You may be any organisation, any professional, anywhere in the world – you have and possibly just before reading this article looked at your stock investment or read about your neighbour be on Shark Tank taking investments or maybe a former colleague in operations launched his logi-tech start-up and has gone public with an IPO possibly the new kid on the block right out of college building an app that has got its series E funding!! Nowadays our conversations include more about investments in technology and the funding boom in llogistics.

From traditional marketing to digital marketing , traditional paper to digital forms and much more has happened especially over the last 5 years. around the same time investors found this space more interesting. Well, especially if you are in llogistics and maritime – it is no longer the same way you or your non-llogistics friends look at you anymore – You are trending as much as the subject! We all knew that Covid reset the entire way we look at the world – An Ayn Rand novel like... Today, our industry has gained more attraction from freshers to experienced professionals wanting to find innovative, efficient and simple ways of doing the same complex tasks.

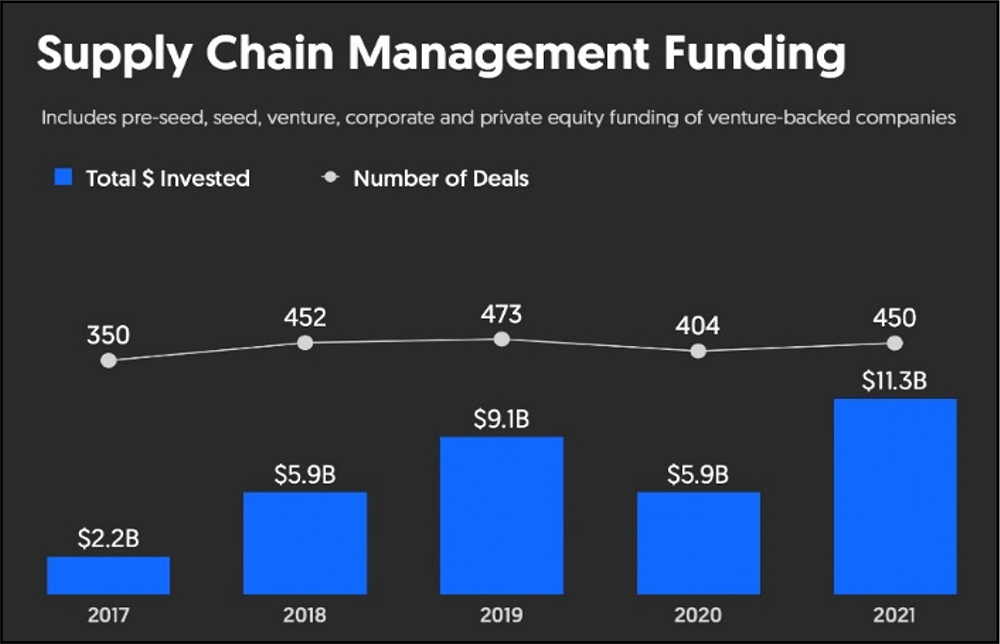

Across the world, 2021 was a great year for venture-backed supply chain management companies, with almost $11.3 billion in funding – Well, that represented almost a twofold increase from 2020! It preceded the previous all-time high in 2019 which saw $9.1 billion go to start-ups that keep the supply chain moving. 2019 was a record-breaking year for venture funding in the shipping industry with $1.14bn raised by start-ups and scaleups building technology aimed at the maritime sector. The year-on-year growth of investments and start-ups making it to the unicorn and soonicorn clubs are on an upward trend.

Last year also saw a record number of Indian start-ups make their debut on the public exchanges, with some eight start-ups having raised a total of $2.5 billion from public investors. According to a PwC report, over 50 Indian startups have the potential to enter the unicorn club - start-ups valued at over $1 billion each - in 2022.

We believe that digital freight forwarding and truck aggregation being one of the most invested segments in our industry. Mostly as their objective is to enhance transparency, professionalize, and digitize the often informally handled information exchange and leverage data as a means to address inefficiencies. They contribute significantly to improving the sustainability a trend that is becoming more prevalent.

- LET US SEE SOME REASONS FOR THIS SUPER L.I.T FUNDING BOOM

The industry had been previously slow in adoption of technologies and change in comparison to others and is seeing the reverberation due to COVID positively especially in order to cater to the raising customer demands in the ecommerce and retail section

The dependency on digital ecommerce – o ne day delivery models have made way for m ore ideation and implementation of solutions to be better by the day for last mile delivery apps

The adoption of ‘open source’ technology which has increased the technical collaboration in the shipping industry such as public APIs which are released by companies with an intent that developers will use them to build platforms. The rise of application programming interfaces (APIs) in shipping gave way to securely integrate systems and services with clients, suppliers, and partners to our stakeholders while other interesting technologies have started to gain more perspective such as blockchain, AI, IOT and more...

Global associations from UN to IMO, DCSA, ICC, BIMCO all are finding ways to contribute and bring trade facilitation through systems and applications, legal rulings to build an ecosystem that supports recent technologies.

With institutes such as the IMO committing to a 5 0% greenhouse gas reduction target has given rise to more funding in green tech, luring investments that contribute to decarbonisation and the sustainable future.

The need to reset and relook at the industry that makes it all go round especially on sea, to be one of the most critical areas to curb and build solutions that refashion global supply chains to reprioritize their impact on the environment - climate change, people, and profits.

The llogistics and shipping industry is one of the biggest markets and the fact is that most processes in the sector are still manual - only construction has a bigger GDP (oh and we do have our infrastructure too!).

Seeing an enormous market that is growing and is poised for disruption given few inefficiencies, the venture capital industry has seen an exceptionally good opportunity with start-ups in the llogistics industry.

Investors find it more sensible due to the simple fact:

Trade is through Logistics , and both are as essential - supply chains are being fully digitized for almost the first time in history.

Investment in digital llogistics and its reinvention brings out an entirely new value to the industry, contributes to economic growth, acts as a catalyst for job creation , new sustainable revenue streams and so much more

Most funding has been in the assetlight freight platforms and last-mile delivery companies, but investors seem to increasingly turn back to good old asset-based models revamped with tech capabilities. Probable reason for cause is for building a lasting start-up or even a digital initiative within a large conglomerate. You need to know the industry, the pain points, the nuances so deeply to be able to actually be effective and gain an edge.

Many entities once adamant in the maritime-llogistics space have started to look inward and outward for being able to match the business change. While they aspire to take up recent technologies and get on with the trend to stay relevant , an underlying reason which has always put this industry one step behind is the investment needed to go digital vs. maintaining the margins. This makes it much evident for newer smaller entities looking to solve complex problems with ease while they focus on resolving pain points and not provide actual llogistics service but a tool to facilitate it.

Therefore, we see that these entities today are riding the digital wave and supporting start-ups through strategies such as buying the rising start-ups, and investing in them. Some mentor and expand with them, some simply become customers and some just add a digital arm.

While India gears up as a nation with budding start-ups, especially in the first quarter of 2022 with llogistics companies becoming unicorns and taking in millions in investment, we are excited to see our industry flourish with new outlooks and ideas! It has become evident that start-ups are becoming the economic backbone and have dedicated policies, schemes, funding and also dedicated a National Start-up Day to grow further. There is a lot more to come this year and beyond.