Natural Gas is known to posses the lowest carbon to hydrogen ratio, making it the cleanest of fossil fuels. Natural Gas is already meeting most of the requirement for fuel in a modern day industries, being efficient, non- polluting and relatively economical. Despite periodic uncertainties and volatility, in both its price and supply, natural gas, has emerged to be major fuel of choice in the energy basket.

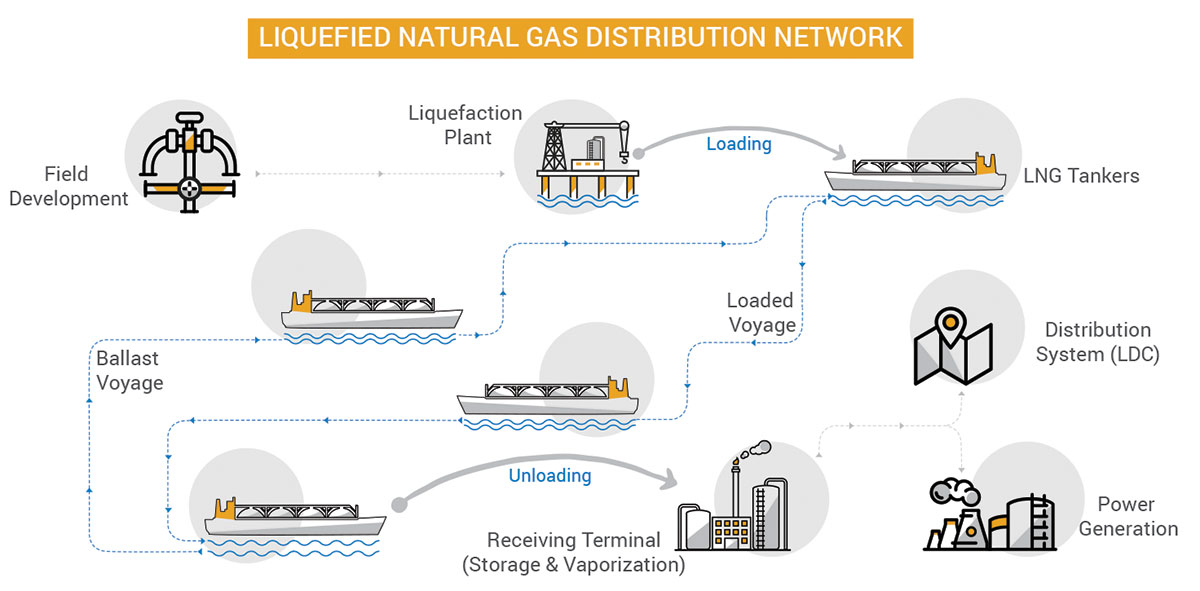

Liquefied Natural Gas (LNG) facilitates its transportation in large volumes in cryogenic tankers across the sea. Once offloaded from ships, it is re- gasified before being transported to consumers through gas pipelines. From the exploration stage to its liquefaction, specialized cryogenic storage, maritime transportation and regasification and distribution networks that spawns a nation-wide pipeline distribution network.

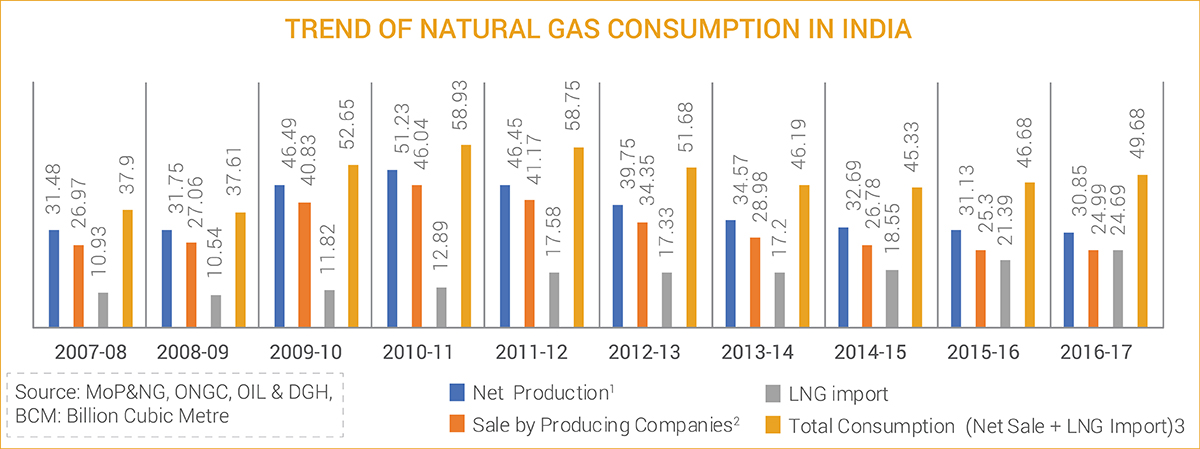

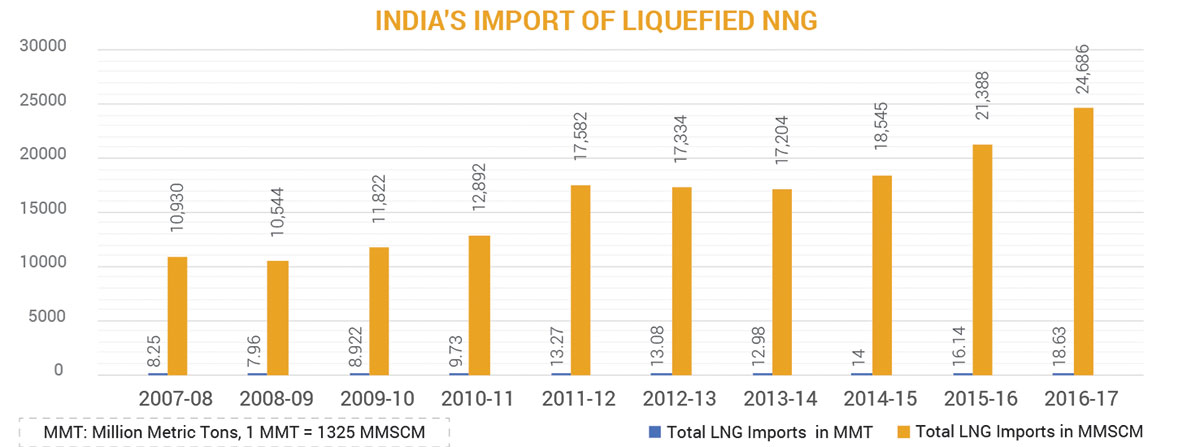

India currently is the fourth-largest Liquefied Natural Gas (LNG) importer after Japan, South Korea and China, and accounts for 5.8 per cent of the total global trade. Domestic LNG demand is expected to grow at a CAGR of 16.89 per cent to 306.54 MMSCMD by 2021 from 64 MMSCMD in 2015. Gas production will likely touch 90 Billion Cubic Metres (BCM) by 2040, subject to adjustment to the current formula that determines the price paid to domestic producers, while demand for natural gas will grow at a CAGR of 4.6 per cent to touch 149 MTOE. The demand for petro products is estimated to reach 244,960 MT by 2021-22, up from 186,209 MT in 2016, and the demand for natural gas is expected to reach 606 MMSCMD by 2021-22 as against a demand of 473 MMSCMD in 2016-17.

After discovery of South Basin fields by ONGC in 1970s, Natural Gas assumed importance and exploration activities in India were initially undertaken only by the National Oil Companies (ONGC & OIL) under nomination. Later private gas companies were allowed to enter into exploration through JV with NOCs. Subsequently, 100% foreign participation in exploration was allowed in the current New Exploration and Licensing Programme (NELP). Subsequently discoveries were made in Gujarat, KG basin, Cauvery basin, Tripura, Assam etc. In 2004, liquefied Natural Gas began to be imported from Qatar under a long-term supply contract and a first ever LNG terminal was set up at Dahej of 5 MMTPA capacity.

Industrial use of natural gas as the feedstock, replacing the conventional sources like the coal and other fuel oils is undoubtedly expected to have a major effect on its natural gas consumption profile, with several coal-fired power plants and other coal dependent industries switching to use of gas. The biggest of constraints to further growth in consumption comes from the scarce domestic availability of gas and costly imports of LNG and inbuilt price uncertainties of LNG trade. A recent study by Platts however, suggests city (household) gas usage might in future actually drive the demand for natural gas in India, City gas includes piped gas delivered to homes, compressed natural gas (CNG) used in automobiles and gas delivered to industrial units. The main change (in demand) is expected to occur for city gas, which will see its share of domestic gas usage rise to 24% in 2021 from the 20% used in 2016. This is in line with the government’s goal of increasing city gas availability for households and transportation. Thirteen states in India currently have city gas distribution (CGD) projects, connecting 3.3 million homes. It is expected to reach 10 million households over the next three years, but the scope for expansion is even larger. Petroleum and Natural Gas Regulatory Board forecast 60 city gas projects by 2022 and 240 networks by 2030.

Natural gas presently accounts for only 6.5% of India’s energy mix, compared with almost 60% for coal. The relatively low penetration rate, compared with the global average of 24%, is a result of India’s abundance of relatively cheap domestic coal availability, infrastructure bottlenecks choking gas supply, price, uncertainty over natural gas imports, and low domestic gas production. With domestic gas production now set to rise to 37 BCM by 2021 and consumption to hit 72 BCM over the same period, the additional demand will have to be met by LNG imports. Over the next five years, Indian LNG demand is expected to grow on average 10% annually, reaching around 30 million metric tonnes by 2020, with re-gasification capacity expanding by almost 60% to over 45 million metric tonnes by 2021. LNG imports and distribution networks would thus grow in India.

| COMPOSITION NATURAL GAS USE IN INDIA | ||||||

|---|---|---|---|---|---|---|

| Sector | Domestic | R-LNG* | Domestic + R-LNG | |||

| Fertilizers | 30.30 | 12.65 | 42.95 | |||

| Gas Based LPG plants for LPG extraction | 1.83 | 1.09 | 2.92 | |||

| Power | 27.26 | 2.17 | 29.43 | |||

| City Gas demand (CGD) for CNG & Domestic PNG Purpose | 7.25 | 8.23 | 15.48 | |||

| TTZ | 0.98 | 0.07 | 1.05 | |||

| Small consumers having allocation less than 50,000 SCMD | 2.45 | 2.58 | 5.03 | |||

| Steel | 1.32 | 1.82 | 3.14 | |||

| Refineries | 1.89 | 10.45 | 12.35 | |||

| Petrochemicals | 3.82 | 0.88 | 4.70 | |||

| CGD for PNG to Industrial & Commercial | 0.00 | 0.00 | 0.00 | |||

| Others | 1.52 | 1.17 | 2.69 | |||

| Internal consumption - pipeline system | 1.40 | 0.00 | 1.40 | |||

| Total | 80.02 | 41.11 | 121.13 | |||

| R-LNG= Re-gassified LNG | ||||||

Industrial growth in consumption of gas is also expected to get a further boost. For re-gasified liquefied natural gas (LNG), the main growth sector will come from fertilizer, which is expected to consume 16 BCM of Re-gasified LNG by 2021, 38% of the total imported LNG, from its 34% in 2016. The fertilizer sector in fact, remains India’s largest single largest gas demand sector, representing around one-third of demand. This included over 6 million metric tonnes of LNG imports in 2016, 20% more than the previous year. “Gas usage from the fertilizer sector is expected to grow by 8% annually, reaching over 26 BCM by 2021, driven by the government’s plans to increase domestic fertilizer production and become fully self-sufficient to meet domestic fertilizer consumption needs by 2022. The power sector, India’s second largest gas user, accounts for around 25% of total gas consumed. While India has over 24 giga watt (GW) of gas-fired power generation plants, of them 14 GW is effectively stranded by a lack of gas availability, while the remaining 10 GW has also been operating well below capacity. The sector is expected to grow merely around 1% to 2021.

Further, LNG imports are plagued by certain global trade limitations and geopolitical constraints, especially Pakistan’s reluctance to allow India to connect to Iran and rest of Central Asia for gas supplies. Due to a lack of international pipeline connectivity, and limited growth of domestic production, the demand for gas will have to be met by a 10% annual rise in LNG imports over the next few years. Given this pace, LNG demand should outpace the volumes supplied by Petronet LNG, Gail India, and Gujarat State Petroleum Corporation. LNG imports have proved to be the only effective means of meeting the supply to meet the country’s increasing gas demand. India’s dependence on gas imports grew to around 50% in 2016, when it imported over 19 million mt/ year, a 50% increase from 2013 levels. LNG imports are expected to continue to grow by 10% annually over the next five years, eventually overtaking domestic production in 2019, before surpassing 30 million mt by 2020.