The ongoing Russia Ukraine crisis continues to have an impact around the globe. It has adversely affected prices and supplies of power, chemicals, fertilizers, food grain among many other things. Russia is the second largest producer of ammonia, urea, potash and the fifth largest producer of phosphatic fertilizers. The country accounts for 23 percent of global ammonia export, 14 percent of urea, 21 percent of potash and 10 percent of complex phosphate. Russia is also a major supplier of natural gas to Europe and many other countries as feedstock for urea plants. Moreover, the Black Sea areas as well as the Black Sea ports like Yuzhny, Odessa, Mariupol, Novorossiysk etc. being a major hub of fertilizer production and trade, are presently closed due to the ongoing war, thereby disrupting the entire global supply chain in the fertilizer sector. This situation has impacted global fertilizer supplies in a big way, with sky rocketing increase in prices.

Ukraine- Russia war has adversely affected the fertilizer supply chain management globally.

Globally, Russia is one of the largest producers of fertilizer and major supplier of natural gas (critical feedstock for urea plants)

The Black Sea region comprising of major fertilizer trade hubs like ports of like Yuzhny, Odessa, Mariupol, Novorossiysk are non- operational.

Disruption in the global fertilizer supply chain has skyrocketed the prices.

Apart from fertilizers, Ukraine is a major food grain producer and supplier and thus has adversely affected the supply chain of wheat commodity, in addition to soaring of prices.

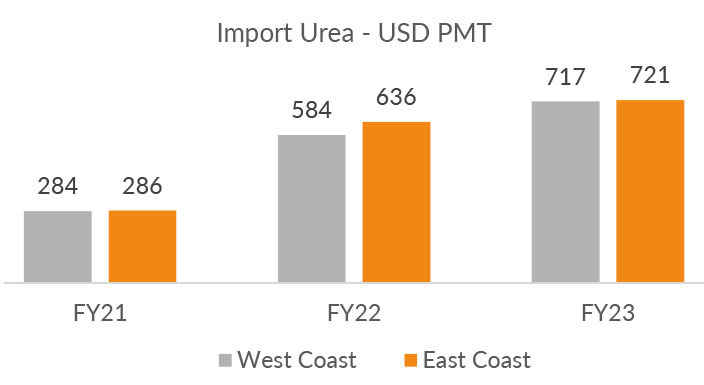

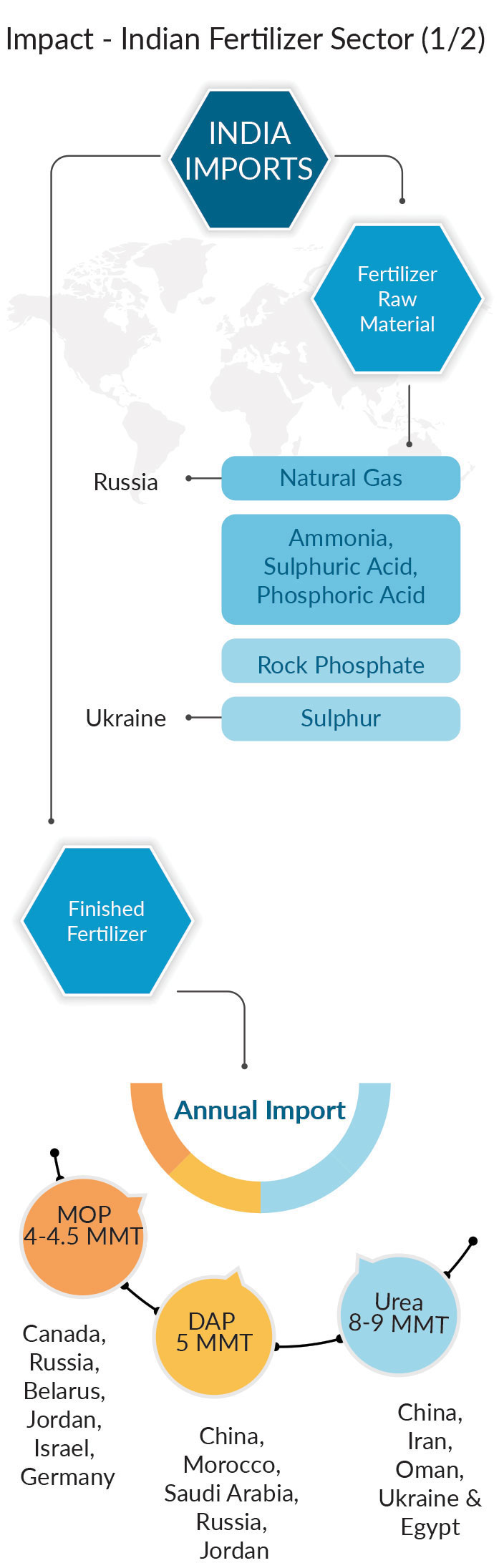

The fertilizer sector in India is import dependent. Finished fertilizers as well as fertilizer raw materials are imported from different global sources. Urea imports amount to 8-9 Mn Metric Ton (MT) annually, mostly from China, Iran, Oman, the Arabian Gulf, Ukraine and Egypt. With the Ukraine Russian conflict disrupting trade from Black Sea ports and restrictions on urea imports, imposed by China since October 2021, urea is presently sourced from Oman, Arabian Gulf countries, Southeast Asian countries like Indonesia, Vietnam, Malaysia, Singapore and Russian ports in the Baltic Sea. As a result of this situation, urea prices are skyrocketing. At the recent Rashtriya Chemicals & Fertilizers (RCF) tender, the L1 prices were established at $716.50/Metric Ton (MT) for the west coast of India and $721.30/Metric Ton (MT) for the east coast of India as against the price range of $284- $286/Metric Ton (MT) during 2020-21 and the subsequent increase of $300-$350/Metric Ton (MT) till October 2021.

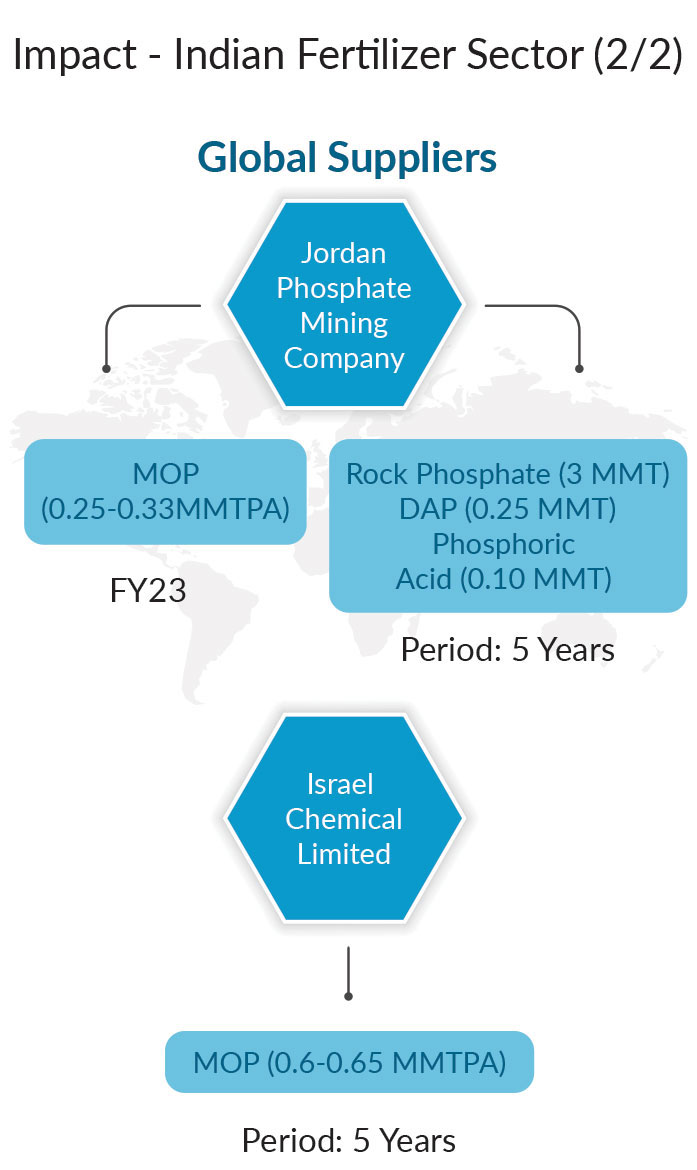

As regards Phosphatic and Potassic (P&K) fertilizers, India imports about 5 Mn Metric Ton (MT) of Diammonium phosphate (DAP) from China, Morocco, Saudi Arabia, Russia, Jordan etc. and about 4 to 4.5 Mn Metric Ton (MT) of Muriate of Potash (MOP) imported from Canada, Russia, Belarus, Jordan, Israel and Germany. With the Ukraine- Russia conflict and restrictions imposed by China on exports since last year, availability of DAP and MOP are extremely poor in the international market. Therefore, India is forced to tap Morocco, Saudi Arabia and Jordan for sourcing DAP and NPK. In view of these critical circumstances, the Union Minister for Chemicals and Fertilizers Dr. Mansukh Mandaviya visited Jordan recently for securing long and short term supplies of P&K fertilizers. Accordingly, pacts were signed with Jordan Phosphate Mining Company (JPMC) and Indian public, cooperative and private sector companies, for the supply of 3 Mn Metric Ton (MT) Rock Phosphate, 0.25 Mn Metric Ton (MT) DAP and 0.1 Mn Metric Ton (MT) phosphoric acid for the current year. Additionally, a long-term pact was also signed for 5 years for annual supplies of 0.25 Mn Metric Ton (MT) of MOP which will be increased every year up to 0.325 Mn Metric Ton (MT). Further, Indian Potash Limited also signed a pact with Israel Chemical Limited for the supply of 0.6 to 0.65 Mn Metric Ton (MT) MOP annually for 5 years.

Apart from the imports of finished fertilizers, India depends heavily on the imports of fertilizer raw materials like natural gas, sulphur and rock phosphate as well as intermediates like ammonia, sulphuric acid and phosphoric acid. Prior to the Ukraine- Russia conflict, India was sourcing supplies of huge volumes of ammonia from Ukrainian ports for domestic complex fertilizer plants, which have now completely stopped. Similarly, the natural gas supplied by Russia is also restricted. As a result of these impediments, domestic fertilizer plants are functioning much below their rated capacity and are not able to achieve optimum production level to meet the growing demand in the agriculture sector. This situation is leading to an increased volume of finished fertilizer imports, in spite of high prices, since the availability of fertilizer is essential to achieve food security of the country.

With the outbreak of the Ukraine- Russian conflict disrupting trade from the Black Sea ports and restriction on urea imports, imposed by China since Oct. 2021, urea is presently sourced from Oman, Arabian Gulf countries, Southeast Asian countries like Indonesia, Vietnam, Malaysia, Singapore and Russian ports in the Baltic Sea.

As a result of this situation, urea prices are skyrocketing, and the price is currently around $700- $800 Per Metric Ton compared to $284-$286 Per metric ton in FY21.

Similarly with Russia and Belarus severely affected by war, there is a scarcity of potash in the international market.

Challenges in the delivery of fertilizer raw materials is forcing domestic plants to function much below their rated capacity, and are not able to achieve optimum production levels to meet the growing demand in the agricultural sector. This is also adding to the pressure of sourcing fertilizer through imports.

In view of these critical circumstances, the Govt. of India is pushing for securing long and short-term supplies through signing pacts between Indian companies (public, cooperative and the private sector) and global suppliers.