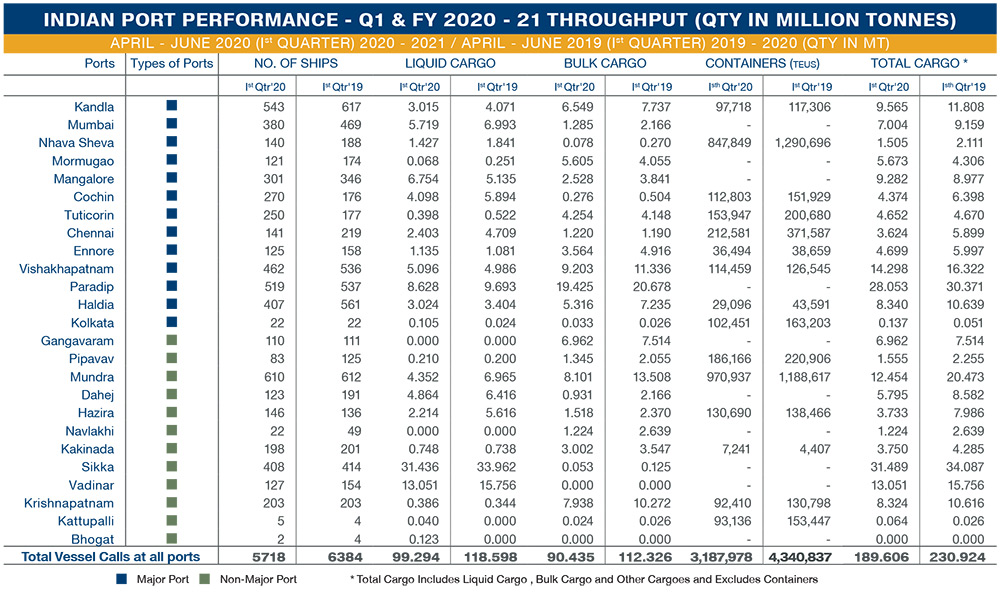

The following is an analysis of data for the period of April to June 2020 compared to the period of April to June 2019.

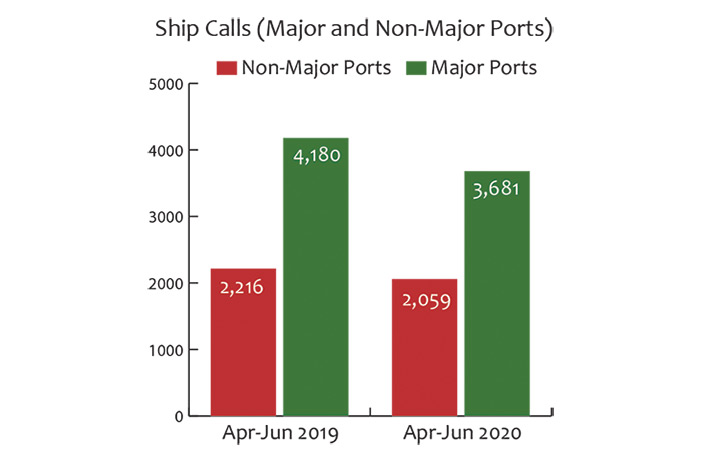

- Ship Calls

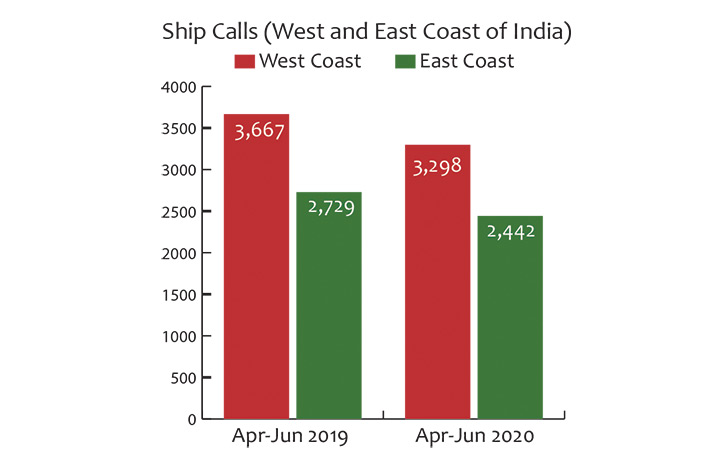

During the period of Apr-Jun 2020, a total of 5,740 ships called on Indian ports, a decrease of 10% over the same period last year. 64% of the ships called on Major Ports with the balance 36% calling on Non-Major Ports. Major and Non-Major Ports saw a decrease of 12% and 7% in ship calls, respectively. The west coast saw a 10% decrease and the east coast saw a 10.5% decrease in ship calls.

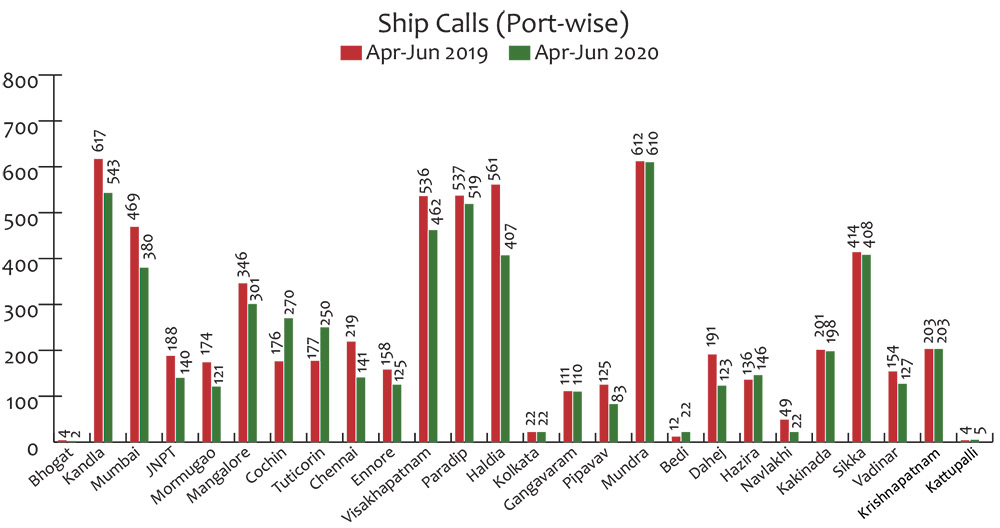

Chennai Port saw the most decline in ship calls at 36% followed by Mormugao (-30%), Haldia (-27%) and JNPT (-26%). Cochin Port saw the highest increase in ship calls at 53% followed by Tuticorin 41% during the period of April-June 2020, when compared to the same period last year.

The port data considered for analysis is for the period of Apr-Jun 2020 and compared with data for the same period last year.

- Liquid Cargo Trends

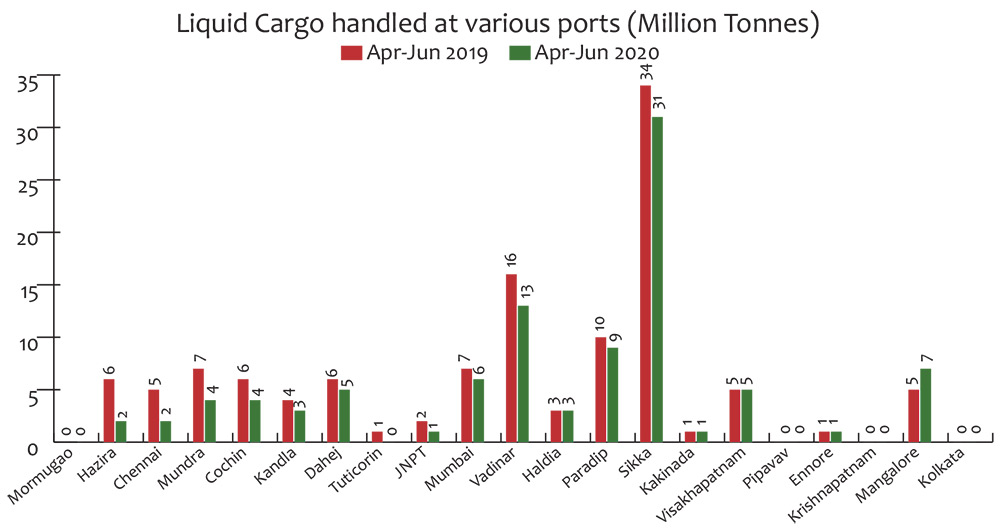

A total of 99.29 million tonnes of liquid cargo was handled during the period of Apr-Jun 2020, a 16% decrease from the same period last year.

Hazira (-61%) saw significant decline in liquid cargo handled followed by Chennai (-50%) and Mundra (-38%). Cochin (-30%), Kandla (-26%) and Dahej (-24%) also saw significant dip in liquid cargo volumes handled. Key liquid terminals JNPT (-22%), Mumbai Port (-18%), Vadinar (-17%), Haldia (-11%) and Paradip (-11%) also saw a decline in liquid volumes handled. Mangalore saw an increase of 31% during the period.

- Bulk Cargo Trends

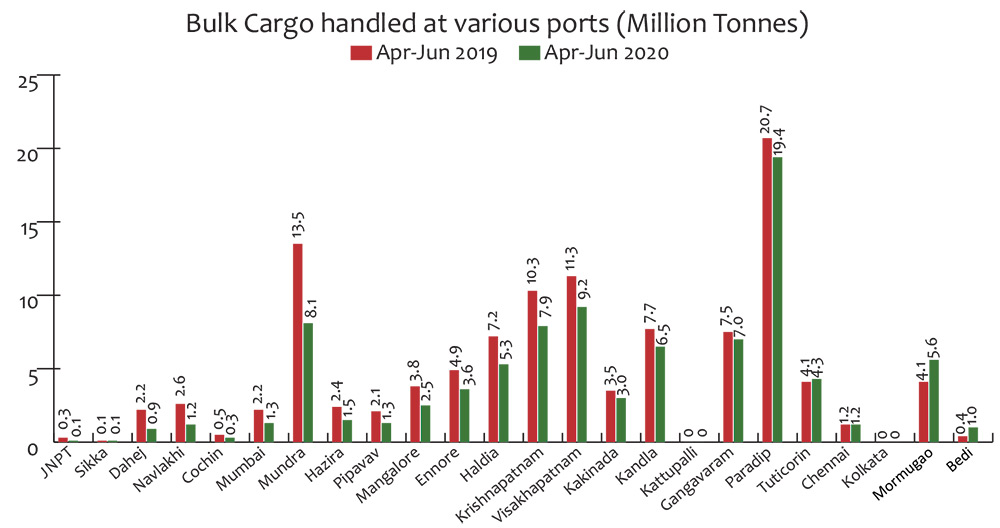

In the bulk cargo segment, Mundra saw a decline of 40% in volumes handled. Krishnapatnam (-23%), Visakhapatnam (-19%), Kandla (-15%) also saw significant decline in volumes handled. During the period Paradip saw a decline of 6% in the bulk cargo volumes handled.

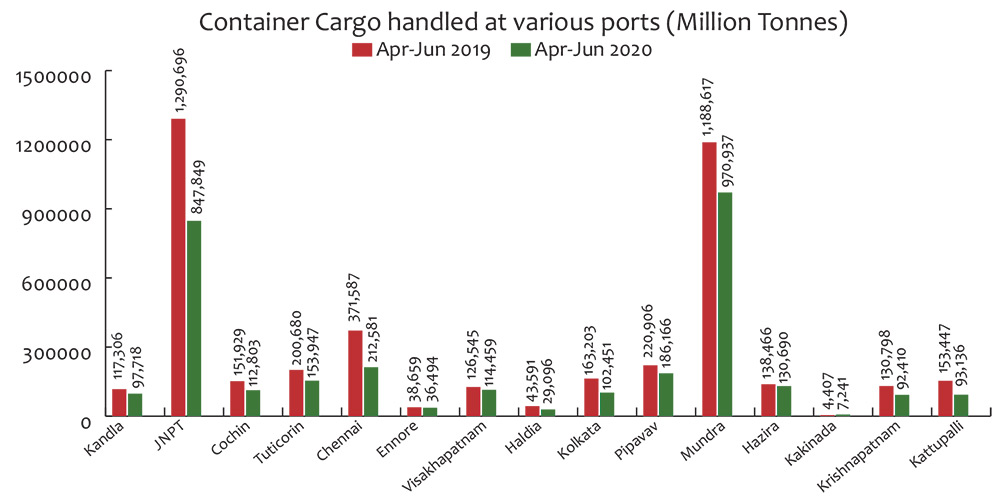

- Container Cargo Trends

A total of 3.2 million TEUs were handled in Apr-Jun 2020, a decline of 24% when compared to the container volumes handled in the same period last year. Amongst key container terminals, JNPT and Mundra saw a decrease in container volumes 34% and 18% respectively, while Krishnapatnam saw a decline of 29%, Chennai (-42%), Kattupalli (-39%) and Kolkata (-37%) experienced steep decline in container volumes handled.

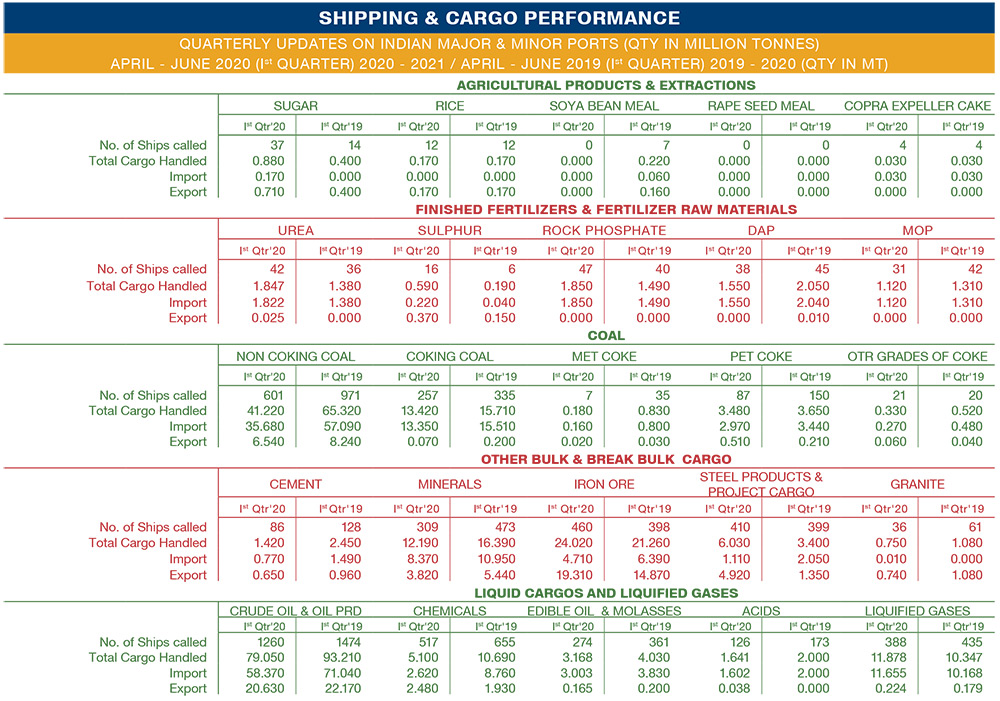

Key Cargo Performance

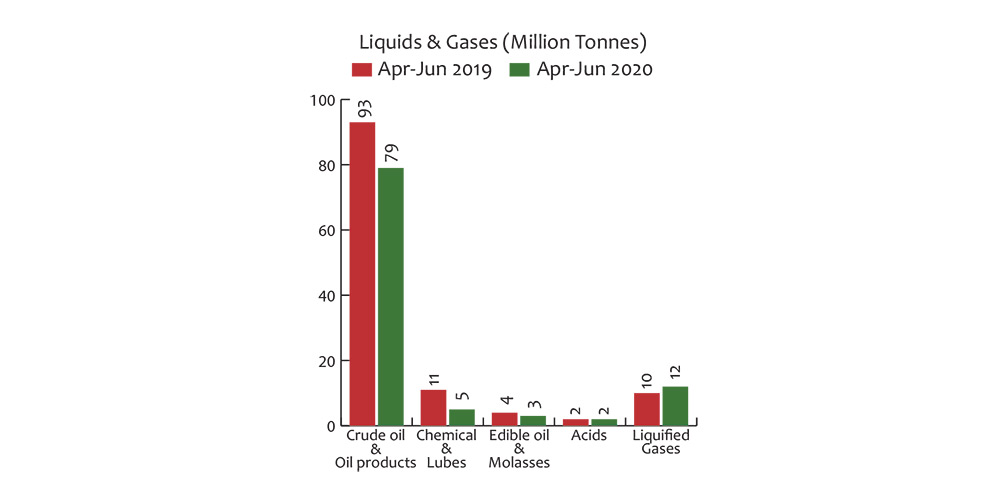

- Liquids and Gases

Volume of liquids and gases decreased by 16% with total volumes handled at 101 million tonnes in comparison to 120 million tonnes during the same period last year. Chemicals and lubes saw the most decline at (-52%) while liquified gases grew at 15%.

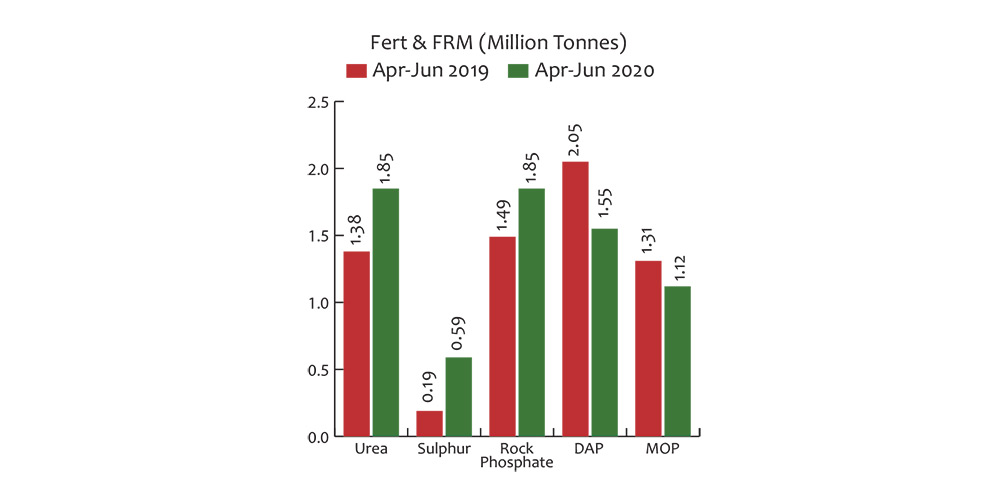

- Finished Fertilizers and FRM

A total of 7 million tonnes of fertilizers and FRM was handled in Apr-Jun 2020, an increase of 8% compared to the same period last year.

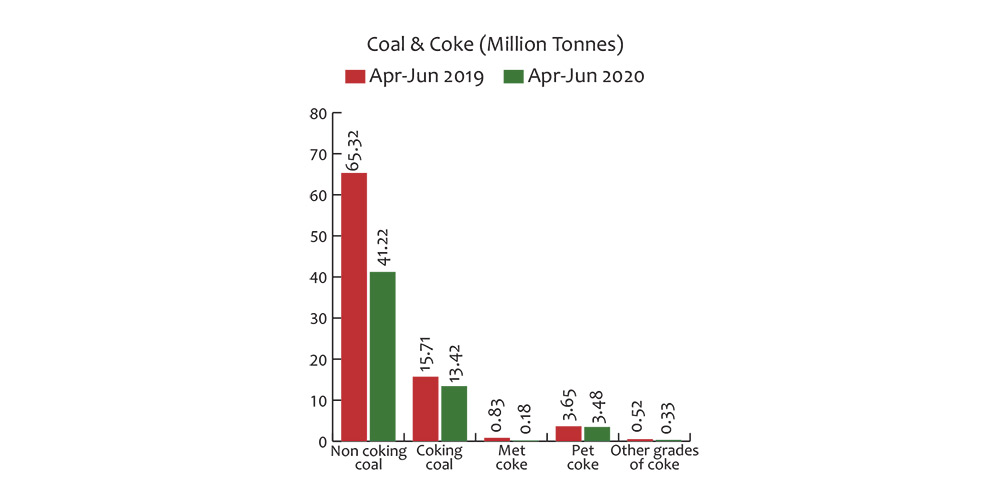

- Coal and Coke

A total of 59 million tonnes of coal and coke was handled in Apr-Jun 2020. Non-coking coal (-37%) and coking coal (-15%) saw decline in the volumes handled compared to the same period last year.

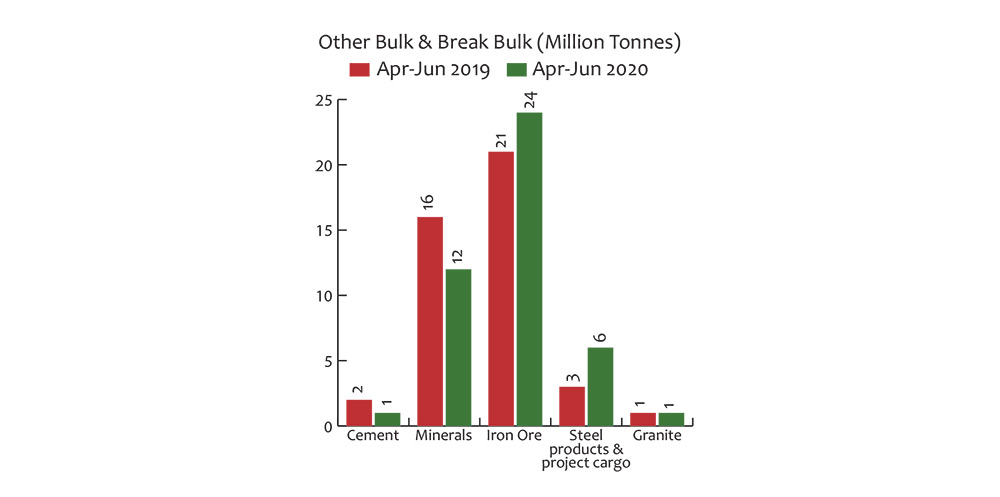

- Other Bulk and Breakbulk

Steel products and project cargo saw a steep increase of 77% in volumes handled, while cement (-42%) and minerals (-26%) saw a declining trend.

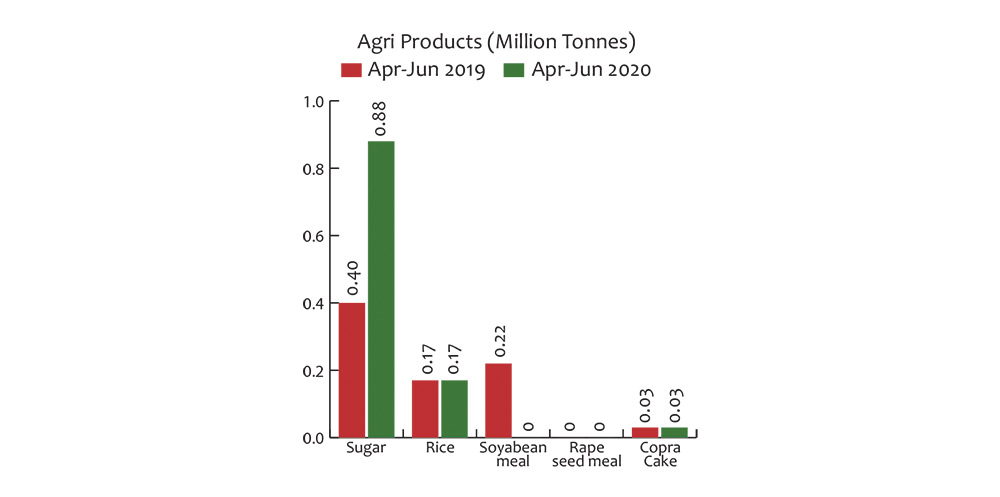

- Agri Products

Volume of agriproducts increased by 32% primarily driven by increase in sugar volumes handled.