India is the largest producer pulses, accounting for 25% of global production. Pulses are a major source of protein for a majority of Indians. Pulses and pulse crop residues are also major sources of high-quality livestock feed in India. As India’s middle class continues to grow, so does its demand for pulses and other proteins.

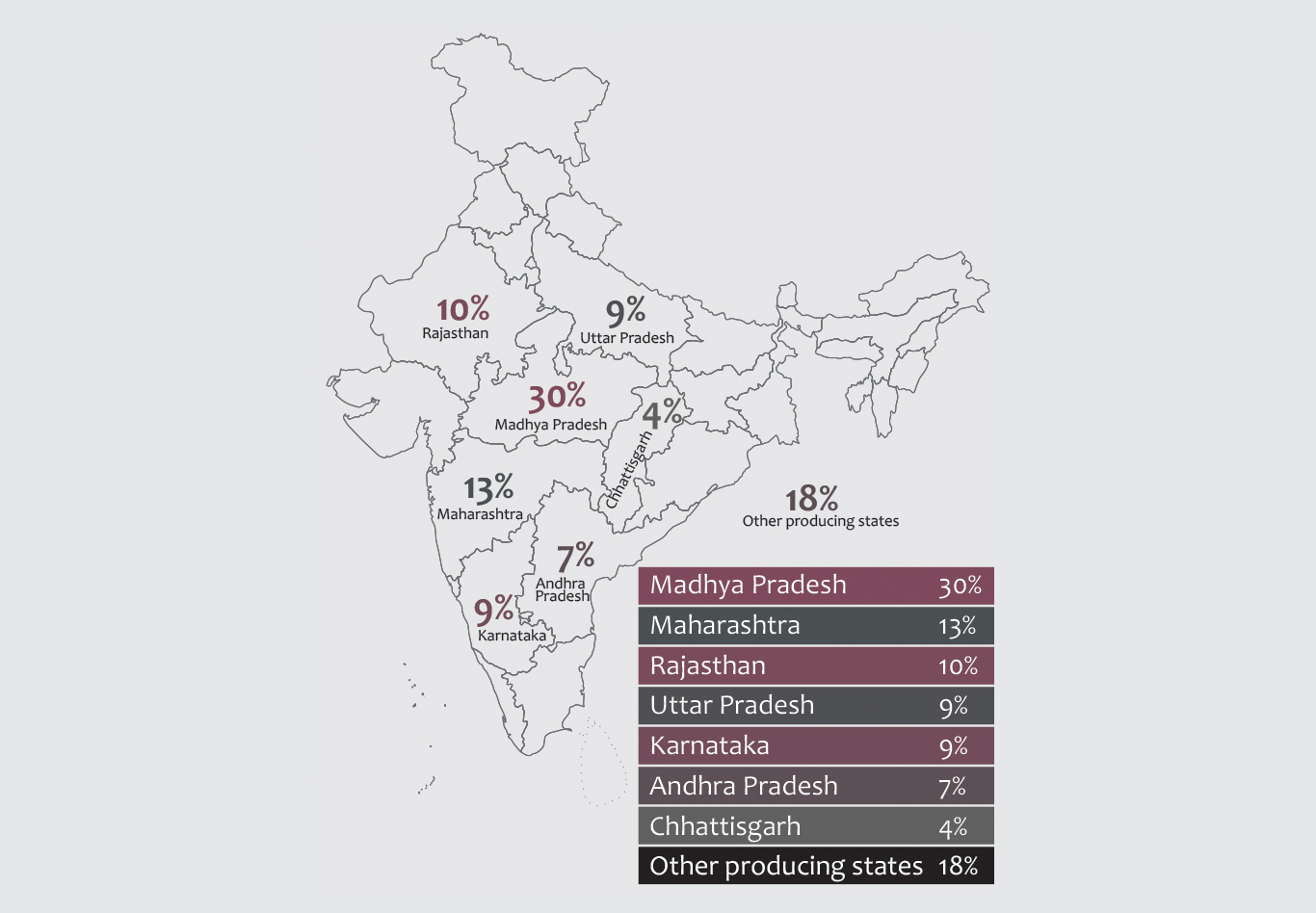

- Areas Of Cultivation

The main regions with high productivity are Madhya Pradesh (30%), Maharashtra (13%), Rajasthan (10%), Uttar Pradesh (9%), Karnataka (9%), Andhra Pradesh (7%), Chhattisgarh (4%) & other producing states (18%).

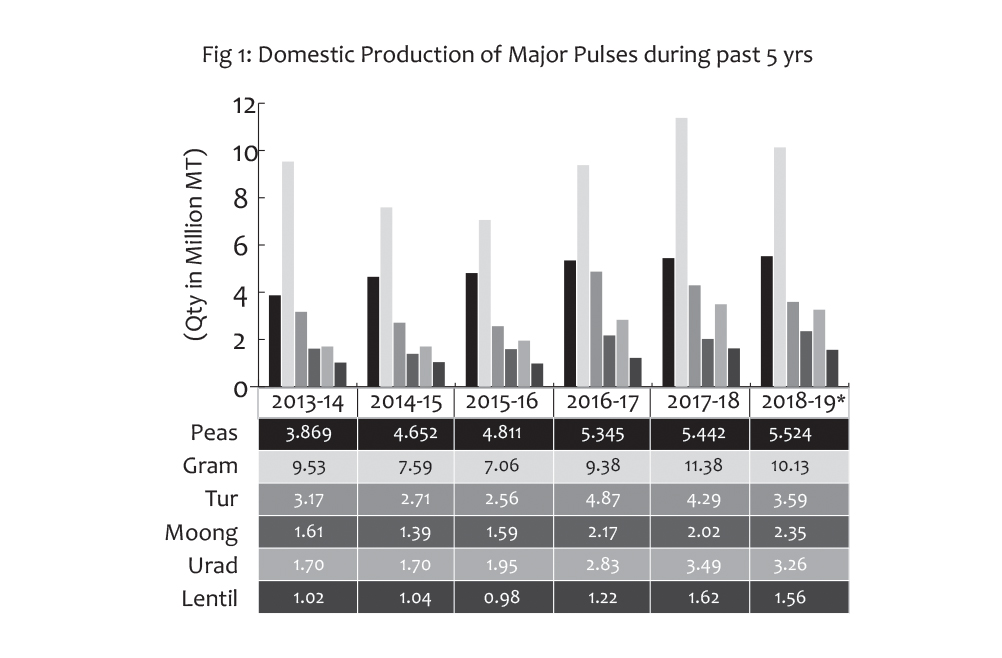

- Domestic Production Of Pulses

Major pulses grown are Chickpeas-gram (38%), Peas (21%), Tur (14%), Urad (12%), Moong (9%), Lentil-Masur (6%).

- Major Pulses Statistics - Marketing Year (March To February)

| Particulars | 2019-20 (In Lakh MT) | |||||

|---|---|---|---|---|---|---|

| Urad | Moong | Tur | Chana | Masur | Total | |

| Opening Stock | 8.75 | 5.52 | 7.87 | 18.22 | 2.84 | 43.20 |

| Production | 19.17 | 18.40 | 37.19 | 101.00 | 13.50 | 189.26 |

| Imports | 2.25 | 1.50 | 4.00 | 3.00 | 5.50 | 16.25 |

| Total Supply | 30.17 | 25.42 | 49.06 | 122.22 | 21.84 | 248.71 |

| Consumption | 28.00 | 21.50 | 42.00 | 99.50 | 19.00 | 210.00 |

| Exports | 0.20 | 0.75 | 0.25 | 1.00 | 0.20 | 2.40 |

| Closing Stock | 1.97 | 3.17 | 6.81 | 21.72 | 2.64 | 36.31 |

- Pulses Imports

India despite its indigenous production, remains a net importer of pulses because of high and continuously growing consumption that exceeds domestic production, creating a growing supply-demand gap. The country imports huge quantities of Yellow Pea.

Historical Import figures are as per below:

| Pulses | 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

|---|---|---|---|---|---|---|

| IMPORTS (In Thousand Tonnes) | ||||||

| Peas | 1330.4 | 1952 | 2245.4 | 3172.8 | 2877 | 719.5 |

| Chickpea | 276.1 | 418.9 | 1031.5 | 1080.6 | 981.3 | 164.9 |

| Moongbean | 624.2 | 622.9 | 581.6 | 574.5 | 347 | 515.9 |

| Lentil | 708.7 | 816.5 | 1260.2 | 829.4 | 796.6 | 218.3 |

| Pigeonpea | 465.8 | 575.2 | 462.7 | 703.5 | 413 | 489.05 |

| Total | 3654.7 | 4584.8 | 5797.7 | 6609.4 | 5607.5 | 2103.36 |

India had allowed the duty-free import of pulses after a drought in 2014 and 2015 and imported a record 6.6 mt of pulses in 2016-17.

- Major Import Sources

| Pulses | >Top 5 Import Sources |

|---|---|

| Peas | Canada (39.1%), Ukraine 20.4%), Russia (16.3%), Lithuania (5.5%), Netherland (4.2%) |

| Chickpeas | Sudan (31.9%), Myanmar (20.2%), Tanzania (18.9%), Ethiopia (5.8%), USA (4.5%) |

| Moong/Urad | Myanmar (80.3%), Kenya (4.9%), Mozambique (2.9%), Australia (2.3%), Tanzania (2.0%) |

| Lentils | Canada (81.8%), Australia (6.2%), USA (4.2%), Netherland (4.2%), Singapore (2.6%) |

| Pigeon Peas | Mozambique (44.2%), Myanmar (30.2%), Tanzania (14.0%), Malawi (5.5%), Sudan (5.2%) |

- Major Pulses Mandies

Below are the important domestic trading markets for pulses in India:

| Major Pulses | Mandies |

|---|---|

| Chickpeas | Delhi |

| Indore | |

| Bikaner | |

| Lentil | Kanpur |

| Patna | |

| Indore | |

| Tur | Gulbarga |

| Indore | |

| Kanpur | |

| Amravati | |

| Vijayawada | |

| Urad | Jalgaon |

| Jaipur | |

| Moong | Vijayawada |

| Indore | |

| Jaipur |

- Exports

All varieties of pulses, including organic pulses, have been made ‘free’ for export without any quantitative ceilings w.e.f. 22nd November, 2017.

Chickpeas contribute the single largest share in India’s export basket of pulses registering 70.92% and 80.02% share in the total pulses export during 2017-18 and 2018-19 respectively.

| HS Code | Pulses/Year | 2017-18 | % Share in Total Pulses Export | 2018-19 | % Share in Total Pulses Export |

|---|---|---|---|---|---|

| 7131000 | Peas (Matar) | 4.44 | 2.47 | 2.06 | 0.72 |

| 7132000 | Chickpeas (Chana) | 127.2 | 70.92 | 228.72 | 80.02 |

| 7133100 | Moong/Urad | 16.75 | 9.33 | 18.77 | 6.56 |

| 7134000 | Lentils (Masur) | 11.20 | 6.24 | 13.96 | 4.88 |

| 7136000 | Pigeon Peas (Tur) | 10.54 | 5.87 | 9.34 | 3.26 |

| Total Pulses Exports | 179.36 | 285.83 |

The country has exported 2.36 lakh MT of pulses worth of Rs.1,534 crores during 2019-20.

- Major Export Destinations

| Pulses | Top 5 Export Destinations |

|---|---|

| Peas | Sri Lanka (48.5%), Nepal (12.6%), U S A (11.1%), Australia (4.1 %), Qatar (3.3%) |

| Chickpeas | Algeria (20.8%), UAE(9.8%), Sri Lanka (8.4%) Turkey (6.9%), Morocco (5.4%) |

| Moong/Urad | USA (37.7%), UK (12.4%), Canada (12.3%), Nepal (8.3%), Qatar (5.9%) |

| Lentils | Bangladesh (48.5%), Qatar (12.0%), Sri Lanka (10.2%), USA (7.8%), Nepal (4.5%) |

| Pigeon Peas | USA (57.8%), Canada (15.7%), UAE (6.8%), Australia (3.4%), Singapore (2.6%) |

- Trade Policy

In the recent years, the country has shifted its approach from import-led to achieving domestic self-sufficiency of production.

Generally, Import of all varieties of pulses is free without any quantitative restrictions under Open General License; however to protect the farmers from cheap imports, Quantitative Restrictions had been imposed on import of Tur to the tune of 4 lakh MT/year and on import of each Peas, Moong & Urad respectively to the tune of 1.5 lakh MT/year in 2019-20.

As for fiscal year 2020-21 the Government has announced annual quota for imports to be allowed only to the Millers/Refiners as per below:

| Restricted Item | Quota |

|---|---|

| Yellow Peas | 1.5 lakh MT |

| Green Peas | |

| Tur/Pigeon Peas | 4 Lakh MT |

| Others | 1.5 Lakh MT |

Beyond quantitative restrictions Govt. in a move to boost domestic availability of crops that face shortfall in domestic supply like Lentils, had reduced the import duty from 50% to 30% for shipments arriving during the period 02nd June, 2020 to 31st August, 2020 except for crop originating from USA. The duty was further brought down to 10% for the period from 18.09.2020 to 31.10.2020.

Boxco Logistics a division of J M BAXI GROUP, handled a vessel carrying imported Lentils in bulk ~ 19,072 MT at Kandla Port in the month of August, 2020 arriving from Canada. The cargo was bagged in 50kg bags and dispatched to various markets like Kanpur, Delhi, Indore, Patna, Jaipur, Bhiwandi etc.

- Fumigation - India

Fumigation is an approved treatment method extensively used for controlling pest infestation in agricultural products in many countries of the world.

In India methyl bromide fumigation is acknowledged though it has potential negative impact on environment, yet so far it is considered as the most appropriate treatment method in eradication of pest infestation in plants and plant products. In view of its effectiveness on all life stages of insect-pests, the use of methyl bromide is allowed for pre-shipment treatments by Plant Quarantine Division - India.

Any import consignments to India that do not undergo fumigation at load port (due to discontinuance of Methyl Bromide for phytosanitary measures as per the policy of the exporting country) are given relaxations and must compulsorily undergo fumigation at discharge port with 4 times the normal plant quarantine inspection charges levied on the importer.

- Future Imports - India

As per trade estimates that there was a 10% reduction in total production of 2.30 MMT target for pulses as set by the government in 2019-20 (July-June).

Therefore, in a move to curb domestic prices in India, the trade body (Indian Pulses and Grains Association) estimates an import volume of approx. 2.3 MMT in 2020-21 which would include the quantity of pulses covered under Quantitative Restrictions and 1 MMT of red lentils, 0.4 MT of Urad, 0.2 MT of red kidney beans and white chickpea .