AN OVERVIEW

India is the second largest producer of steel in the world after China. In the year 2021 India’s steel production stood at 104.91 MMT out of which finished steel production was 96.20 MMT and consumption was 93.057 MMT. Expected crude steel output for the year 2022 is 125 MMT. The per capita steel consumption in the country is at around 72.3 KG at present, while the present production capacity is at 143.9 MMT.

The liberalization of industrial policy and other initiatives taken by the Government have given a definite impetus for entry, participation and growth of the private sector in the steel industry. While the existing units are being modernized/expanded, a large number of new steel plants have also come up in different parts of the country based on modern, cost effective, state of-the-art technologies. Over the last few years, the rapid and stable growth of the demand side has also prompted domestic entrepreneurs to set up fresh greenfield projects in different states of the country.

OPPORTUNITIES FOR THE GROWTH OF IRON AND STEEL IN THE PRIVATE SECTOR:

The New Industrial policy opened up the Indian iron and steel industry for private investment by (a) removing it from the list of industries reserved for the public sector and (b) exempting it from compulsory licensing. Imports of foreign technology as well as foreign direct investment are now freely permitted up to certain limits under an automatic route. The Ministry of Steel plays the role of a facilitator, providing broad directions and assistance to new and existing steel plants, in the liberalized scenario.

ROBUST DEMAND:

The National Steel Policy envisages production of 300 MT steel by 2030. According to Vision 2030, the development of downstream units in the metal sector envisages to achieve more than 50 per cent value addition to the primary metal produced in the state.

| TOTAL FINISHED STEEL PRODUCTION | |||

|---|---|---|---|

| Year | Production (MMT) | Export (MMT) | Import (MMT) |

| 2016-17 | 91.54 | 8.24 | 7.22 |

| 2017-18 | 95.01 | 9.62 | 7.48 |

| 2018-19 | 101.29 | 6.36 | 7.83 |

| 2019-20 | 102.62 | 8.36 | 6.77 |

| 2020-21 | 96.20 | 10.78 | 4.75 |

| 2021-22 (till Sept) | 66.91 | 7.75 | 2.37 |

| TOP TEN STEEL COMPANIES IN INDIA | |||

|---|---|---|---|

| Company | Location | Capacity | Total Capacity |

| JSW Steel | Dolvi | 10 | 29.1 |

| Kalmeshwar | 1.8 | ||

| Vijayanagar | 12 | ||

| Salem | 1 | ||

| JSW Ispat | Raigarh | 1.5 | |

| JSW BPSL | Lapanga | 2.8 | |

| SAIL | Rourkela | 4.5 | 20.8 |

| Bhilai | 7.5 | ||

| Bokaro | 3.5 | ||

| Burnpur | 2.8 | ||

| Durgapur | 2.5 | ||

| Tata Steel | Jamshedpur | 10 | 18.6 |

| Meeramundali | 5.6 | ||

| Kalinganagar | 3 | ||

| JSPL | Angul | 6 | 10.6 |

| Raigarh | 3 | ||

| Patratu | 1.6 | ||

| AMNS | Hazira | 10 | 10 |

| RINL | Vizag | 7.3 | |

| Shyam Metaliks | Sambalpur | 2.9 | 4.57 |

| Kolkata | 1.67 | ||

| JSL | Kalinganagar | 1.6 | 2.4 |

| Hisar | 0.8 | ||

| Rashmi Metaliks | Kolkata | 1.5 | 1.5 |

| ESL Steel | Bokaro | 1.5 | 1.5 |

| 99.07 | |||

In FY 2020-21 total East region has produced 40.3 MMT of steel, whereas Odisha alone stands for almost half of the total production with 19.44 MMT followed by Jharkhand with 14.1 MMT.

The government also announced the production based incentive scheme, PLI for incremental sales for the products manufactured in domestic units.

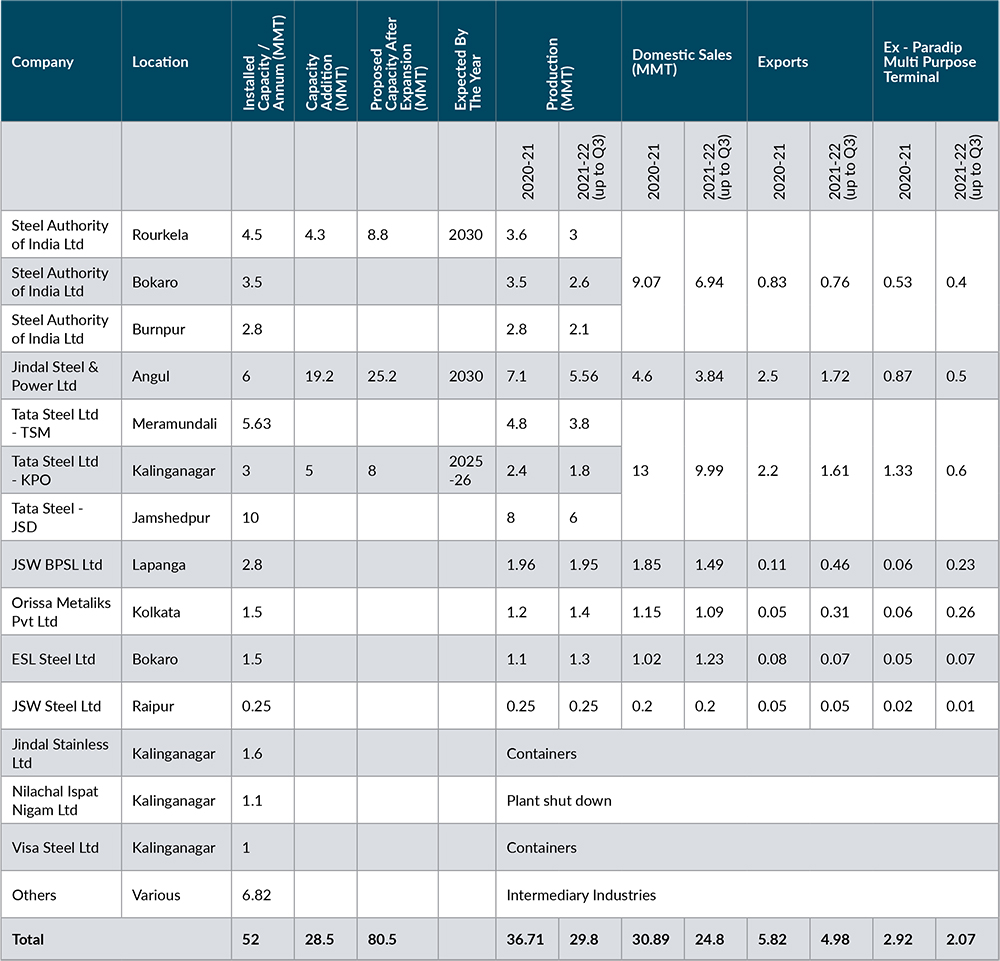

A GLANCE AT STEEL INDUSTRIES – EASTERN REGION OF INDIA:

The eastern part of India viz., Odisha, Jharkhand, West Bengal and Chhattisgarh are mineral rich states suitable for the location of the Iron and Steel Industry where Odisha with its rich natural resources and raw material security has aspired to be the manufacturing hub for steel. Odisha has a target to produce 100 million tonnes of the metal by 2030. 47 steel plants with a total installed capacity of 32.45 MMT have been set up in Odisha so far and many more steel industries are in the process of setting up a manufacturing base here. Out of the 47 steel plants, Rourkela Steel Plant (SAIL) is the only unit in the public sector, whereas the remaining steel plants are established by private sector entities. The Union Ministry of Steel has initiated the formation of 'Purvodaya' as an integrated steel hub encompassing Odisha, Jharkhand, Chhattisgarh, West Bengal and Northern Andhra Pradesh.

JHARKHAND

In the state of Jharkhand major steel producers are Tata steel, Bokaro Steel Plant (SAIL) and ESL Steel Ltd. Other steel products (finished) producers are Metalsa India (P) Ltd, CTC (India) (P) Ltd, JMT Auto Ltd, Timken India Ltd, Metaldyne Industries Ltd, Omni Auto Ltd.

The total capacity of Tata Steel, Bokaro Steel Plant (SAIL) and ESL is 17 MTPA and the production also nearly 100%.

CHHATTISGARH

There are ten major steel manufacturing industries in the state of Chhattisgarh. Among them Bhilai Steel Plant (SAIL), Jindal Steel & Power are the larger ones. The capacity of these two units together is 10.5 MTPA and the current production is also equal t o the capacity. Apart from the above big names there are industries like Vandana.

| EXISTING MAJOR STEEL INDUSTRIES IN ODISHA | |||||

|---|---|---|---|---|---|

| Company | Location | Installed Capacity (MMTPA) | Capacity Expansion (MMT) | Proposed Capacity after expansion (MMTPA) | Expected by the year |

| Steel Authority of India Ltd | Rourkela | 4.5 | 4.3 | 8.8 | 2030 |

| Jindal Steel & Power Ltd | Angul | 6 | 19.2 | 25.2 | 2030 |

| Tata Steel Ltd - TSM | Meramundali | 5.63 | |||

| Tata Steel Ltd – KPO | Kalinganagar | 3 | 5 | 8 | 2025/26 |

| JSW BPSL Ltd | Lapanga | 2.8 | |||

| Jindal Stainless Ltd | Kalinganagar | 1.6 | |||

| Nilachal Ispat Nigam Ltd | Kalinganagar | 1.1 | |||

| Visa Steel Ltd | Kalinganagar | 1 | |||

| Others | Various | 6.82 | |||

| Total | 32.45 | 6.82 | 28.5 | 60.95 | |

| MAJOR NEW PROJECTS APPROVED / ADVANCED STAGE (ODISHA) | ||||

|---|---|---|---|---|

| Company | Location | Capacity (MMTPA) | Commission Expected By The Year | Investment (Rs. In Crores) |

| Arcelor Mittal Nippon Steel India | Kendrapara | 24 | 2030 in phases | 1,02,000 |

| JSW Utkal Steel Ltd | Jagatsinghpur | 13.2 | 2030 | 65,000 |

| Dhenkanal Steel Ltd (Rungta) | Dhenkanal | 7.5 | 2030 | 11000 |

| Total | 44.7 | |||

Global - 223000 TPA, Bhagawati Power & Steel - 117600 TPA, Bhilai (Ancillary Units) - 100000 TPA, Bajrang Power & Ispat - 129600 TPA, Godavari Power & Ispat - 52200 TPA, Sarda Energy & Minerals - 75000 TPA, Hira Power & Steel - 95000 TPA. The current production of all these companies is 602320 TPA.

HANDLING OF STEEL AT A GLANCE:

Paradip Multi Purpose Terminal as a gateway port to the steel industry

Paradip Multi Purpose Terminal is a clean cargo terminal at Paradip Port Authority. It is developed under a Build Own Transfer (BOT) project for 30 years. Paradip Multi Purpose Terminal became partially operational on March 2018 with a single berth and subsequently fully operational in April 2018 with the second berth coming into operation. It has a Quay length of 450 meters with a capacity to handle a 125000 D WT vessel. The draft alongside is 17.1 me ter. Paradip Multi Purpose Terminal is equipped with 3 MHCs (100 t onne each) and 2 RTGs (41 tonne each) along with a fleet of various yard cranes and equipment to support yard and vessel operations. Paradip Multi Purpose Terminal is also designated as a Private Freight Terminal (PFT) by The East Coast Railway (ECoR). Two full length dedicated rail siding is directly connected to ECoR network. The sidings operate on Engine On Load (EOL) scheme thus making the rake loading /unloading faster. Paradip Multi Purpose Terminal is better known for its operational efficiency and higher productivity in handling steel commodities.

- The folloing steel companies are currently patronising Paradip Multi Purpose Terminal:

- Steel Authority of India Limited

- Tata Steel Limited

- Jindal Steel and Power Limited

- JSW BPSL Limited

- Orissa Metaliks Pvt Limited

- ESL Steel Limited

- Jindal Stainless Limited

- JSW Steel Limited

Due to excellent operational efficiency along with ancillary support services, the steel exporters are enthusiastically increasing their volumes through Paradip Multi Purpose Terminal and also adding on commodity profile.

OPPORTUNITY FOR PARADIP MULTI PURPOSE TERMINAL:

With the capacity expansion (in phases) of plants like SAIL - Rourkela, Tata Steel Kalinganagar, JSPL – Angul and upcoming steel plants in the vicinity of Paradip by JSW Steel and Arcelor Mittal Nippon Steel India, it is foreseen that there will be a surge in finished steel products in the near future, where Paradip Multi Purpose Terminal will play a vital role in catering to their demands.