The Central Government initiated its strategic port development policy in the mid-1990s when for the first time, the private sector investments were invited in Build-Own-Transfer (BOT) and later in Public-Private Partnership (PPP) projects. This policy aimed at enhancing the throughput capacity of the port sector, with the creation of new green-field ports, private captive jetties, cargo berths, terminals and other cargo-related infrastructure. Over the last two decades, this policy has resulted in a sustained increase in the overall capacity of the port sector, with the major ports seeing a dramatic increase in their throughput capacity, from less than 300 million tonnes in 1996 to 1,451 million tonnes in 2018. Together with the throughput capacity of the non-major ports, including private ports, the aggregate throughput capacity in the port sector has almost touched 2,000 million tonnes.

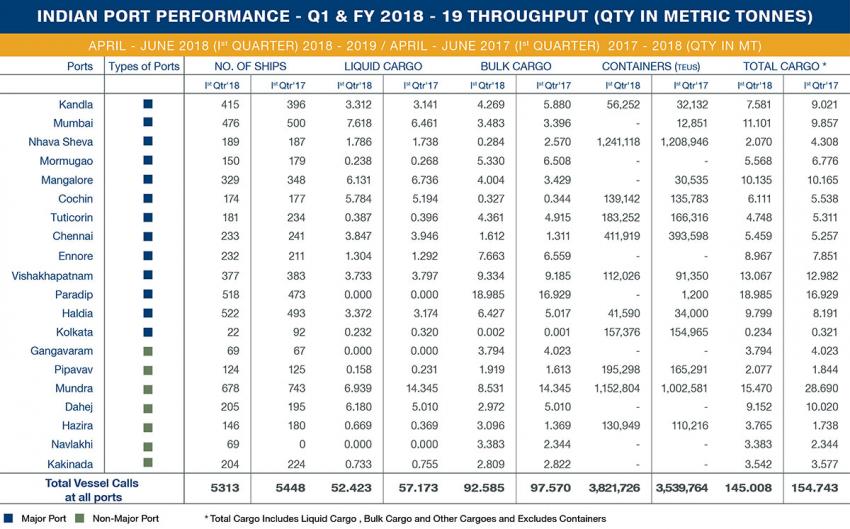

The standard benchmark of having an ideal port infrastructural capacity at about twice the actual level of capacity utilization is being realized, while a certain saturation of sorts has also been reached in terms of further growth in port capacity. The actual throughput in the Indian port sector as a whole has meanwhile touched about 1,200 million tonnes. A little over half is coming from the major ports, while non-major ports are almost set to surpass the share of major ports shortly. The overall growth of port throughput capacity in the port sector as a whole has already outpaced the growth in actual cargo traffic throughput, resulting in increasing inter-terminal and inter-port competition for cargo market shares.

This growing competition has given rise to a new element of service differentiators - between the public and private ports - with respect to various cargo performance parameters. The traffic throughput at private ports (including private terminals at major ports) has, in fact, outpaced the performance of major ports, mainly as they offer much better service efficiency to the shipping lines and shippers. While performance-related data is not available for the private ports, the private port owners and terminal operators are working overtime to ensure that their vessel turnaround time, berthing time, loading and unloading rates are optimal and meet the expectations of shipping lines and shippers. However, sustaining this service advantage by private ports would also mean that they are able to provide required hinterland infrastructure networks and facilities, in terms of road and rail networks and connectivity and adequate cargo processing and storage facilities, multi-modal logistics parks, in proximate vicinity.

Investments in road and rail connectivity have so far been mainly undertaken by the Government and other nodal public authorities like the National Highway Authority of India (NHAI) and Indian Railways (IR) at various major ports to link them up to their cargo hinterlands (see the tables on rail and road connectivity). The connectivity by rail and road for the private ports, however still remains a challenge because of the high capital cost involved, and other regulatory and public monopolyinduced entry barriers, in privatizing such core services. In addition to its own connectivity projects, the Government has been open to private investment initiatives in undertaking the development of toll roads and bridges, private railways sidings and operation of leased and owned railway assets by private parties. A number of private sector initiatives (Pipavav Railway, Automobile Train AFTOs and SFTOs) in this direction have been initiated and would surely help improve the prospect of private ports, evolving into a more integrated logistics players.

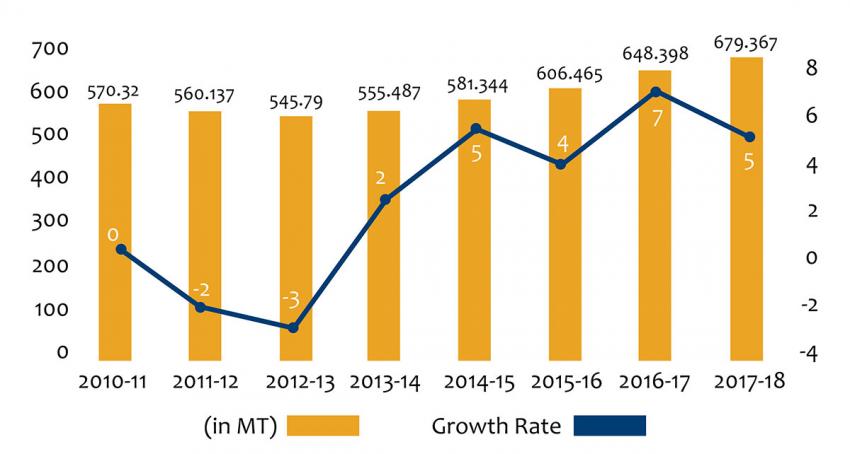

Growth Trends in India Major Ports

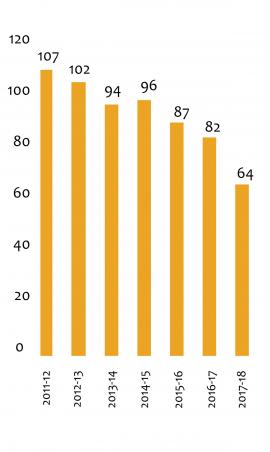

Average Port Turnaround Time

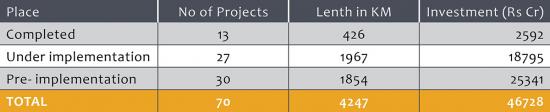

Rail Connectivity

Projects

Projects

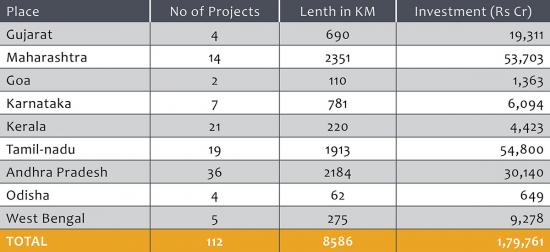

Road Connectivity Projects

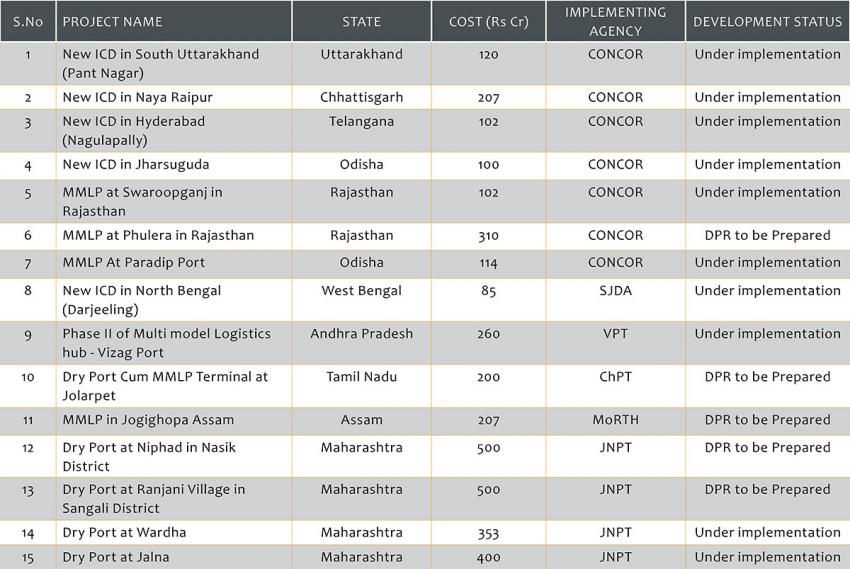

Status of Multi-modal Logistics Parks (MMLPs)