India is the world's third largest oil importing and consuming nation behind the US and China. The demand for petroleum products in India is supported by a healthy economic growth of 7.1 percent, continuing economic reopening amid ease of COVID-19 restrictions and easing of trade-related bottlenecks supporting both mobility and industrial sector activity.

Until FY 22 India met its energy demands by importing crude oil from Iran and Saudi Arabia. Total imports from Iran stood at 21 percent followed by Saudi Arabia at 16 percent. The total import of crude oil in India stood at 212 MnT in FY 22. In the present scenario, Russia has emerged to be the top exporter of crude oil to India. This can be attributed to the ongoing Russia-Ukraine war. Due to the sanctions imposed by the western countries, Russian crude oil flowed at a discounted rate in the market. India imported approx. 935,556 barrels per day of crude oil from Russia in Oct 22.

The oil and petroleum sector are among the eight core industries in India and plays a major role in influencing the decision-making for all the other important sections of the economy.

India's refining capacity stands at about 251.2 MnT per annum as on October 2022, comprising of 23 refineries - 18 under public sector, 3 under private sector and 2 in a joint venture. Refinery capacity utilization was 88.8 percent for the year 2020-21. Indian Oil Corporation (IOC) is the largest domestic refiner with a capacity of 80.6 MMTPA. The top three companies – IOC, Bharat Petroleum Corporation (BPCL) and Reliance Industries (RIL) - contribute around 70 percent of India's total refining production from FY 2020-21. India plans to almost double its oil refining capacity to 450 MnT in the next 10 years to meet the rising domestic fuel demand as well as cater to the export market. Petro products play a considerable part in India's economy as an earner of foreign exchange.

| Refineries across India | ||||

|---|---|---|---|---|

| Sr. No | Refinery location | Name of the company | Name plate capacity (MMTPA)(As of 01.01.2022) |

Crude oil processing (MMT) 2021-22 |

| Public sector unit refineries | ||||

| 1 | Digboi – 1901 | Indian Oil Corporation Ltd. |

0.65 | 0.7 |

| 2 | Guwahati – 1962 | 1.0 | 0.7 | |

| 3 | Barauni – 1964 | 6.0 | 5.6 | |

| 4 | Koyali – 1965 | 13.7 | 13.5 | |

| 5 | Bongaigaon – 1974 | 2.70 | 2.6 | |

| 6 | Haldia – 1975 | 8.0 | 7.3 | |

| 7 | Mathura – 1982 | 8.0 | 9.1 | |

| 8 | Panipat – 1998 | 15.0 | 14.8 | |

| 9 | Paradip – 2016 | 15.0 | 13.2 | |

| 10 | Manali – 1965 |

Chennai Petroleum Corporation Ltd. |

10.5 | 9.0 |

| 11 | Nagapattinam – 1993 | 0 | 0 | |

| 12 | Mumbai – 1954 |

Hindustan Petroleum Corporation Ltd. |

9.5 | 5.6 |

| 13 | Visakhapatnam – 1957 | 8.3 | 8.4 | |

| 14 | Mumbai – 1955 |

Bharat Petroleum Corporation Ltd. |

12 | 14.4 |

| 15 | Kochi – 1963 | 15.5 | 15.4 | |

| 16 | Numaligarh – 2000 | Numaligarh Refinery Ltd. | 3 | 2.6 |

| 17 | Mangalore – 1996 |

Mangalore Refinery and Petrochemicals Ltd. |

15 | 14.9 |

| 18 | Tatipaka, AP – 2001 |

Oil and Natural Gas Corporation Ltd. |

0.066 | 0.075 |

| Joint venture refineries | ||||

| 19 | Bina – 2011 | 7.8 | 7.4 | |

| 20 | Bathinda – 2012 | 11.3 | 13.0 | |

| Private sector refineries | ||||

| 21 | DTA-Jamnagar – 1999 | 33.0 | 34.8 | |

| 22 | SEZ-Jamnagar – 2008 | 35.2 | 28.3 | |

| 23 | Vadinar – 2006 | 20 | 20.2 | |

| GRAND TOTAL | 251.2 | 241.7 | ||

- Crude oil to petro-products

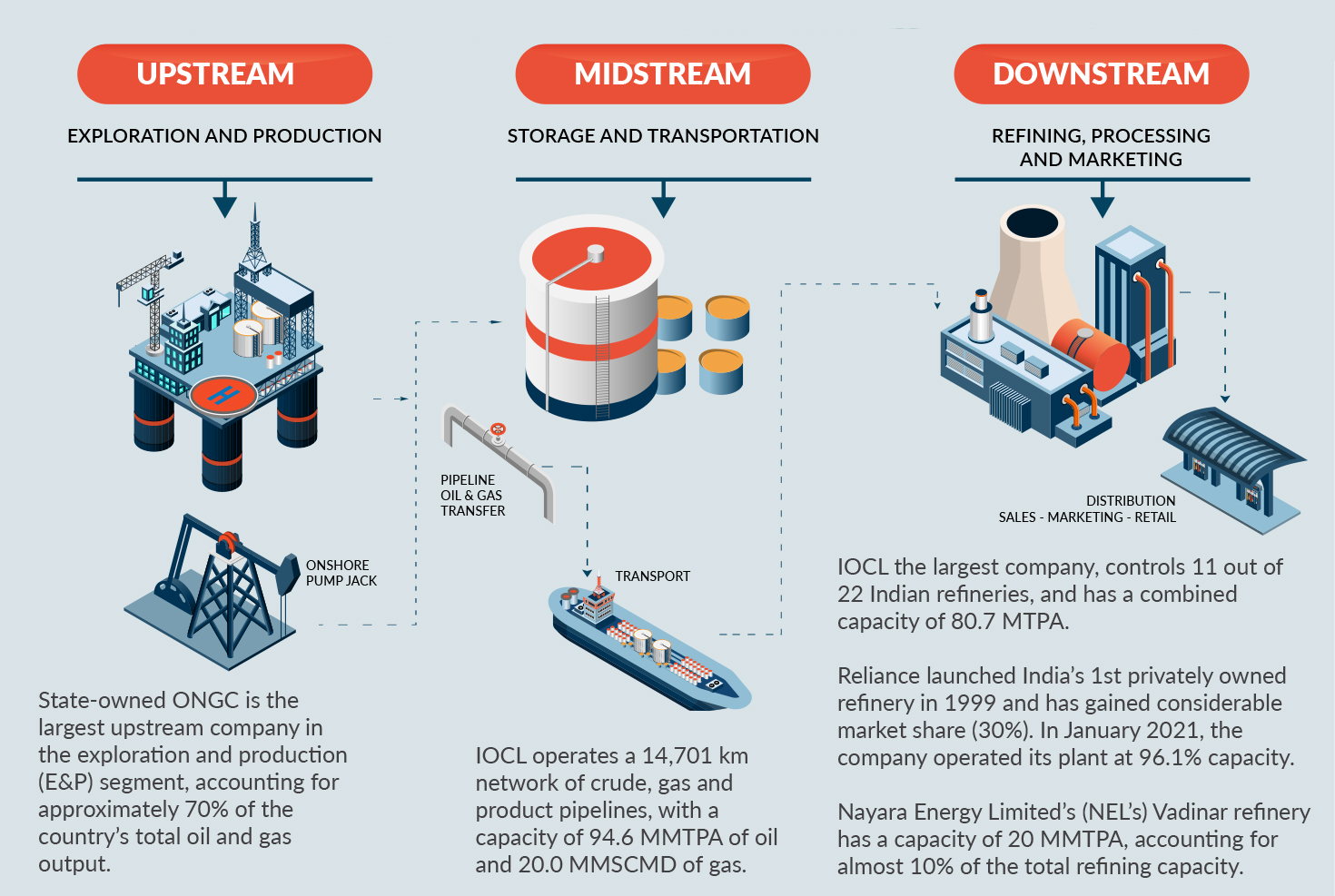

From its extraction to how it is supplied to end consumers, crude oil passes through various refining stages. Different kinds of companies operate and specialise in activities at each stage. Based on the operations and their position in the supply chain, these oil companies are divided into upstream, midstream, and downstream companies.

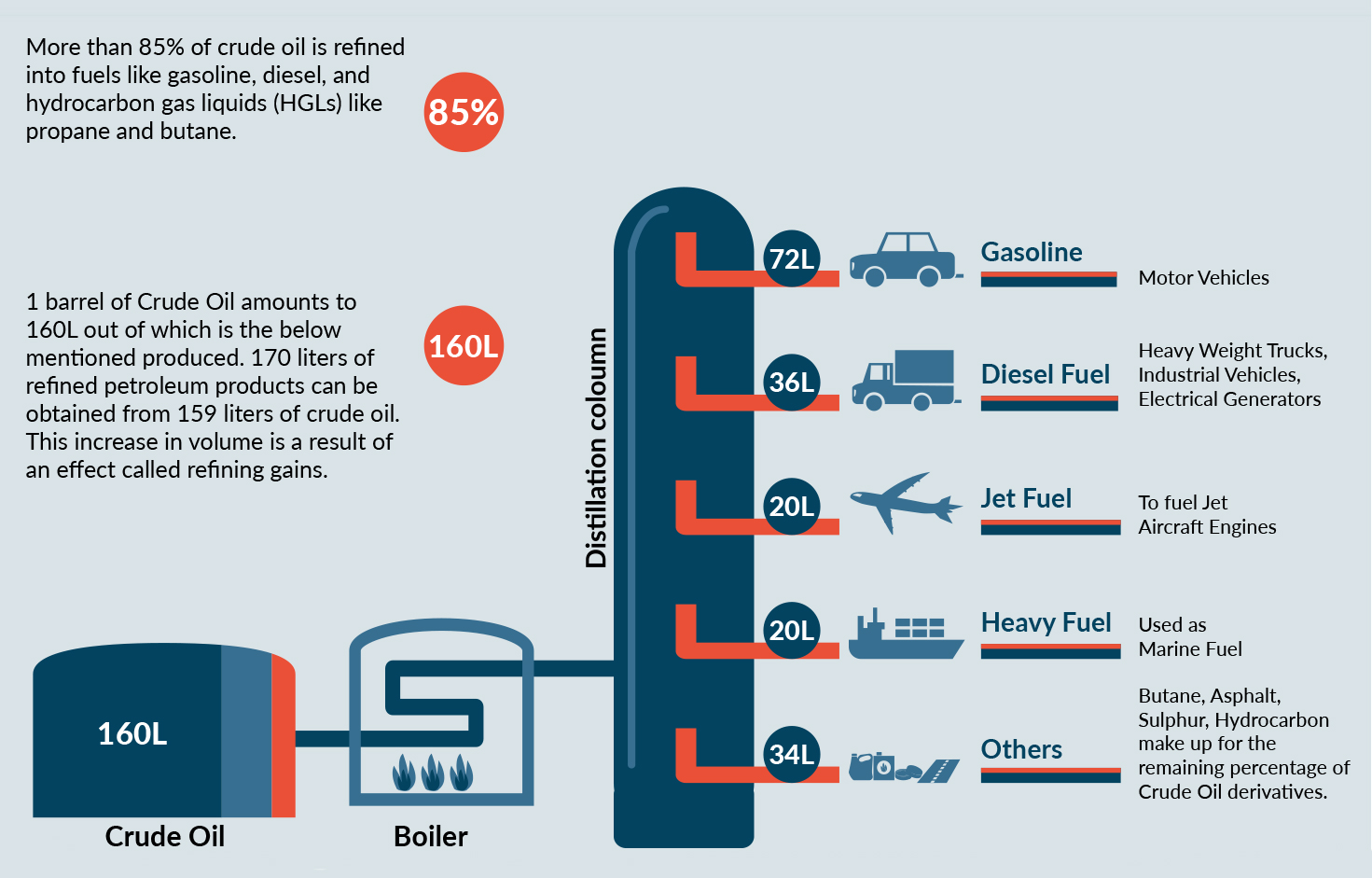

Petroleum products derived from crude oil include light distillates such as LPG and naphtha; middle distillates such as kerosene; and heavy ends such as furnace, lube oils, bitumen, petroleum coke and paraffin wax.

OIL AND GAS SUPPLY CHAIN

Production of petroleum products reached 254.3 MMT in FY 22. India is one of the largest exporters of refinery products due to the presence of various refineries.

- Petroleum products - current scenario

Petroleum demand in the world’s third largest oil consuming nation has been growing faster than anywhere else in 2022, rising by more than 400,000 barrels a day. That’s equivalent to more than 20 percent of the total global increase.

| Import, export and consumption of petroleum products in the country (in MMT) | ||||

|---|---|---|---|---|

| Year | Crude Oil imports | Petroleum products import | Petroleum products export | Petroleum products consumption |

| 2020-21 | 196.5 | 43.2 | 56.8 | 194.3 |

| 2021-22 | 212.4 | 42.1 | 62.8 | 204.2 |

| 2022-23* | 134.2 | 25 | 36.3 | 126.1 |

India is one of the largest exporters of refinery products due to the presence of various refineries. Exports of petroleum products from India reached 62.7 MMT in FY 22 from 60.5 MMT in FY 16. Crude oil and petroleum products worth US $ 4 4.41 Bn were exported in FY 22. During FY 22 high speed diesel was the major export item among petroleum products, followed by Motor Spirits (MS) , naphtha, Aviation Turbine Fuel (ATF) and furnace oil. Major export destinations for Indian petro products are Singapore, Brazil, Netherlands and South Korea. India mostly imports motor spirit, ATF and fuel oil from Russia and the UAE.

The overall consumption of Petroleum Oil and Lubricant (POL) products for FY 22 in India was recorded at 211 MnT with a growth of 5.1 percent over the previous financial year with Motor Spirit (MS) continuing to be a growth driver in oil consumption in India with a growth of 10.3 percent over FY 21, surpassing pre-pandemic volumes. High-Speed Diesel (HSD), the highest volume product, achieved a growth of 5.5 percent over FY21. LPG consumption recorded a volume of 28.58 MMT in FY22 which is 7.6 percent higher than the years preceding the pandemic. As of April 2022, the total length of the crude oil pipeline network across India is 10,419 km with a capacity of 147.9 MMTPA. During FY22 the utilization of the crude oil pipelines increased by 5.7 percent. Product pipelines including LPG pipelines have a total network of 18,820 km and 115.7 MMTPA capacity.

| Petro products and their end use | |

|---|---|

| LPG | Domestic and auto fuel. Also for industrial application where technically essential. |

| Now permitted as auto fuel. | |

| Naphtha | Feedstock/fuel for fertilizer units, feedstock for petrochemical sector and fuel for power plants. |

| MS | Fuel for passenger cars, taxies, two & three wheelers. |

| ATF | Fuel for Aircrafts. |

| SKO | Fuel for cooking & lighting. |

| HSD | Fuel for transport sector (railways / road), agriculture (tractors, pumpsets, threshers, etc.) and captive power generation. |

| LDO | Fuel for agricultural pumpsets, small industrial units, start up fuel for power generation. |

| FO/LSHS | Secondary fuel for thermal power plants, fuel / feedstock for fertilizer plants, industrial units. |

| BITUMEN | industrial units. |

| LUBES | Lubrication for automotive and industrial applications. |

| PETROLEUM COKE | Fuel grade petcoke is used as fuel for cement kilns and and other carbon consuming industries. electric power plants. Calcined petcoke is used in manufacturing aluminium, graphite electrode, steel, titanium dioxide. |

| Other products (Benzene, Toluene, MTO, LABFS, CBFS, Paraffin wax etc.) |

Feedstock for value added products. |

- The road ahead

India’s oil consumption is forecast to rise from 5.2 Mn barrels per day (mbd) in 2022 to 7.0 mbd in 2030. India state refiners are set to invest US $ 26.96 Bn to boost oil refining capacity by 20 percent by 2025. India's refining capacity of about 251 MnT a year in 2022 is expected to climb to 298 MnT a year by 2025. India will soon start crude oil imports from Iran which was banned in 2019, due to US Sanctions. By 2025 it may also increase the crude oil imports from the UAE.

DISTILLATION OF CRUDE OIL

While the share of renewables, including solar, wind and natural gas, is likely to increase in the next 10 years, absolute oil demand would still rise strongly over the next decade.

Demand for gas oil will rise by an average 5.3 percent per year through FY 25 and by an average 4.5 percent through 2030. India will continue to rely mainly on road transport to move freight around the country, while the number of passenger cars would steadily increase in the coming years with rising vehicle ownership. Gasoline and gas oil will continue to benefit from rising car sales and a stronger manufacturing industry, but faster than expected penetration of electric vehicles could slow demand growth.

While the near-term recovery for oil demand will primarily stem from transportation fuels, it is the petrochemical sector that will dominate growth over the medium term in India. Total ethane, LPG and naphtha demand is expected to grow. India is likely to start operations of 281 petrochemical projects by 2025, accounting for nearly 34 percent of the total upcoming petrochemical project starts in Asia for the year. Petrochemicals demand in India is outpacing supply due to consistent economic growth and is one of the largest consumers of petrochemicals globally. Petrochemicals are one of the fastest growing industries in the Indian economy as it supports other growing industries such as construction, pharmaceuticals etc.

A common feature impacting all segments of the oil market is the acceleration of the energy transition in recent years and to meet this increasing oil demand the government is focusing on exploration so that India can reduce reliance on imports and insulate the country from effects in the energy sector arising from geopolitical situations. Recently, the centre opened bidding for 26 blocks for oil exploration in the country. This will help produce 25 percent of the country’s crude oil demand by 2030. India has set a target of 5 MnT of green hydrogen by 2030. Over the next decade, the country plans to add 175 GW of green hydrogen-based energy, and thereby curb the country’s dependence on crude oil imports.

For the near to mid-term future, crude oil will continue to play a pivotal role in India’s growth trajectory. However, as the emphasis on research and thrust on infrastructure for green energy grows, there will be a gradual yet inevitable phasing out of the fossil fuel that has brought us so far.