Dear Friends and Colleagues, Regrettably, one more "From the Quarter Deck" starts with a reference to the COVID-19 pandemic. India is haltingly and slowly trying to open up, with various cities, towns, states and regions seeing different rates of infection and recovery. Public transport remains affected and controlled; public spaces remain closed or strictly controlled.

The latest cargo-handling figures at the ports of India seem to suggest a decline of cargo volumes of up to 15 or 20%. However, this is changing, month by month, with each succeeding month showing an upward correction. Globally, too, various ports and container terminals have seen a decline in their volumes. The last three months have also seen blank sailings across all the shipping lines as well as the main consortia services.

However, most of the shipping companies have declared positive results in this period, as revenues have been much better than expected. Freight rates have remained firm or increased. Shippers have shown a strong preference for working with shipping companies with the least number of enforced rollovers and have reportedly paid premiums for no rollover guarantees.

With blank sailings and declining volumes, the off-hires of chartered-in tonnage are reported to be high, which has resulted in a drop in charter rates for container ships. To further add to this volatility, there has been a steep fall in fuel prices, and an even sharper drop in the differential price between low (SOx ) MARPOL-compliant fuel and conventional fuel. This has made ships fitted with scrubbers and using old fuel unviable compared to ships using low (SOx) MARPOL-compliant clean fuel. What is frightfully interesting is how, just in the last four months, so many of our previous assumptions have been turned on their head. With oil prices remaining depressed, oil and gas exploration activity remains muted, leading to depressed prices for offshore oil and gas shipping assets. The demand for dry bulk carriers also continues to remain stable but low. The only sector in shipping that seems to be more than healthy is the tanker market and that too is mainly because of the carriage of crude oil. Like dry bulk carriers, gas carriers are also witnessing a stable run.

Even during the pandemic, India continues to make efforts to get its fuel needs met by gas. The only way to do this is to create the necessary infrastructure, such as regasification terminals and pipelines, and by transporting gas by road (last-mile transport, gas fuelling stations etc.). It is also encouraging to notice that large infrastructure projects, such as the Mumbai coastal road and the trans-harbour link project, continue to make progress, as are the river multimodal terminal projects, such as at Haldia and Sahibganj. Along with these developments, the government of India and the Ministry of Railways have invited the private sector to participate in running passenger trains. Moreover, private developers are to be involved on a PPP basis in the development and redevelopment of trains and railway stations.

Various commentators have continued to debate about the recovery post-COVID-19. The latest report from the Asian Development Bank makes interesting reading, although it does predict a slower recovery than a V-shaped one. At the time of writing, the stock markets, especially in the US and India, have been rising and not in keeping with the expected economic pain post-COVID-19.

- It is still difficult to predict what the new normal will be or when that will be. On the other hand, two aspects do clearly stand out

- Significant growth of trade and production is expected in India.

- There will be a rapid and urgent growth of digitalization and the adoption of technology in almost all spheres of life in India.

It has indeed been enthusing (especially in these COVID-19 constrained times) to witness our various authorities and regulatory bodies, like DG Shipping, several port authorities, customs authorities and the different ministries in the Indian government implementing and planning numerous policies and processes relating to digitalization and “e” based systems. It was also exciting to read that Cochin Shipyard has won an order to build an autonomous electric ferry for Norwegian interests, including for the government of Norway. Whilst it is clear that the journey ahead will be difficult, it is equally clear that there seem to be great opportunities too.

In a period of uncertainty, there are bound to be many unknowns. Various countries and geographies are seeing different levels of such uncertainty. If we were forced to make a prediction for India, we could not help but be more optimistic than pessimistic. Large infrastructure projects are being implemented, agricultural production is growing and basic industrial production, such as steel, cement, aluminium, refineries, petrochemicals etc., continues to grow.

Due to the geopolitics, India is positioned to attract more interest as well as investment. With the massive fiscal stimulus and liquidity easing schemes and measures implemented by the developed and rich nations, a fair amount of the resources will find their way to the emerging markets, including India. So, whilst the next 6 to 12 months may see heightened uncertainty, it is certainly fair to predict that India should see a rebound, and probably quicker than in a few other nations and regions. India should continue to see reforms and repairs, and also regeneration and reconstruction.

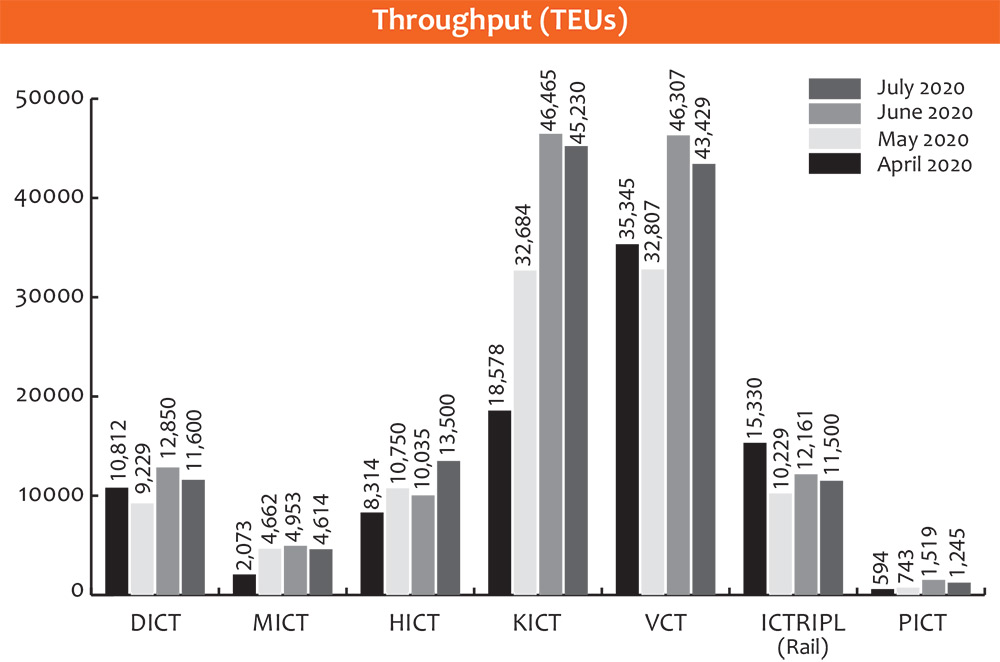

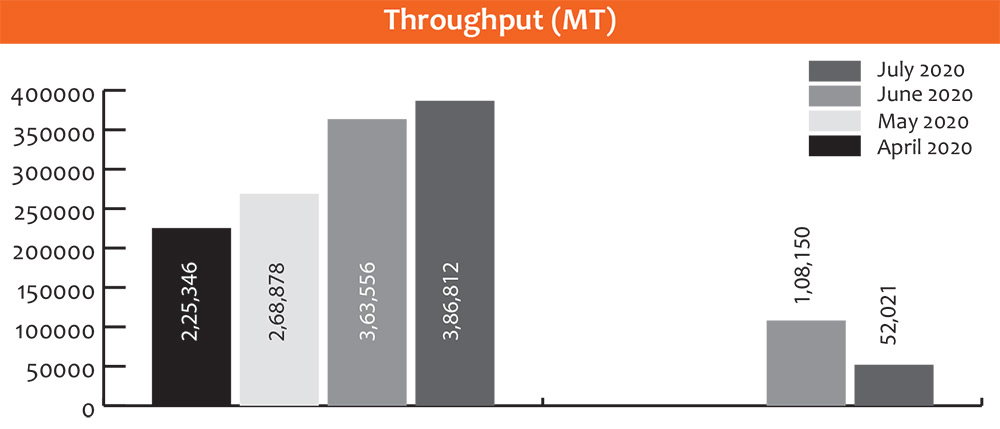

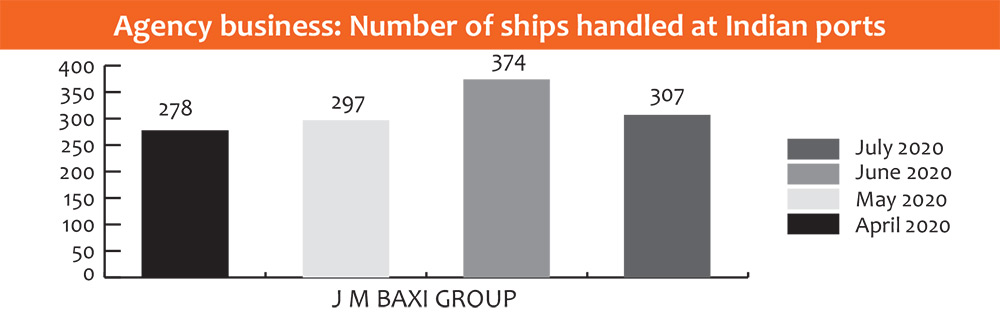

When we look at the numbers and volumes across our various businesses for April to July 2020, we feel a deep sense of relief. We will let the numbers speak for themselves. However, we hope, and we are striving hard so that we continue to achieve such results in the months ahead.

Before I close this edition of the Quarter Deck, let me acknowledge each and every colleague of J M BAXI GROUP. You have really helped us in weathering and riding this storm. This has clearly enabled us to work closely with our customers and principals during the lockdown. I would also like to acknowledge our partners, associates and vendors who have stood shoulder to shoulder with us. It promises to be an exciting journey ahead.

Be safe! Be healthy!

Krishna B. Kotak

Chairman - J M BAXI GROUP