India’s rising energy concerns

India is the world’s third largest energy-consuming nation, and a significant part of its energy requirements are met through oil secured largely through imports. India’s share in global energy consumption is set to double by 2050. Rising energy demand and high reliance on imports pose significant energy security challenges. It also leads to massive foreign currency outflow. Further, excessive use of fossil fuels leads to higher carbon emissions.

Domestically produced ethanol is a potential opportunity to reduce reliance on oil imports by blending it with conventional fossil fuels for consumption.

What is ethanol?

Ethanol is one of the principal biofuels, which is naturally produced through the fermentation of sugars by yeasts or via petrochemical processes such as ethylene hydration. Apart from being an alternative fuel source, it is used as a chemical solvent and has medical applications as an antiseptic and disinfectant.

Currently, most of this ethanol is made from molasses, a by-product of sugarcane. The production process uses a lot of water. Every litre of ethanol needs 2,860 litres of water.

Ethanol blending

India started blending ethanol in petrol, on a pilot basis in 2001. However, the Ethanol Blending Programme (EBP) was formally launched in January 2003. In 2006, the Ministry of Petroleum and Natural Gas, directed the Public Sector Oil Marketing Companies (OMCs) to sell 5 percent EBP in 20 states and 4 union territories. Even though the programme started early, it faced multiple inherent challenges leading to slow adoption and growth.

Various challenges leading to unsatisfactory performance of EBP -

- Non-inclusion of grain conversion to ethanol, restricting grain-based distilleries to participate in EBP.

- High taxation rate of ethanol at 18 percent

- Procurement challenges due to infrastructure and multiple tenders in a given supply year.

- Dissatisfactory ‘take home’ price and irregular pricing for ethanol suppliers.

- Limited availability of feedstock

| To overcome challenges, the government introduced the following key stimulus packages to the EBP: | |||||||

|---|---|---|---|---|---|---|---|

| 2014 - 2015 | Re-introduced administered price mechanism for ethanol to be procured under the EBP. Directed oil PSEs to set up bio-refineries. Tendering process simplified. |

||||||

| 2016 | IDR act amendment to clarify the roles of Central/ State Govt.for continuous supply of ethanol for blending with petrol. | ||||||

| 2018 - 2019 | Extending financial assistance in the form of interest subvention at 6 percent per annum or 50 percent of the rate of interest charged by banks/financial institutions whichever is lower for five years including a one-year moratorium. | ||||||

| 2020 | GST on ethanol lowered from 18 percent to 5 percent. Alternate source for production of Ethanol - Allowed conversion of heavy molasses, sugarcane, juice and damaged food grains to ethanol. Extension of EBP to the whole country exceptAndaman Nicobar and Lakshadweep. One- time registration of ethanol suppliers for long term, including giving them visibility of ethanol demand for 5 years. Additional differential excise duty of rupees two per litre on unblended fuel from October 2022. Notification for target of blending 20 percent of ethanol in petrol by April 2025. |

||||||

Effects of reforms

India has achieved the target of 10 percent ethanol blending five months ahead of the November 2022 targetwhich translates into:

- Reduced import bill and increasing self-reliance - cumulative foreign exchange impact due to EBP is over US $ 3,206 Mn during the period of 2014 to 2021.

- Green House Gas emissions reduction of 2.7 Mn ton (10 Mn litre of ethanol blended petrol can save around 20,000 ton of CO2).

- Protecting the economic interest of farmers – OMCs have paid sugar mills nearly US $ 5,079 Mn for ethanol supplies in the last seven years, which has helped mills clear farmers’ dues. Additionally, decisions have been taken to buy damaged and surplus food grains for ethanol production.

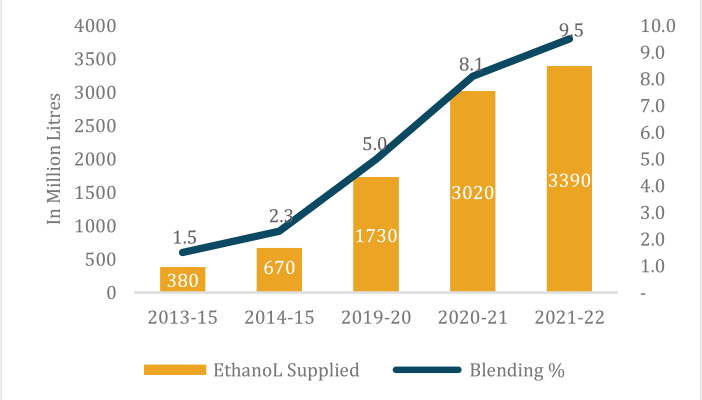

Ethanol supplies and blending percentage have increased more than 9 times since, 2013-14.

India plans to achieve 12 percent ethanol blending in 2022-23 and meet the target of 25 percent by 2025.

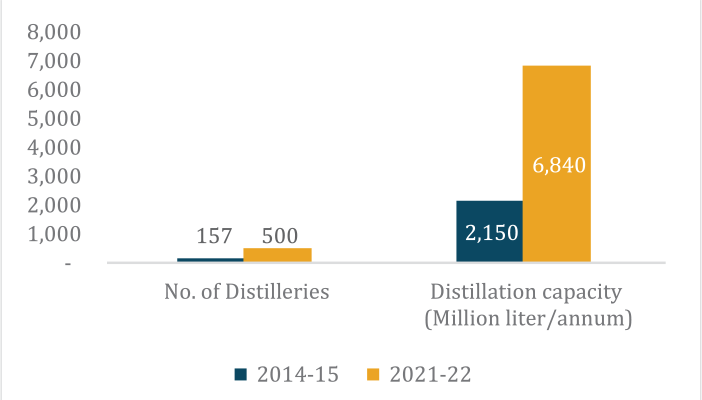

Ethanol distillation has increased by 200 since 2014-15.

Effects on the sugar industry

To meet the anticipated ethanol demand, the rush is to bolster the sugar industry as sugar ethanol is the most viable and a cheaper source of ethanol fuel.

Most of India’s ethanol is produced from sugarcane, with molasses-based distilleries making up 4,260 Mn Liters of the overall production capacity

India’s sugar production has reached 40 Mn ton against the consumption of 27 Mn ton, so 13 Mn ton of excess sugar can be diverted for production of ethanol as against 4.5 Mn ton being done currently. This excess production is being exported now. Indian exports are likely to touch 11 Mn ton this year.

This has made India the secondlargest exporter of sugar in the world after Brazil, but exports are not a long-term solution. Indian sugar can sometimes command higher prices compared to other sugar producers, due to higher sugarcane prices. The situation gets exacerbated when there is global surplus production. This can oftentimes lead to Indian stock lying idle, with payments to sugarcane growers held up.

Simply put, the sugarcane industry is the backbone of India’s sustainable and renewable fuels push. It is indispensable to India’s ambition of slashing its current account deficit, attaining energy security and meeting its 2070 net-zero carbon emissions target.

The sugar industry is bound to gain from the increasing thrust of the ethanol program as it powers the country’s self-reliance and carbon-freedreams.

| Future opportunities for the ethanol industry | |||||||

|---|---|---|---|---|---|---|---|

| The ethanol industry is expected to grow by 500 percent | Ethanol distillation capacity to grow around 2 times to 15,000 million litre annually | Integrated bio refinery: Second generation (2G) ethanol plant | |||||

| By 2025, at 20 percent blending level, ethanol demand will increase to 10,160 Mn litres. Therefore, the worth of the ethanol industry will jump by over 500 percent from around US $ 1088 Mn to over US $ 6047 Mn. | 895 proposals with loan amounts of US $ 8516 Mn. 16.5 Mn ton of surplus grain to be utilized annually from 2025 to produce ethanol which would result in US $ 3268 Mn payment to farmers. |

These plants can convert agricultural residues like rice straw, wheat straw, energy crops etc. to ethanol. With around 160 Mn ton of surplus agricultural residues generated in India annually, 2G ethanol plants offer significant opportunity. | |||||

India geared for green energy transition and climate action

India has time and again shown its commitment to environmental stewardship, climate action and focus on renewables to decarbonize the way the country operates.

India’s 2030 commitments are:

- Increasing non-fossil energy capacity to 500 Gigawatts (GWs)

- Fulfilling 50 percent of energy requirements from renewable sources

- Reducing carbon intensity of the economy by 45 percent and reducing the total projected carbon emissions by 1 Bn ton.

- The provisions relating to climate in the Union Budget 2022-23 reflect India’s commitment to achieve the target of net-zero carbon emissions.

- The Ministry of Environment, Forests and Climate changereceived a total allocation of US $ 366 Mn (increase in allocation of budget in comparison to US $ 318 Mn in FY2013-14). US $ 56 Mn has been allotted towards control of pollution which is a sizeable amount.

- FAME-India (Faster Adoption and Manufacturing of Hybrid and Electric Vehicle in India), the scheme received a big boost from US $ 97 Mn last year to US $ 352 Mn this year. The government had approved Phase-II of the FAME scheme with an outlay of US $ 1209 Mn for a period of five years. This phase aims to generate demand by way of supporting 7,090 e-buses, 0.5 Mn e-three wheelers, 55,000 e-Fourwheeler passenger cars (including strong hybrid) and 1 Mn e-two wheelers. The permit requirement for electric vehicles has also been removed.

- GST on electric vehicles has also been reduced from 12 percent to 5 percent; GST on chargers/ charging stations for electric vehicles has also been reduced from 18 percent to 5 percent.

- Ministry of New and Renewable Energy (MNRE) being responsible for overseeing India’s ambitious renewable energy targets - To achieve the target of producing 280 GW of installed solar capacity by 2030, the solar energy sector including both grid-interactive and off-grid projects received the highest allocation in the MNRE. It has been allocated US $ 407 Mn compared to last year’s US $ 315 Mn, a 29 percent increase.

- In a push for Electric Vehicle (EV) adoption, a battery swapping policy along with inter-operability standards to improve efficiency in the EV ecosystem was announced. This will allow drivers to replace depleted battery blocks for freshly charged ones at swap stations, a faster option than charging stations. It also incentivizes the private sector to develop sustainable and innovative business models for battery or energy as a service.

- Alternate green fuels - On August 15, 2021, the National Hydrogen Mission was launched. The Mission aims to aid the government in meeting its climate targets and making India a green hydrogen hub. This will help in meeting the target production of 5 Mn ton of green hydrogen by 2030 and the related development of renewable energy capacity. Hydrogen and ammonia are envisaged to be the future fuels to replace fossil fuels.

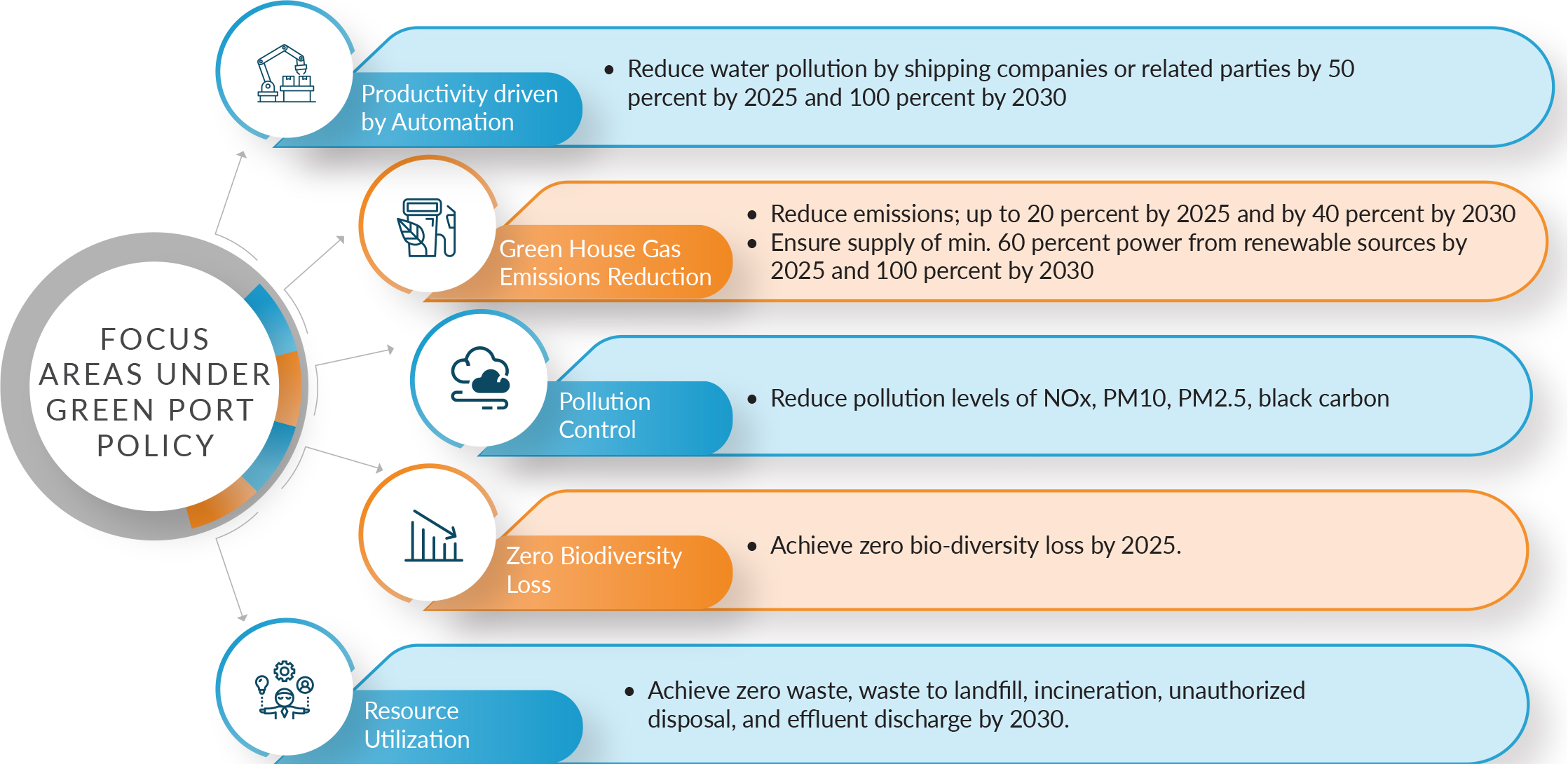

- Green Port Policy: A frameworkfor implementation/interventions carried out towards becoming sustainable and to reduce, mitigateand manage environmental pollution.

| Switching to Energy Efficient Operations – Green Port Policy | |||||||

|---|---|---|---|---|---|---|---|

| Phase I | Phase II | Phase III | |||||

| Electrification of shore equipment | Electrification of yard equipment and intra terminal trailers | Providing shore power to vessels at berth | |||||

Thus, India ports and maritime sector shall focus on sustainability of:

- Increasing renewable energy

- Improving air quality

- Optimizing water usage and increasing green cover

- Solid waste management

- Dredging material recycling

Key focus areas under Green Port Policy: