Since the commencement of liberalization in 1991, the automotive industry has grown consistently in India over the years, backed by the various initiatives of the Government. The Government of India encourages foreign investment in the automobile sector and allows 100 per cent Foreign Direct Investment (FDI) under the automatic route. Presently, the Indian Auto Industry has become the 4th largest in the world with sales increasing 9.5 per cent year-on-year to 4.02 million units (excluding two-wheelers) in 2017. India was the 7th largest manufacturer of commercial vehicles in 2017.

According to data released by the Department of Industrial Policy and Promotion (DIPP), the Indian Automotive industry has attracted FDI worth US$ 18.413 billion during the period April 2000 to December 2017.

The Overall Market And Investments

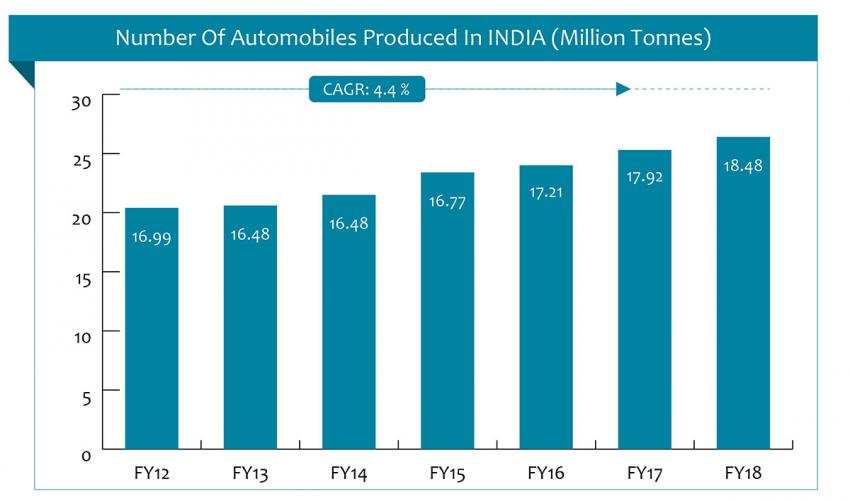

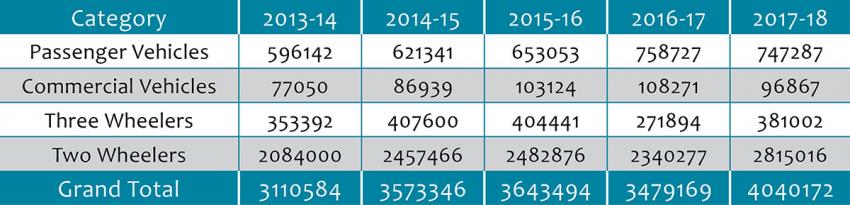

Overall domestic automobiles sales in India has witnessed a CAGR growth at 7.01 per cent during FY 2013-18 with 24.97 million vehicles getting sold in FY18. Two-wheelers dominate the industry and made up 81 per cent share in the domestic automobile sales in FY18. The passenger vehicle sales in India crossed the 3.2 million units in FY 2018 and is further expected to increase to 10 million units by FY20. Auto sales in Q1 FY19 witnessed a yearon-year growth rate of 18.1 per cent across segments, driven by a 19.91 per cent growth in passenger vehicle sales. Overall exports in Q1 FY19 increased 26.73 per cent year-on-year basis.

- In order to match the growing demand, several auto-makers have started investing heavily in various segments of the industry during the last few months. A few of the recently planned investments and developments in the automobile sector in India are as follows

- Ashok Leyland has planned a capital expenditure of Rs 1,000 crore (US$ 155.20 million) to launch 20-25 new models across various commercial vehicle categories in 2018-19, possibly to meet the challenge of the in-roads made by MNC competitors.

- Mahindra & Mahindra is planning to make an additional investment of Rs 500 crore (US$ 77.23 million) for expanding the capacity for electric vehicles in its plant in Chakan.

Automobile Export

India has also grown to be a prominent auto exporter, registering a reasonably strong export growth so far and expectations for the near future are high. Overall, automobile export from India has grown at 6.86% CAGR during FY 2013-18.

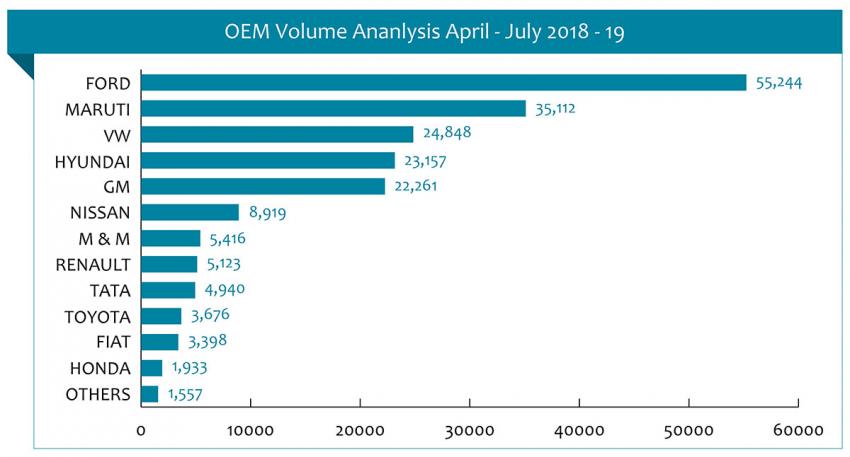

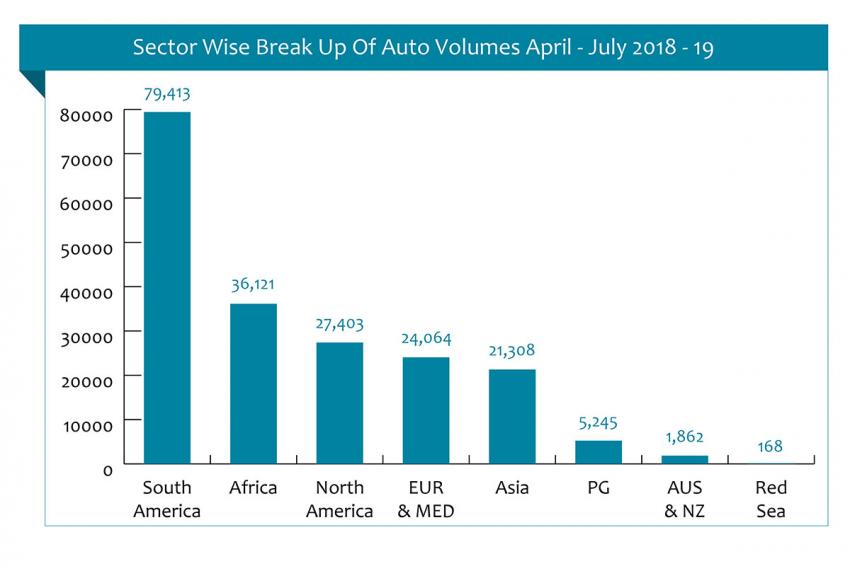

About 14% of India’s annual automobile production is being exported presently. After decline by about 4.5% in FY17, exports witnessed a sharp growth of over 16% in FY18. Exports of two and three wheelers have registered a sharp growth of over 22% year-on-year on the back of gradual recovery in overseas demand; though commercial vehicles’ export has declined by about 10%, the growth of export of passenger vehicles has remained largely stable. Many companies like Volkswagen, Ford Motors and General Motors, are focusing on exports and expansion in newer markets such as South America, North America and Asia. Demand from African and Latin American countries is expected to pick up on back of stabilization of exchange rates and commodity prices in those regions.

The US, which was non-existent as an export market for Indian automakers, is now the third-largest export destination, thanks to the slowdown in other regions. In FY 2018, passenger car exports to the US ballooned to $654 million from a paltry $3.52 million a year before, according to export data from the Ministry of Commerce. In 2017, two American companies, Ford and GM started exporting to the US in a big way for the last 2 years. While Ford started exporting its Eco Sport model from India to the US, GM completely shut down their Indian sales, using the entire production capacity for exports, and to the US primarily. Ford Eco Sport and Chevrolet Beat remained the most exported cars from India. Hence, the US market accounted for 9.2% of the overall car exports from India.

Initiatives And Future

The Government aims to develop India as a global hub for Manufacturing and Research & Development for the automotive industry. It has set up a National Automotive Board to act as a facilitator between the government and the industry; National Automotive Testing and R&D Infrastructure Project (NATRIP) centres have also been set up by GOI. Also, under the impetus from GOI for alternative fuel to meet the country's energy demand in the auto sector, the CNG distribution network in India is expected to rise to 250 cities in 2018 from 125 cities in 2014.

- The Indian government has also set an ambitious target of maximizing the sale of electric vehicles in India going forward. Some of the recent initiatives taken in the public sector are

- The GOI is planning to set up a committee to develop an institutional framework on largescale adoption of electric vehicles in India as a viable clean energy mode, especially for shared mass transport, to help bring down pollution level in major cities.

- The Ministry of Heavy Industries, Government of India has shortlisted 11 cities in the country for introduction of electric vehicles (EVs) in their public transport systems under the FAME (Faster Adoption and Manufacturing of (Hybrid) and Electric Vehicles in India) scheme. The government will also set up incubation Centre for startups working in electric vehicles’ domain.

- Energy Efficiency Services Limited (EESL), under Ministry for Power and New and Renewable Energy, Government of India, is planning to procure 10,000 e-vehicles via demand aggregation and has already awarded contracts to Tata Motors Ltd for 250 e-cars and to Mahindra and Mahindra for 150 e-cars.

- The Government of Karnataka is going to obtain electric vehicles under FAME Scheme and set up charging infrastructure across Bengaluru, according to Mr R V Deshpande, Minister for Large and Medium Industries of Karnataka.

The luxury car market is also expected to register high growth and annual production is projected to reach 150,000 units by 2020.

The auto industry is set to witness major changes in the form of electric vehicles (EVs), shared mobility, Bharat Stage-VI emission and safety norms. Electric cars in India are expected to get new green number plates and may also get free parking for three years along with toll waivers. Sales of electric two-wheelers are estimated to have crossed 55,000 vehicles in 2017-18. Premium motorbike sales in India crossed one million units in FY18. The automotive industry is therefore upbeat.

The J M BAXI GROUP has had a long interface with the automotive industry. While its shipping agency arm has been handling vessels of K Line and WWL, the freight forwarding team has worked on and off with import-based projects and rail-based logistics of automobiles.

[Sources: Media Reports, Press Releases, Web Site of Department of Industrial Policy and Promotion (DIPP), Automotive Component Manufacturers Association of India (ACMA), Society of Indian Automobile Manufacturers (SIAM), Union Budget 2017-18, Internal Data]