India is the 4th largest importer of LNG in the world with imports of about 22 MMT last year. Owing to continual growth in economy and rising concern on using cleaner source of energy has led to the gradual increase in share of natural gas in the energy mix of India. It is expected to increase from 8.5% now to 20% in 2025. A number of new infrastructure e.g. regasification terminals and natural gas pipeline are being developed in various parts of the country, which would strengthen the development of LNG market in India. India presently has regasification capacity of 30 mmtpa, which is expected to go up to 55 mmtpa by 2025. Similarly, India’s gas transmission pipeline of 16,200 km is also witnessing huge capacity augmentation and is expected to reach around 27,430 km by the year 2025. It is likely that India would be the third largest importer of LNG in the world in the next five years.

Demand/Supply Dynamics

In recent years the demand for natural gas in India has increased significantly due to its higher availability, development of transmission and distribution infrastructure, the savings from the usage of natural gas in place of alternate fuels, the environment friendly characteristics of natural gas as a fuel and the overall favorable economics of supplying gas at reasonable prices to end consumers. Power and Fertilizer sector remain the two biggest contributors to natural gas demand in India and continue to account for more than 75% of gas consumption. Balance 25% is consumed by the Petrochem and other industries, and city distribution for vehicles and domestic consumption.

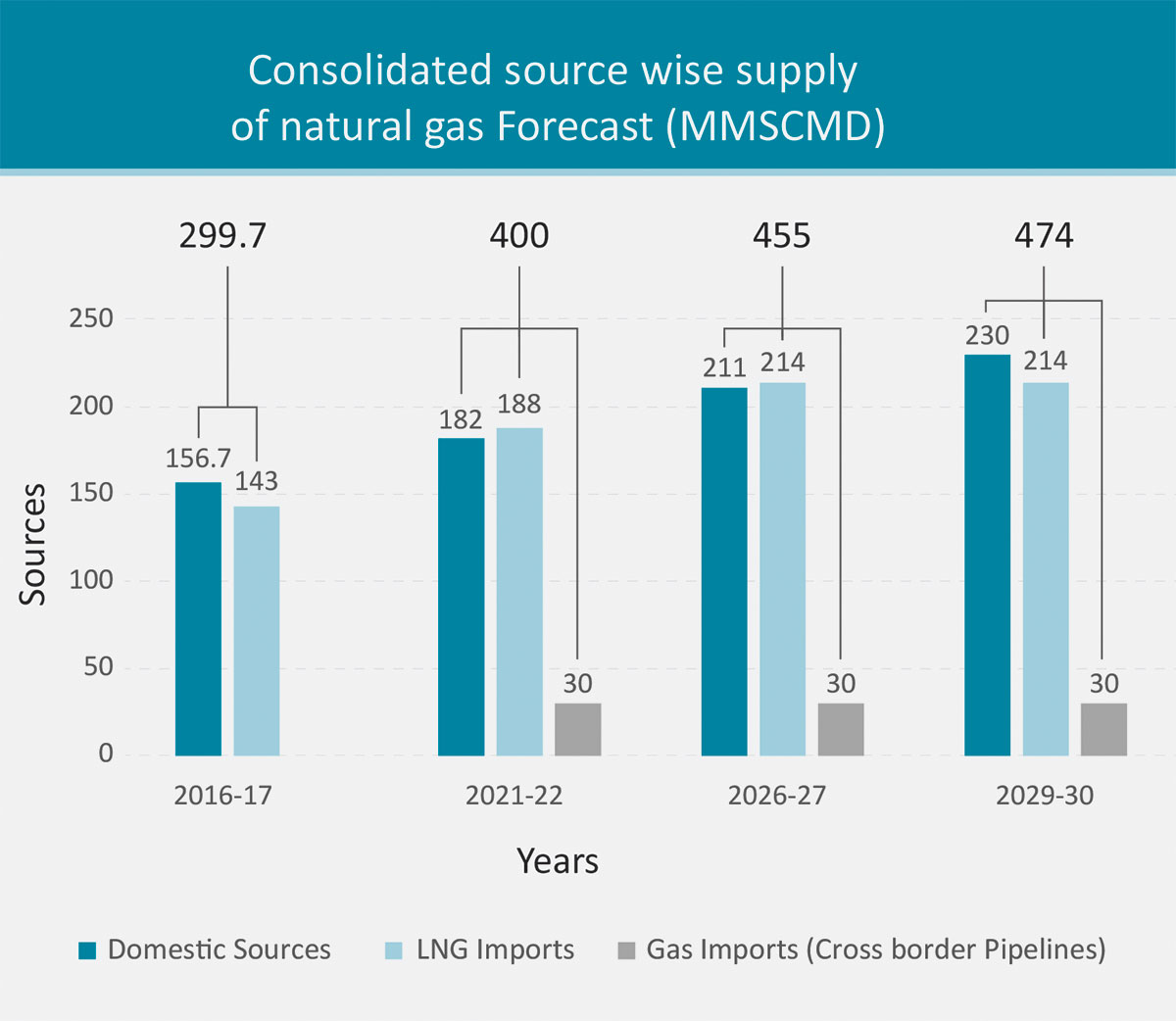

Supply of Gas into India is forecast to grow as under :

At present, natural gas markets remain mostly limited to the states where gas sources have been found or in states closer to pipeline infrastructure. Geographically Western and Northern India have the highest consumption due to better pipeline connectivity. There is increasing impetus in laying a national grid for gas pipelines and with increasing coverage and reach of pipelines, this regional imbalance is expected to get corrected.

Imports of LNG

Currently the natural gas demand far exceeds domestic supply in India and the situation is likely to prevailing future as well. Given that there are very few new domestic sources available, additional demand is likely to be catered through Re-Gasified Liquefied Natural Gas (R-LNG) in future. India’s increasing appetite for LNG has spawned a dozen plans for import terminals across the west and east coasts of the country. The ramp-up of existing facilities and Construction of new LNG terminals could theoretically more than triple current capacity to over 80mtpa of regasified LNG over the next 10 years. Below are the existing Operational R-LNG Terminals capacity of India.

| Location | Owner | Terminals Capacity (MMTPA) |

|---|---|---|

| Dahej | PLL | 15 |

| Hazira | Hazira LNG | 7.5 |

| Kochi | PLL | 5 |

| Dhabol | GAIL | 5 |

| Total Existing Capacity (MMTPA) | 32.5 | |

LNG Sourcing

While the Middle East, in particular Qatar, was the sole supplier of LNG to India till 2004 and remains the largest LNG supplier at present, the range of suppliers is becoming increasingly diverse. India started diversifying its supply portfolio from 2006 onwards and imported LNG from many other countries including Algeria, Nigeria, Yemen, Australia, Trinidad and Tobago, Russia, UAE, Norway, Indonesia and Oman. India is looking at diversifying its long term supply portfolio as well and Australia and US are likely to emerge as key LNG exporters.

LIQUEFIED NATURAL GAS (LNG) SHIP

Currently, LNG is imported in India through mix of long term, short-term and spot basis. An important factor in the future viability of planned import projects is India’s ability to secure long-term LNG contracts at competitive prices. Current long- term contracted volumes fall way short of the potential growth in LNG demand forecast by numerous sources with newly-signed contracts pointing towards only an incremental increase.

Earlier the Indian market was unable to commit to short-term contacts (up to two years) and spot purchases as the country lacked adequate gas infrastructure. However, short -term and spot market accounted for most of the increased LNG supply in the two years given that only 7.5 mtpa of LNG import is through long term contracts. While India remains one of the most price sensitive markets for LNG in Asia, short-term demand is not solely determined by the level of spot LNG prices. Competition from competing fuels, the price of contractual LNG and terminal constraints can play a role in tempering the level of spot imports. In an uncertain crude price environment, buyers may also favour an alternative balance between pure spot trades and structured contracts as part of the overall short-term mix in the near term.

India will remain sensitive to the price movements in the global LNG market with buyers switching to coal from gas for power generation with reasonable flexibility. Hence we can conclude that going forward, the industry is likely to see an increased trend of procuring LNG through midterm and short-term contracts as these will be negotiated at rates cheaper than spot prices.

Way Forward

While India is emerging as major LNG market of future with all round development in LNG terminals, gas pipelines to attain desired sustainable growth, a comprehensive approach which can meet suppliers expectation on one side and meet consumers price expectation on other side needs to be firmed up. India would also need to take strategic decisions like upstream participation in integrated liquefaction projects, tax efficient structures, and a consumer friendly regulatory environment to make this dream a reality.

| Long Term Contracts | ||||||

|---|---|---|---|---|---|---|

| Company | Date Signed | Source | Location | Supply (MTPA) | Period | Start Date |

| GAIL | 2011 | Cheniere Energy | US | 3.5 | 20 | 2017 |

| 2013 | Dominion | US | 2.3 | 20 | 2018 | |

| 2012 | Gazprom | Russia | 2.5 | 20 | 2019 | |

| PETRONET | 2009 | Exxon Mobil | Australia | 1.4 | 20 | 2016 |

| 1999/2004 | Rasgas | Qatar | 7.5 | 25 | 2004 | |

| GSPC | 2013 | BG Group | BG Group | 1.25-2.5 | 20 | 2015 |