Indian pharmaceutical sector has for long been historically dominated by the Multi-National Corporations (MNCs) like Roche, Johnson & Johnson, Pfizer, Merc & Co, Burroughs Wellcome to name a few. These MNCs controlled around 80 to 90 per cent of the domestic drug market - primarily through imports and limited manufacturing under monopoly license. Approximately 99 per cent of all pharmaceutical products under the patent of India are held by these MNCs and therefore, the domestic Indian drug prices were unaffordable and amongst the highest in the world.

The pharma industry and markets however, underwent a major structural transformation during the 1980s and 1990s when the dominant MNCs gradually withdrew and paved the way for several Indian drug entities that took over the industry leader. The dominant presence of MNCs in India was primarily owing to the following factors - firstly, their control over the drug patents, being ahead in the research value chain; secondly due to what they considered the cost advantage of cheap labour in India. These advantages eroded, as India proactively took to establishing knowledge-lead through indigenous research and secured its own global drug patents and restive labour in the 1980s forced industry relocation and restructuring.

Industry Growth

The Indian pharma industry once almost non-existent in the 1970s has now become one of the largest and most advanced pharmaceutical industries in the world. The pharma sector was valued at US$ 33 billion in 2017 and is expected to expand at a CAGR of 22.4 per cent over 2015–20 to reach US$ 55 billion. India’s pharmaceutical exports stood at US$ 17.27 billion in 2017-18 and are expected to reach US$ 20 billion by 2020. Globally the industry ranks 4th in terms of volume and 13th in terms of value. It not only provides employment to millions but ensures that essential drugs are available to the vast population of India at affordable prices. Enviably, India now has the highest number of manufacturing plants that have been approved by US FDA, next to the US itself.

Indian drug market has come a long way from its utter dependence on imports to more than 85% of the formulations are produced and sold in the domestic market. The pharma industry in India was able to effectively leverage the advantage of a significantly large indigenous demand base for a wide range of drugs, which in turn provided rapidly expanding healthcare network and infrastructure, and improved access and affordability of healthcare.

Export Growth

Over 60 per cent of India's bulk drug production is currently exported. India holds a lion's share in the World’s Clinical Drug Research business, as activity in the pharmaceutical market continues to explode. Over a dozen prominent global Contract Research Organizations (CROs) operating in India are attracted by its ability to offer efficient R&D on a low-cost basis. About 35 per cent of business is in the field of new drug discovery and the rest is in the clinical trials arena. India offers a huge cost advantage in the clinical trials domain as compared to western countries. India’s prospect has also got a major boost with the signing of Trade Related Intellectual Property Rights and a number of drug patents registered by the research entities. Indian companies received 304 Abbreviated New Drug Application (ANDA) approvals from the US Food and Drug Administration (USFDA) in 2017. Today, India accounts for around 30 per cent by volume and about 10 per cent in value in the US$ 70-80 billion US generics market.

By the year 2020, India will be projected to be among the top three pharmaceutical markets in the World by its growth rate and sixth largest market in size. Increase in the size of middle-class households, along with the improvement in medical infrastructure and increasing penetration of public health services in the country will influence the further growth of pharmaceuticals sector. The pharmaceuticals market has witnessed growth at a CAGR of 5.64 per cent, during the year 2011-16, with the market pie increasing from US$ 20.95 billion in FY11 to US$ 27.57 billion in FY16. The industry revenues are estimated to have grown by 7.4 per cent in FY17. The pharmaceutical market grew at 9.5 per cent year-onyear with sales of Rs.10, 029 crores (US$ 1.56 billion).

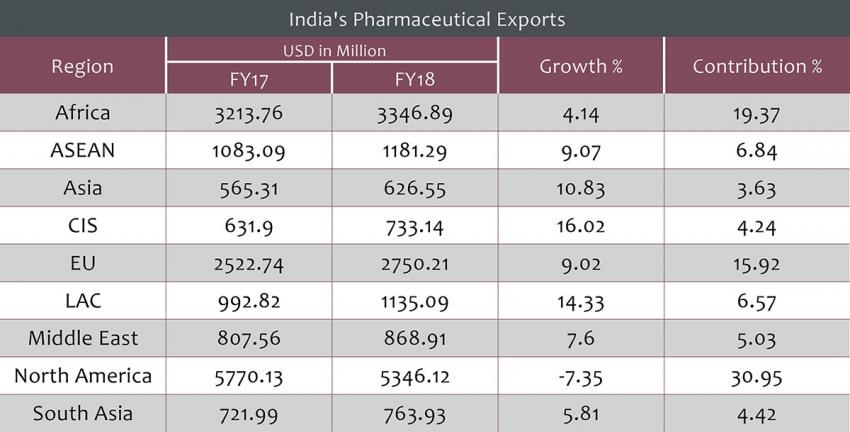

Around 40.6 per cent of Indian US$ 16.8 billion pharmaceutical exports in 2016-17 was to the American continent, followed by a 19.7 per cent to Europe, 19.1 per cent to Africa and 18.8 per cent to Asian countries. Indian pharma companies are capitalizing on the export opportunities in regulated and semi-regulated markets and in FY 2017, and exported pharmaceutical products worth US$ 16.8 billion with the number expected to reach US$ 40 billion by 2020. Consequently, India is now the world’s largest provider of generic medicines; the country’s generic drugs account for 20 per cent of global generic drug exports (in terms of volumes) and are exported to more than 200 countries in the world.

Indian pharmaceutical industry supplies over 50 per cent of global demand for various vaccines, 40 per cent of generic demand in the US and 25 per cent of all medications in the UK. India contributes the second largest share of the pharmaceutical and biotech workforce in the world. The pharmaceutical sector in India was valued at US$ 33 billion in 2017. In June 2018, the market grew by 12.8 per cent year-on-year with a turnover of Rs.10, 460 crore (US$ 1.56 billion). The composition of India’s pharma exports also reflects on the maturity of the industry in terms of its diversified capabilities. With 71 per cent market share, generic drugs form the largest segment of the Indian pharmaceutical sector. Domestic Active Pharmaceutical Ingredients (API) consumption is expected to reach US$ 18.8 billion by FY22. India is also accounted for the second largest number of Abbreviated New Drug Applications (ANDAs) and the world’s leader in Drug Master Files (DMFs) applications with the US. Indian Drugs & Pharmaceuticals sector has received cumulative FDI worth US$ 15.72 billion in April 2000 to March 2018 which is considered as an achievement.

Logistics Optimization

Indian drugs are currently exported to over 200 countries around the world, with the US among its key export destination. The pharmaceutical exports by value stood at US$ 17.27 billion in 2017-18. Out of which 31 per cent went to the US alone. With further ambitious growth plans for the industry and export trade, the Government of India (GoI) has set up a US$ 640 million venture capital fund to boost drug discovery and strengthen pharmaceutical infrastructure. The ‘Pharma Vision 2020’ by the Department of Pharmaceuticals aims to make India a major hub for end-toend drug discovery. The rapid pace growth of global pharma trade in a highly sophisticated range of drug products has generated many new challenges on the logistics front in packaging, storage, warehousing, domestic/global trade distribution and transportation of drugs - the entire supply chain connecting the manufacturing sources to end-user. Stringent international regulatory and shipper-driven specifications and standards, make the supply value chain a key challenge for all the stakeholders. It is very critical for providing the right medicine to the right patient at the right time, place and dosage and most importantly at the right price.

Source : Pharmexcil

Since business is highly competitive today, success largely depends upon the efficiency of the supply chain. The supply chain is very critical as it maintains the complex network relationship between the organizations (drug manufacturers), trading partners to source raw materials, delivery products, retailers and hospitals. The lifeblood of the pharmaceutical industry is new product innovation and delivery. The Industry mainly focuses on R&D efforts to develop the product and gain necessary approvals. SCM activities related to making the product available to providers and patients is being increasingly outsourced to customized logistics service providers. Pharma products need the services of a cold chain with temperature-controlled storage and distribution. The industry has given importance to logistics by focusing on supply chain and logistic level activities in terms of delivering the product to the end customer at the right time, right place, in a secure mode and at a competitive operational cost.

The most important supply chain factors in the pharmaceutical industry are the reduction in inventory and order cycle time. This is because operational performance could be directly linked to logistics costs, while inventory reduction and the demand to decrease order cycle time are related to just-in-time deliveries and supply chain speed. Lately, there has been a paradigm shift in the supply chain process of Indian pharmaceutical industry. Value added tax, consolidation of pharmaceutical companies and emergence of pharmaceutical retail chains are some of the factors that are driving momentous changes in the drug distribution cycle.