The reverse gear of the indian auto industry came immediately after the government declared a nationwide lockdown on March 24, 2020 to contain the spread of COVID-19. SIAM declared that the plant closure of auto original equipment manufacturers and component manufacturers has led to a loss of INR 2,300 crore per day. Indian Auto sector was facing difficult year even before the outbreak. Auto sales had been tepid for 12 to 15 months. The switch from Bharat Stage 4 (BS4) to Bharat Stage 6 (BS6) emission norms has also added to the woes of the sector as BS6 was to be implemented from April 1, 2020. This brought in long-term problems to the automobile industry from both manufacturing end to sales point such as research and development, technological upgradation and closing of plants to stop piling up of old inventory. As new BS6 vehicles were few in the market and the switch to BS6 saw the overall demand sales of BS4 vehicles drop, this led to an increase in inventory of old (BS4) vehicles both in two-wheeler and four-wheeler segments.

Hence many automobile plants of leading players were closed for few days to halt production, which led to loss of jobs of the contractual workforce. Macroeconomic issues that added to this crisis include the decline in demand/consumption both from the rural and urban markets, and a liquidity crunch in the financial markets.

| Indian Auto Sector Exports (Apr-Jun 2020) | ||

|---|---|---|

| Major Players | Exports (Units) | Y-o-Y Change in % |

| Hyundai Motors | 12,688 | -74.73% |

| Maruti Suzuki | 9,410 | -65% |

| Kia Motors | 5,395 | -84% |

| Ford India | 5,209 | -84.53% |

| Volkswagen India | 4,154 | -77.56% |

| General Motors | 3,186 | -84.06% |

| Nissan India | 2,127 | -80.92 |

| Mahindra & Mahindra's (M&M) | 896 | -79.73% |

The Indian Automobile Industry is the fourth largest in the world with an annual turnover of $100 billion and employs 32 million people. The two-wheeler industry in India is the largest in the world. India is also the largest tractor manufacturer and the eight largest commercial vehicles manufacturer in the world. The automobile sector currently contributes about 7.1 per cent of overall GDP. The sector contributes approximately 13 per cent of excise revenue to the government. In 2018-19, 4.06 million cars were manufactured and at present around 32 million cars run on Indian streets. The two-wheeler segment dominates the industry with a share of 80 per cent. As India battles its worst pandemic crisis, there is huge toll on the automobile industry. The initial estimates were scary, but the recovery of the sector is more than expected with some timely government intervention.

- The New Normal forThe Auto Sector

Preference For Personal Mobility The pandemic has brought about marked changes in consumer habits and behaviours. There is likely to be a shift away from shared mobility options as people prioritise social distancing and personal hygiene. This would effectively translate into a higher preference for affordable personal mobility, which could boost sales for auto manufacturers, especially in the entry-level vehicle’s category. A similar trend was witnessed when the lockdown ended in China, where car ownership gained traction vis-a-vis car-hailing and sharing. India is expected to follow a similar path, which could help reverse the declining sales trend in the automotive sector.

The outbreak, however, has also greatly strained personal finances with significant job losses across sectors. As a result, the consumer’s financial ability to purchase new cars might be constrained. The automotive sector will have to devise innovative purchase/leasing schemes to drive automotive sales. As new cars may be unaffordable for certain sections of the population, the two-wheeler and organised used car market might also stand to gain.

Going Digital The increasing preference for contact-less online transactions has emerged as a major trend and is expected to reflect in automotive purchases as well. There was already a shift towards online models in after-sales with increases in online booking of appointments, doorstep pickup/delivery and online payments. Several original equipment manufacturers (OEMs), both premium and mass market, have already recognised this trend and launched a complete online buying experience[2], starting from initial enquiries and customisation of features, to booking, financing and delivery in a completely contact-less transaction. Even test drives are today offered at the customer’s doorstep, thereby eliminating the need to visit a showroom.

Online Marketing Traditional marketing events, such as auto shows and exhibitions, will take a backseat for some time with social distancing being the norm. Going forward, digital media platforms likely will be the gainers.

Innovating With New Features In adapting to the post COVID-19 world, several consumers will look for better health, hygiene and sanitation features in their vehicles. Certain features like in-built sanitisation, enhanced air-purification systems and anti-bacterial surfaces may see a spike in demand. Consumers are likely to lean towards cars that offer such features and might even be willing to pay extra for their own physical and mental wellbeing.

- Auto Component Industry

With automobile industry sales estimated to fall by about one-fifth in the current fiscal year, revenues of the auto component industry may also shrink. Noticeably revenues of auto component manufacturers aren’t falling at the same rate as automobile manufacturers. Exports and replacement sales, which together generate almost half of the industry’s revenue, are withstanding the downturn better. Battery and Tyre manufacturing segment is expected to recover sooner than other segments in the Auto industry. Replacement volumes to grow at 14% for 2 wheelers and 6% for other vehicles.

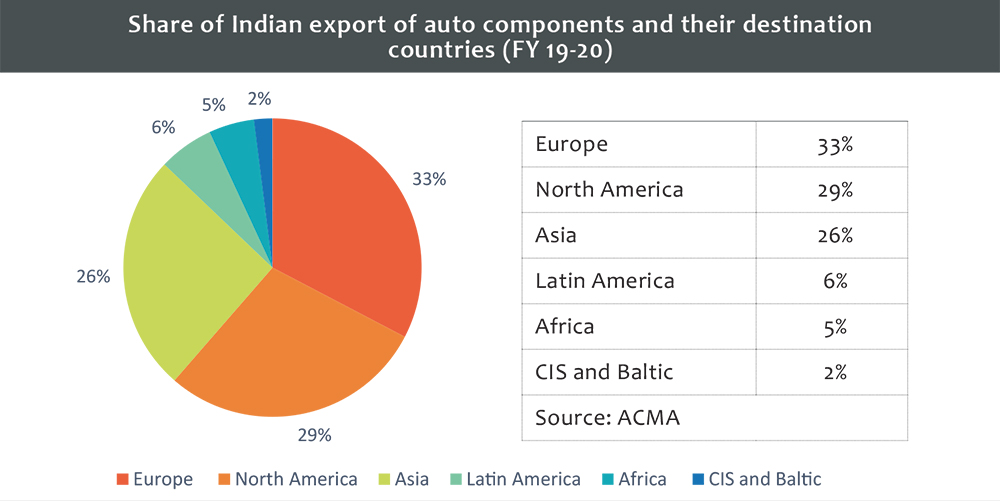

Exports remains key focus in the ancillaries with Europe and North America being the major destination. Both countries had suffered during COVID-19 but gradually expects that demand for this segment to come back. Overall, 50 % of exports are in the area of engine, transmission & steering parts and high growth areas in the recent years includes electrical and electronics items.

Imports A huge chunk of Indian auto component imports, an estimated worth USD 4.5 billion comes from China. A whopping 27 percent of the automotive parts are manufactured in China and imported to India. India imports a wide array of automotive parts, spanning various vehicle types from China. Crucial automotive parts like fuel injection pumps, Egrmodules, electronic components, turbochargers, airbag components, etc are the key non-domestic commodities that can limit the further production of commercial vehicles, passenger vehicles, and two-wheelers, The deadly outbreak has rendered the Chinese factories ineffectual, which in turn has brought the Indian automotive industry to a halt. The solution, it seems, is to switch to alternate suppliers outside of China, formulate an action plan to acquire multiple vendors on a global scale, rather than limiting imports from one region entirely.

However, there will be subdued demand for FY 20-21. Revenue of auto ancillaries, except tyre segment, to drop by 16-20 per cent which will further show strong growth during FY 22. With the sequential pick-up in production across all automotive segments and the gradual opening of export markets, capacity utilisation for most auto component players will be close to 60-65 %.

Post-Covid mindset It is hardly surprising that two-wheelers are among those motorised transport forms leading the way. It’s largely the rural areas that are pushing up sales for now. Hero Motocorp, the market leader, sold 4,50,774 vehicles in June. That was 26 per cent down from sales of over 6,00,000 in June 2019, but everyone is heaving sighs of relief that it wasn’t worse. Other two-wheeler companies like TVS and Bajaj Auto have posted similar results, with the June domestic sales down by 26 per cent year-over-year for Bajaj and 36 per cent for TVS. Caution is the watchword in the pandemic era, and with the desire of many to avoid crowded public transport, everyone is hoping that that two-wheelers will be back on the road quickly.

A similar scenario is playing out for smaller automobiles, which have suddenly become hot favourites, mainly in rural areas. In the future, too, though, the mini and compact segments are expected to see interest even from urban customers — again because anyone who plans to return to office has realised public transit is a no-go for the foreseeable future. Companies which don’t offer small cars have taken a harder hit. For Mahindra, however, the Bolero has done well.

Another big winner is the light commercial vehicle (LCVs) segment. Sales of LCVs are being driven almost entirely by the booming e-commerce industry, which needs to get goods from its godowns to the sheltering customers. There is another segment who performed extremely well ie., Tractor segment. manufacturers like Mahindra and Escorts. Mahindra, the market leader, actually saw year-on-year domestic sales rise 12 per cent in June. The company called this its second-best performance ever, and attributed it to the good rabi crop combined with a strong South-West Monsoon.

Struggle ahead All the auto companies are grappling with getting suppliers back online and ensuring that their retail showrooms are able to open once again. Most companies, because of social distancing rules, are running one or two shifts, and are only just looking at running a full three shifts.

Indian carmakers suggested several steps to revive the industry, like a temporary tax cut on cars, trucks and motorbikes as well as incentives to scrap old vehicles. SIAM had said that carmakers want a temporary, 10% cut in tax on the sale of all automobiles and auto parts and incentives, in the form of tax rebates, for car owners to scrap their old vehicles.

While Minister of Road Transport and Highways Nitin Gadkari has assured a vehicle scrappage policy for India soon. In the simplest of terms, the vehicle scrappage policy takes aim at old polluting vehicles on Indian roads and looks at confining them to the scrapyard. With resale value of vehicles beyond 15 years being extremely low, these vehicles can be sent to scrapyards with some sort of monetary compensation to owners which could ensure two benefits - incentive for owners to get rid of such vehicles and putting these polluting vehicles out to help the environment. There could, however, be other equally important benefits like such owners then going to the market for new vehicles which could boost demand and re-using the scrap materials like steel and aluminium for manufacturing new vehicles.

In conclusion The easing of lockdowns offers hope that the automotive sector will soon set a course for recovery. This will be a testing time for the sector and the recovery trajectory will depend on how well manufacturers and retailers are able to respond to challenges and adapt to the evolving trends in the post COVID-19 world.