporters.

Certificate of Origin -

Certificate of Origin services with authentication for use by Chambers

of Commerce and Exporters.

* P-CaSo also offers trucking and eVGM services via established digital service providers

- Getting Traction, Speeding Adoption Of Digital Documents

Despite the clear win-win of this proposition, lack of knowledge; worry of claims and lack of clear governmental drive to digitising documents still keeps many players in global trade feeling locked in to paper. Educating people is empowering them to experiment and make the shift in a step by step approach.

Each contract of sale in global trade is a private contract and all parties (including banks) can agree to adopt a paperless transaction. Once consensus is reached; the platform can be tried and experienced to build confidence, until such time (inevitably) that governments mandate electronic documentation and ban paper. Early adopters will gain and pass on the value to their customers and vendors, they will also participate in the maturing of the business models and delivery mechanisms of digital trade documents.

- Conclusion

For India to lead with fastest adoption, certain mandates may be required as also advisories and policy guidelines to banks, carriers and other stakeholders to embrace the move. Most recently post-COVID-19; The International Chamber of Commerce (ICC), has called on governments to enable an “immediate transition” to paperless trading.

In a direct call to action, the ICC has requested governments and central banks to take emergency measures to void any and all existing legal prohibitions on the use of electronic trade documentation, removing requirements for key trade documents such as bills of lading, bills of exchange, promissory notes and commercial invoices to be presented in paper format.

There is no better time than now for the trade and governments to work together and transform the paper intensive world of global trade to a sleek digital experience for all.