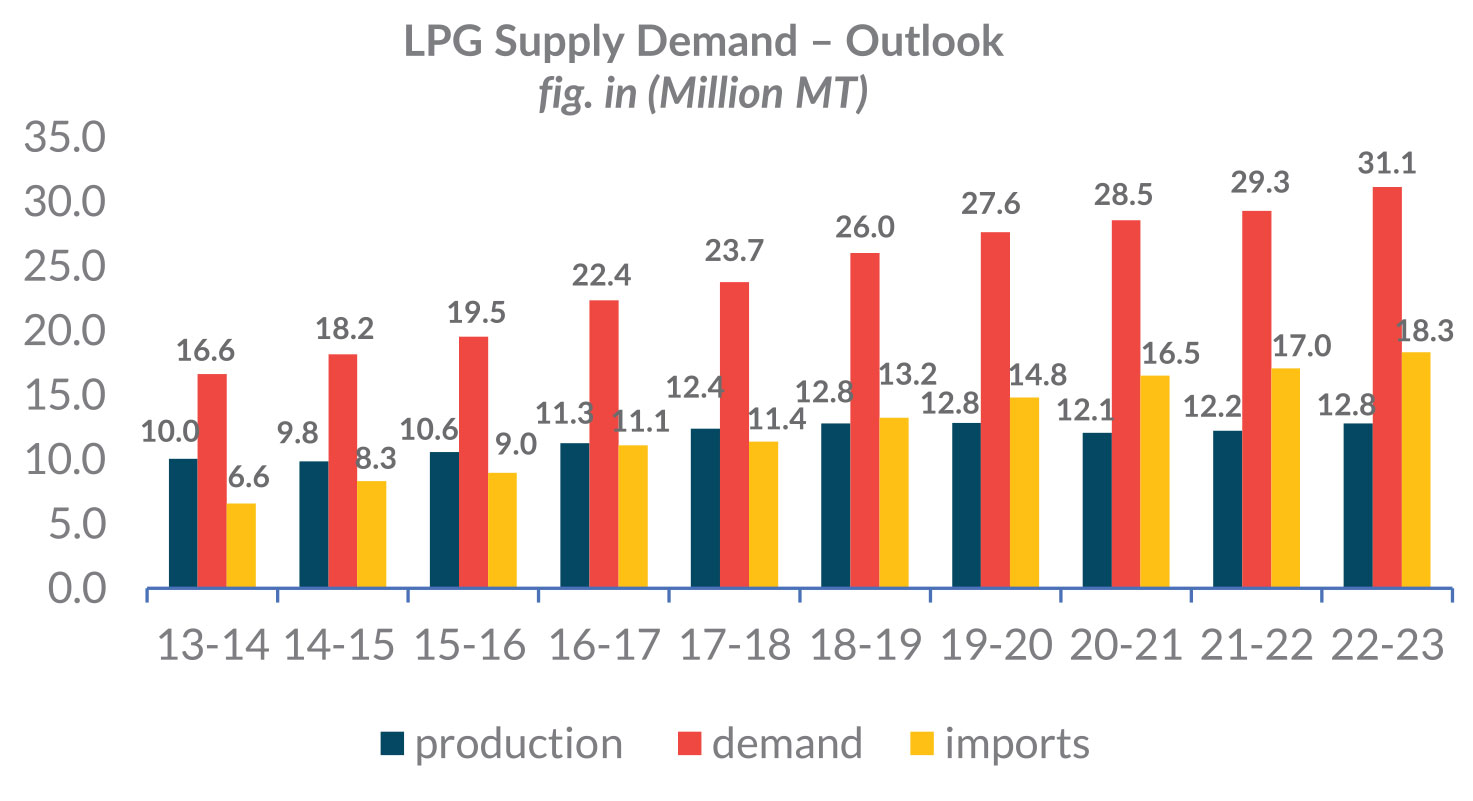

The Indian government's efforts to ensure access to clean cooking fuel for every household have made India the world's second-largest LPG consumer, with consumption reaching 28.5 million tonnes in FY 23. The Pradhan Mantri Ujjwala Yojana (PMUY) has played a pivotal role in this achievement, with beneficiaries increasing from 159.9 million in 2018- 19 to 344.8 million in 2022-23. LPG consumption is projected to increase to 32 million tonnes by 2025 and further rise to 42.5 million tonnes by 2040. The government has undertaken several initiatives to encourage LPG use across the country, particularly in rural households, with the aim of shifting them away from traditional, health hazardous, and polluting fuels.

LPG consumption in India is expected to reach new highs in 2023, with a growth rate of 1.5-2%, according to forecasts from several sources, including the state-controlled refiner IOC, Crisil and ICRA. LPG demand increased by 2.9% to 28.7 million tonnes in 2022, following a 1.5% increase in 2021, but it grew by 8.5% per year in 2016-19. In August 2023, the government announced a reduction of Rs 200 in LPG prices, along with an additional subsidy of Rs 200 for Pradhan Mantri Ujjwala Yojana (PMUY) beneficiaries. This move is expected to stimulate increased LPG consumption. Additionally, infrastructure development, such as the Kandla- Gorakhpur LPG pipeline and a new LPG import terminal in Andhra Pradesh, will play a role in the industry's future.

Imports

| Refineries wise LPG Production FY 22 (000'mt) | ||||

|---|---|---|---|---|

| Company | LPG | % of total | ||

| IOCL | 3,066 | 25.1% | ||

| Jamnagar Refinery, RIL | 1,898 | 15.5% | ||

| Kochi Refinery, BPCL | 1,428 | 11.7% | ||

| MRPL, Mangalore, ONGC | 1,049 | 8.6% | ||

| Vadinar-Nayara Energy Ltd. | 1,006 | 8.2% | ||

| Punjab, HPCL- Mittal Energy Ltd. | 983 | 8.0% | ||

| HPCL | 561 | 4.6% | ||

| CPCL, Manali Refinery | 296 | 2.4% | ||

| BORL,BINA | 257 | 2.1% | ||

| NRL, Numaligarh Refinery, Assam | 44 | 0.4% | ||

| Subtotal | 10,588 | 86.5% | ||

| Fractionators | 1649 | 13.5% | ||

| Total | 12,237 | 100.0% | ||

India's dependence on imported liquefied petroleum gas (LPG) has risen significantly, reaching 64% in 2022- 23, up from 49% six years earlier. This increase is attributed to a 32% growth in LPG consumption, while domestic production only grew by 14%. The country's domestic LPG customer base has more than doubled in the past decade, reaching 314 million households, leaving very few without access to LPG due to government initiatives.

Industry experts suggest that the import dependence may soon plateau, as further significant growth in local demand is unlikely. Many existing customers are expected to shift to piped natural gas (PNG), reducing the demand for LPG cylinders. Private sector imports of LPG, which once accounted for around 7.8% of total imports in 2010-11, have fallen to zero in 2022-23.

Regarding LPG import sources, the Middle East countries, including Qatar, Saudi Arabia, and the United Arab Emirates (UAE), have remained the top suppliers to India. However, the share of the Middle East in India's LPG imports has decreased from over 99% in 2012- 13 to about 92% in 2022-23. Despite a reduction in its share, Qatar continues to be India's largest LPG supplier.

In the fiscal year 2022-23, India imported 18.3 million tonnes of LPG valued at US$13.8 billion. LPG imports accounted for 41% of total petroleum product imports in terms of volume and 51% in terms of value.

Indian refiners have not ramped-up LPG production capability. LPG produced by Indian refineries was only 4.2 percent of total crude processing capacity in 2022-23. Indian refineries are more optimally designed to produce petrol and diesel and have lower LPG yields, limiting domestic LPG production.

LPG - Industry Use

In India, LPG is mainly associated with household cooking, but it offers precise temperature control and low emissions, making it valuable in various industrial processes like metalwork, food production, and petrochemicals. It has high controllability, a high calorific value and enhances product quality, especially in glass and ceramic manufacturing. LPG is also used in road construction, sign lighting, and as a propellant in aerosol products. However, industrial and service sector LPG consumption in India is less than 10% of the total, primarily due to a strong focus on household cooking. Promoting LPG's industrial use aligns with economic and environmental goals, offering a clean, versatile fuel option with modular packaging and transportation capabilities.

LPG – Automotive Fuel

LPG (Liquefied Petroleum Gas) offers advantages as an automotive fuel in India, with a higher-octane rating than petrol, leading to improved engine efficiency and reduced emissions. However, despite its cost-effectiveness and environmental benefits, auto LPG consumption in India has declined over the years, accounting for less than 0.3% of total LPG consumption in 2022-23. To boost the use of auto LPG and reduce pollution, policy initiatives that simplify access to auto LPG and reduce regulatory burdens could be instrumental in its promotion as a cleaner transportation fuel. Indian LPG- Distribution Infrastructure

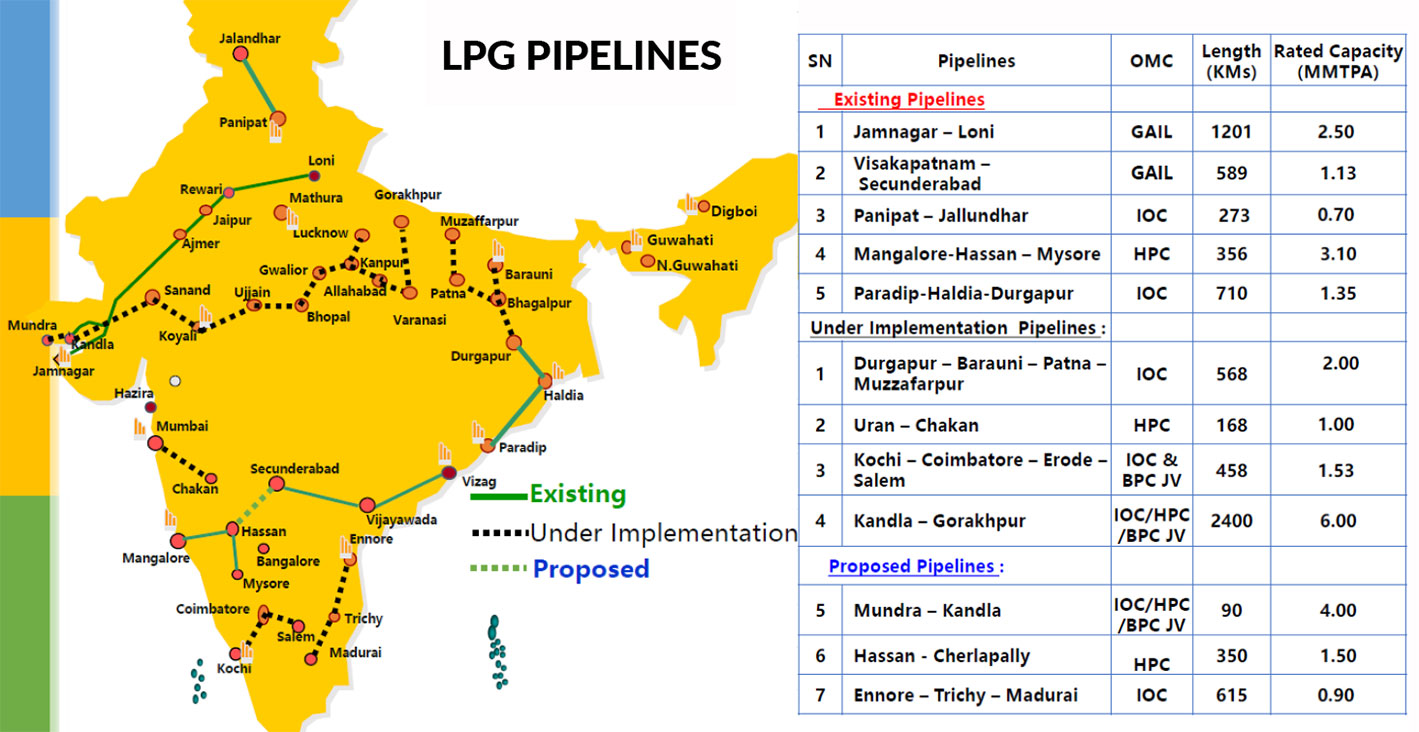

The Ujjwala program has boosted India's LPG supply chain to meet rising demand, which relies heavily on imports (over 60%). To accommodate this, new import terminals in Mundra and Haldia have been added, with more planned on east and west coasts. This will provide flexibility as import requirements are set to reach 20-21 MMTPA in the next 2-3 years. Over 4000 km of product pipelines are being laid for cross-country transport. The bottling infrastructure is expanding with over 30 new plants to increase capacity near demand hubs. Currently, the industry's recorded bottling capacity is 22.2 MMTPA, with utilisation ranging from 120% to 140% across 208 plants. The transportation fleet has also grown to support more distributors and larger supply areas.

The establishment of LPG Pipeline infrastructure is carried out by the Public Sector Oil Marketing Companies (OMCs) based on techno-commercial feasibility studies. LPG Pipelines are laid from refineries to LPG bottling plants. The Petroleum and Natural Gas Regulatory Board (PNGRB) established under the PNGRB Act, 2006, in the year 2007, is the authority to grant authorization for laying of LPG pipelines. Entities that propose to lay, build, operate or expand a pipeline apply to the Board for obtaining authorisation under the Act.

| Particulars (As on 1st of April 2023) | UNIT | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 (P) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LPG Active Domestic Customers | Lakh | 1486 | 1663 | 1988 | 2243 | 2654 | 2787 | 2895 | 3053 | 3140 | |||

| LPG Distributors | No. | 11489 | 12610 | 13896 | 15930 | 17916 | 18786 | 20146 | 23737 | 24670 | 25083 | 25269 | 25385 |

| Auto LPG Dispensing Stations | No. | 652 | 667 | 678 | 681 | 676 | 675 | 672 | 661 | 657 | 651 | 601 | 526 |

| Bottling Plants | No. | 184 | 185 | 187 | 187 | 188 | 189 | 190 | 192 | 196 | 200 | 202 | 208 |

| Gross Tankage | 000' MT | 711 | 771 | 777 | 781 | 869 | 878 | 912 | 929 | 978 | 994 | 1088 | 1178 |

The total length of LPG Pipeline network in the country is 8,296 km comprising of the following pipelines: -

India has a total of 31.4 crore domestic LPG consumers, with 9.6 crore being beneficiaries of the Ujjwala scheme, leaving 21.8 crore non-Ujjwala consumers. Government data reveals that the average LPG refill rate for Ujjwala beneficiaries in FY23 was 3.71 cylinders, while non-Ujjwala consumers averaged 6.65 cylinders. This results in a total domestic LPG consumption of 180.6 crore cylinders per year based on FY23 data. Assuming the Rs 200-per- cylinder reduction remains for a year, the cost savings would amount to Rs 36,117 crore. Additionally, the annualized cost of benefits for the 75 lakh new connections under the Ujjwala scheme is estimated at Rs 1,113 crore. This brings the total cost of the two announcements to approximately Rs 37,230 crore for a year.

Out of the ten busiest LPG ports in the world, five of them are in India and in terms of LPG ports with the longest waiting times, five of the ten globally are also in India. This congestion slows down LPG delivery, increases costs, and is inefficient. India’s LPG import terminals are located at Kandla, Mundra, Dahej, Pipavav, Mumbai, J N Port, New Mangalore, Visakhapatnam, Ennore, Paradip and Haldia. Of these, Haldia is a significant import facility on the Eastern coast from where the LPG cargo is transported to most of India’s heartland.

The significant growth opportunities for LPG in India include its use as a feedstock in the petrochemicals industry and as a fuel in the automobile sector. In countries like China, Korea, and Japan, a substantial portion of LPG imports is directed towards the petrochemicals industry, accounting for up to 40 percent of their total LPG imports. In contrast, in India, this figure is only 8 percent. Another promising sector for LPG growth is the automobile industry. LPG is a cost-effective and cleaner alternative to diesel and other fossil fuels. Currently, only three-wheelers and trucks use LPG, representing a mere 2 percent of the total imports. This share has the potential to increase to 10-15 percent.