- The Situation During the Lockdown

As Covid-19 was spreading its wings in India, despite logistics being categorised as an essential service, volumes took a plunge due to the transport challenges for the first mile (cargo evacuation from port) and the last mile (supply chain between inland container depots to company warehouses). With the disruption to both the demand side as well as the supply side, the terminals, CFSs, ICDs and warehouses were feeling the heat.

Pre-Covid bookings of imports were still arriving in India and the CTOs were evacuating containers from ports trying to avoid port ground rent, which was not relaxed by the ports even after the government notification. At the same time, many customers were not able to receive deliveries due to the lockdown as manufacturing units were not classified as essential services. The only exports were of essential commodities (such as agricultural goods, especially rice), which made exporting easy for the terminals. Import containers, thus, became stuck at terminals and ICDs. Within a month due to non-deliveries of imported cargo, an imbalance arose and 40 per cent of the container inventory in the NCR was surplus. Moreover, some of the inventory at terminals was idle because it was the wrong size for exporters. This resulted in a clogging up of facilities and a lack of space at some ICDs and CFSs.

Ultimately, the railways allowed empty containers and flats to move without charge during lockdowns 2.0 and 3.0, which resulted in significant savings for CTOs. The operators were able to move rakes swiftly on the rail network, which ensured the timely movement of cargo to and from ports. This also helped the shipping lines to manage their inventory levels and reduce the imbalance.

As terminals were facing issues related to exporting, north Indian ICDs started to receive empty containers for export movements from their area, which is continuing due to the slowdown of imports. Mainly TEUs were required due to the relaxation of which commodities could be exported.

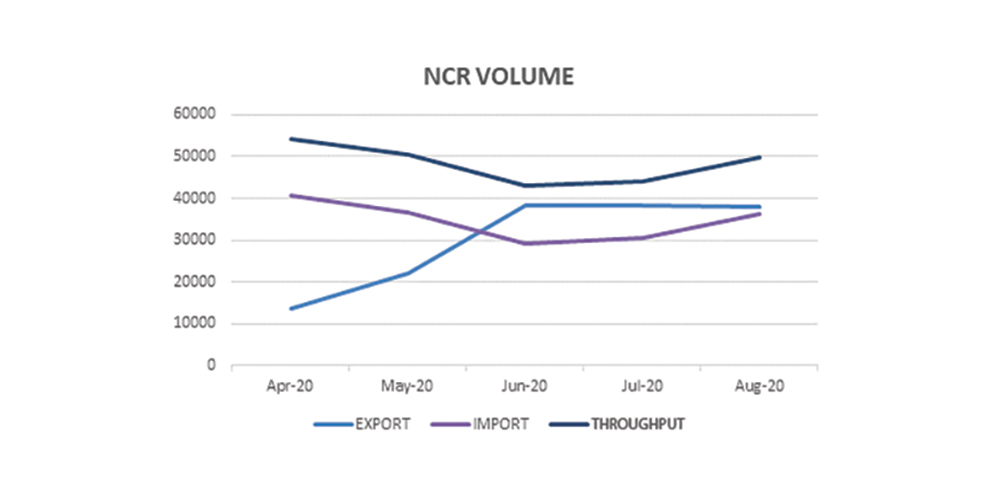

In April 2020, during the second phase of the lockdown, movements in the NCR fell by 30 per cent compared to March 2020. Volumes fell again in May, though there was less of a decline as exports started picking up due to a relaxation of the lockdown for some businesses. The overall trade was affected, as market volumes had fallen by 24 per cent compared to before the lockdown.

- The Situation After Lockdown 4.0

Logistics chains are experiencing bizarre and huge misfortunes due to the interruption resulting from the Covid-19 pandemic. Even after a relaxation in the lockdown for some industries, business has not yet returned to normal, as many workers, including drivers, went back to their home towns, which resulted in staff shortages at various facilities and manufacturing units across the region. Some industries have closed due to the non-availability of skilled staff as per health and safety guidelines. This has directly hit export and import volumes for the nearby terminals, ICDs and CFSs.

After the relaxation of the lockdown and movements of cargo increased again, we faced our next challenge, which was the space crunch due to the amount of uncleared cargo and the number of containers at the terminal. Waiting times for loading and unloading increased due to the bunching of exports and imports, uncleared cargoes, the non-utilisation of empty containers, an increase in the number of vehicles etc.

To reduce congestion and waiting times at the terminal, DICT has begun to store empty containers at nearby yards, which has relieved the congestion at the terminal and reduced loading and unloading times for containers. However, road forwarding is still challenging as Sonepat District is in the red zone as per the government demarcation and because DICT has to manage its daily operations with a limited workforce. DICT is working to increase its service levels during the crisis and provide services to its valued customers.

With the surfacing of the deadly Coronavirus, many export businesses, such as manufacturers of chemicals, dyes, pigments, pharmaceuticals, textiles and automobiles, faced short-term supply disruptions due to global production shutdowns and slowdowns. However, the situation improved after lockdown 4.0 and DICT witnessed an increased flow of cargo.

In contrast, importers have suffered from a reduction in demand. Supplies of wastepaper, petrochemicals, dyes, pigments, chemicals, rugs etc. may be affected for some more time due to a lack of workers and reduced market demand.

Volumes started picking up in June, as restrictions on the movement of major export commodities were relaxed and imports from other countries, which had been stuck due to the various lockdowns, started to pump in. However, July and August were challenging, as imports were slow for north India. New export orders are catering to the festival season in the Gulf and the West. There is still a long way to go, as volumes are not great in comparison to the pre-Covid era.

Containers are still blocked by the slow delivery of import containers, mainly due to the unavailability of skilled workers, closures and inland supply chain bottlenecks. Carriers are continuing to move empty containers from overseas locations to fulfil demands by exporters.

Further, the immediate growth prospects of the sector remain subdued and the domestic logistics sector is expected to contract in the current fiscal year.

- Way Forward

Though the manufacturing industry is still facing challenges due to the demand and supply issues, the logistics sector may soon see the visible growth of exports and imports, which may reach the volumes of 2019/20 by the end of calendar year 2020. From discussions with customers, it is expected that volumes will grow in the coming months. The entire NCR EXIM market is expected to grow by 6–7% during the third quarter of this financial year.

As imports of commodities such as polymers, EVA, PVC compounds, etc., which comprise 5% of NCR import volumes, have been shifted to Mundra Port, NCR ICDs will witness a decrease in the volumes of these commodities in the coming months.

In contrast, imports of other major commodities, like wastepaper, scrap, rags and calcium carbonate, will witness an improvement in the coming months. However, there is an increasing amount of imports pending at ports and destined for NCR ICDs. Imports from China may be affected for some time, but we are receiving mixed reports about imports from China from the shipping lines. Imports from the USA, Europe, the Gulf, Africa, Singapore and Korea are returning to normal.

The volume of cotton goods exported will slow down after mid-November 2020. Rice exports will peak after November as bookings from Gulf countries resume. Reefer exports have already improved, as demand from Malaysia, Indonesia, Hong Kong, some Gulf and African countries, and China has increased. Capital goods, machinery, petrochemical products, pharmaceuticals, hand-loomed items, handicrafts, etc. will be stable from now onwards as bookings are stable.

The shipping lines are also expecting a surge in bookings as volumes are showing a visible increase. The shipping lines are reducing the repositioning of empty containers from the port to north Indian ICDs based on import projections, which indicate that the trade is expecting expecting positive results in the coming months.

Though the COVID-19 pandemic cooled the markets for a while, it has not killed off people’s spirit, and businesses in various industries are expecting growth from the third quarter onwards.