(Continued from issue XXIV)

Current Scenario

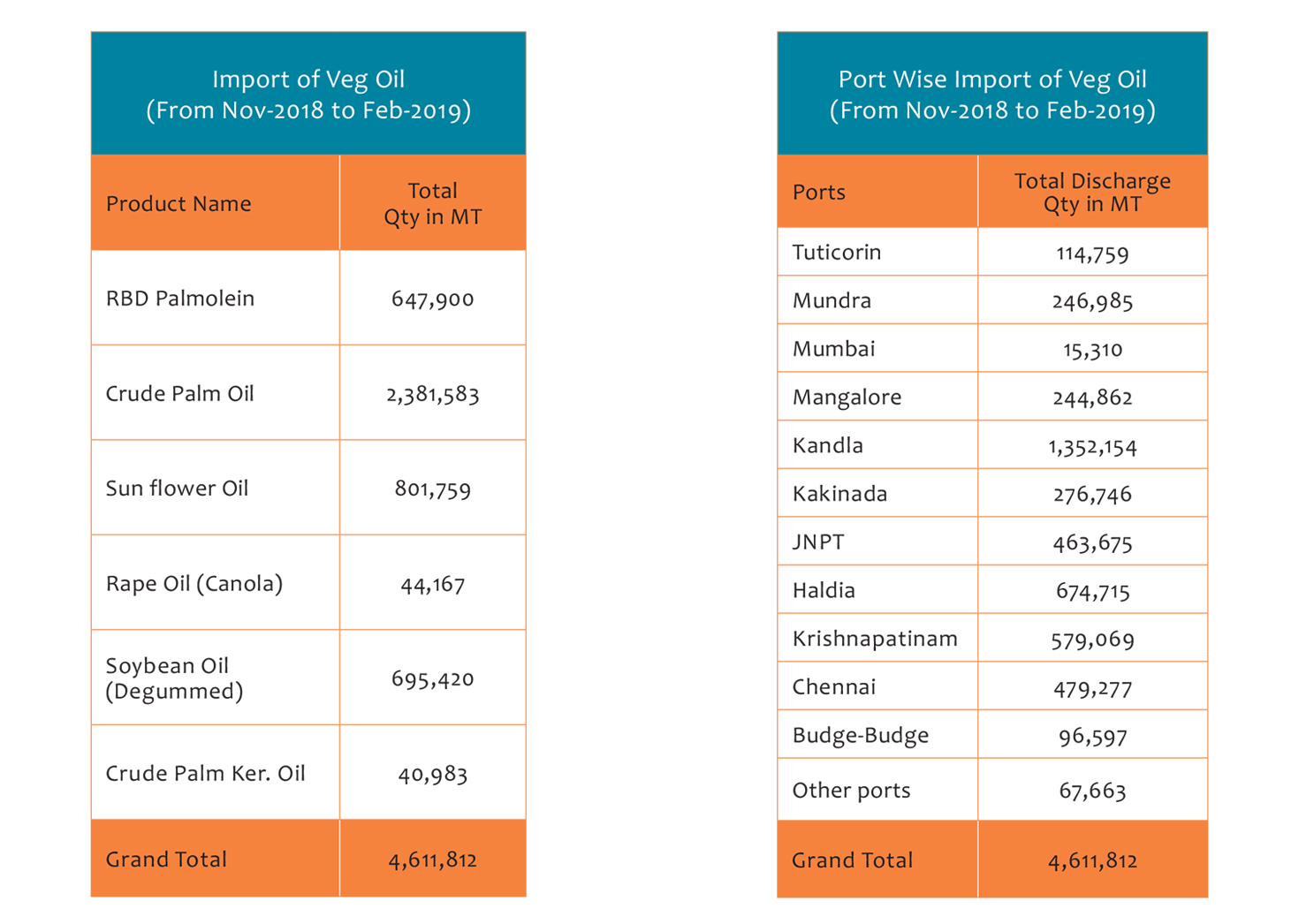

Despite the government’s avowed policy to usher in self-reliance by decreasing imports of edible oils; during November 2017 to October 2018, the import of vegetable oils (comprising edible oil and non-edible oil) only fell marginally by 2.72% to 15 MMT as against 15.4 MMT in the corresponding period of the previous year. India’s oil year runs from November to October. “In last one year, in the international market, prices of edible oils have gone down by 2 to 10 percent due to larger supply, and at the same time rupee depreciation by nearly 5 per cent in one year, nullified the advantage of price reduction, “ SEA Said. During November - October period of 2017- 18 oil year, SEA said that the overall palm oil import has decreased to 8.7 MMT from 9.29 MMT. Soft Oils (like Soybean) import increased to 8.7 MMT from 5.78 MMT during same period of last year. Also, a parcel of 3,000 tonnes of cottonseed oil from the US had arrived during April 2018.

The industry pegs the country’s edible oil consumption at 23.5 million tonnes for 2018-19 and expects to import 15.5 million tonnes, with 60 per cent from Malaysia and Indonesia, followed by soyabean oil from Argentina and Brazil, sunflower oil from Ukraine and Russia and canola oil from Canada.

India imports 60 per cent of its edible oil requirements, largely from Malaysia, Indonesia, Argentina and Ukraine. The duty on crude palm oil from Malaysia, Indonesia and other members of the Association of South East Asian Nations was cut to 40 per cent from 44 per cent, while the tax on refined palm oil was cut to 45 per cent from 54 per cent if imported from Malaysia and to 50 per cent, if purchased from Indonesia or other member-nations of Asean. The duty on crude Soybean Oil and Sun flower oil is unchanged at 35% while refined soybean oil and Sunflower oil remain at 45 %. The effective duty difference between crude and refined palm oil has narrowed to 5.5% from 11% for shipments from Malaysia, which could lead to higher imports of refined palm oil and could be a death knell for the domestic refining industry and halt expansion of palm oil plantations in the country.

About 70% of the domestic requirement is met through imports, and palm oil accounts for 60% of the shipments.

"During 2017-18, imports increased in the first quarter, however imports decreased in the second and the third quarter due to revision of import duty in June, fast rupee depreciation and also credit crunch” the SEA said in a statement.

Imports increased in the fourth quarter as pipelines were dried up due to lesser import in June and July, coupled with improved parity in the import of palm oil due to reduction in spread between palm oil and soft oils, it added. According to SEA, over the last one year in the international market, prices of various edible oils have gone down in the range of 11 to 25% due to excess supply in the world market and reduced demand by India. The rupee depreciating nearly 13% also made the import expensive. Near absence of palm oil cultivation in India has however jinxed the Indian edible oil sector in terms of continued imports, comprising the bulk of the total edible oil imports.

- Sources

- Euromonitor International

- Solvent Extractor’s Association of India

- Rabo Reasearch, Rabo Bank

- Department of Food and Public Distribution

Demand-Led Imports To Continue

Growing population, economic growth and rising disposable income will drive India’s vegetable oil consumption growth, which is expected to grow by three percent annually to exceed 34 million tonnes by 2030. “Increasing income, urbanisation, changing food habits and deeper penetration of processed foods will be key drivers of future consumption growth of edible oil in the country, " as per the Rabo Research report.

The Future Of India’s Edible Oil Industry: How Will India’s Vegetable Oil Demand Shape Up By 2030.

The country’s vegetable oil consumption was at 23 million tonnes in 2017. Because of current stagnant domestic vegetable oil supplies, import volumes will continue to fill the majority of the supply and demand gap over the next decade. Palm oil, soy oil and sunflower oil are expected to penetrate regional markets further in the future, with the packaged edible oil segment leading the way for future growth of the industry. “Domestic oilseed production growth can't keep up with rising demand. Rising demand and stagnant domestic vegetable oil supply, which has been range bound between 6.5 million tonnes and 8.5 million tonnes in the past decade, will push the country’s vegetable oil imports to over 25 million tonnes by 2030, from 15.5 million tonnes in 2017” Rabo Bank analyst for Grains and Oilseeds, Mr. Rohit Kumar Dhanda Said.