(Continued from issue XXIX)

- Global sugar scenario

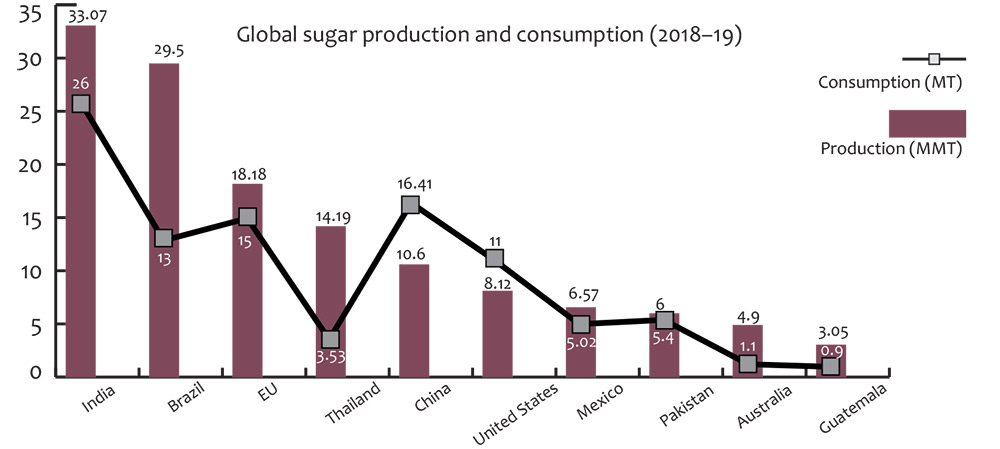

In the 2018-19 crop year, global sugar production was 179 million metric tonnes, with 181 million metric tonnes expected for 2019-20. Approximately 80% of the world's sugar is produced from sugarcane in tropical and subtropical climates, with the remaining 20% derived from sugar beet, which is grown mostly in the temperate zones of the northern hemisphere. A total of 124 countries produce sugar.

The major producers of sugar in the world are also the leading exporters and are highly dependent on the world trade. Australia exports around 72 percent of its production, while Brazil exports 56 percent of its production. India is however unique, as it has the world's largest consumption market. India's dependence on the world trade is marginal and therefore, it is largely insulated from the global price variations.

- India’s sugar exports

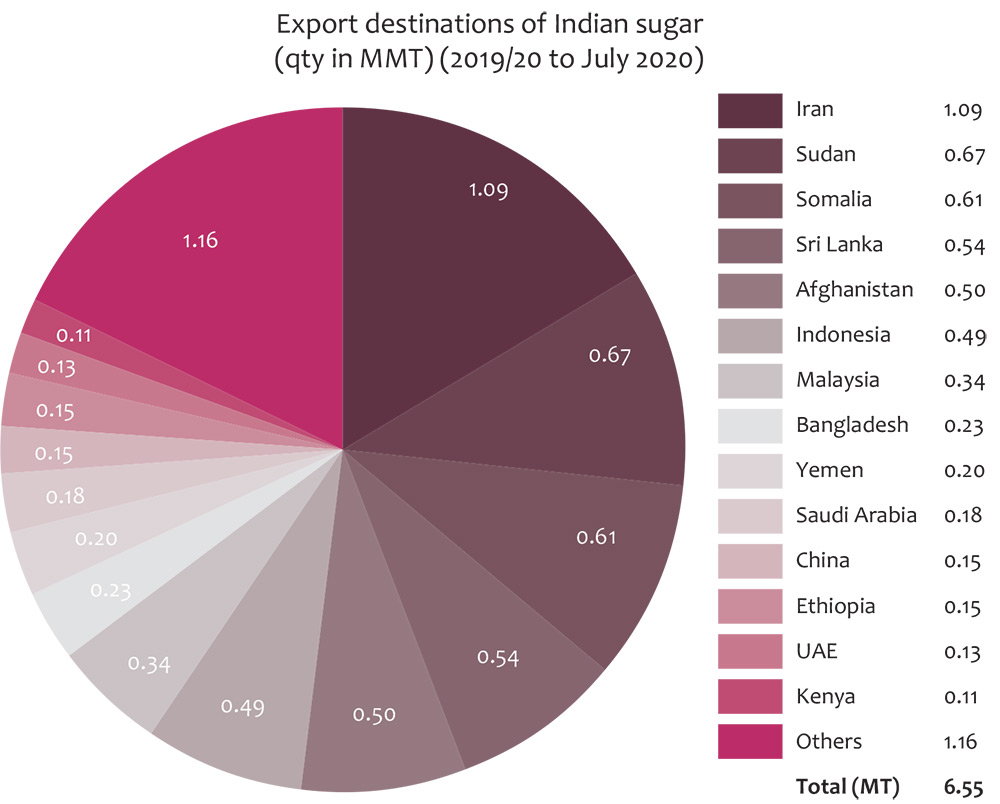

India is close to major sugar-deficient markets. The Indian ocean countries Indonesia, Bangladesh, Sri Lanka, Pakistan, Saudi Arabia, UAE and some East African countries are sugar deficient and regularly import sugar, primarily from Brazil, Thailand, the EU and Australia.

- Exports contract signed by India

As per market reports, contracts for exports under the Maximum Admissible Export Quantity (MAEQ) have been signed for over 3.5 MMT, of which about 1.6 MMT has already been shipped out of the country.

J M BAXI GROUP through its bulk cargo division, Boxco Logistics, is currently engaged with various exporters to handle 1 MMT of sugar in the current season. The company has already handled more than 5.4 lakh of sugar at Kandla till date.

- Exports from the top producing countries decline

Thailand, one of the top global producers of sugar, has had a 30 per cent drop in production. Brazil was the largest producer of sugar in the world until two years ago, but after the fall in sugar prices, it started producing more ethanol than sugar. Ethanol prices are very attractive, and the Brazilian government gives incentives to produce ethanol. In Brazil, the revenue earned for producing ethanol is 19 per cent higher than that for sugar for a tonne of cane. Brazil also substituted 48 per cent of petrol with ethanol and this is expected to increase in the coming season.

- Opportunities for India

Due to the drought in Thailand, sugar production there is likely to drop by around 30 per cent to 9.5 MMT. This gives India an opportunity to export sugar to Indonesia, South Korea and China. Indonesia recently changed the colour-grading standard known as the International Commission for Uniform Methods of Sugar Analysis (ICUMSA) from 1200 to 600 to allow raw sugar shipments from India. Previously, Thailand was normally the main supplier of raw sugar to Indonesia.

Recently, at an international conference in Maharashtra, Indian Sugar Mills Association (ISMA) president, Mr. Vivek M. Pittie, stated that:

Thus, it is clear that India is now all set to become one of the largest producers and exporters and will be a prominent player in the global sugar industry.