Dear Friends and Colleagues, Greetings from the Quarter Deck! I hope all of you and your families have spent the long festive season joyously and safely. The season started with the Ganesh Festival and continued with Eid, Navaratri, Dussehra, Diwali and Christmas, so a belated Happy Festival Season and wishing you all a Happy New Year 2022.

As mentioned in my earlier messages, the safety and health of each one of you and your family members is paramount. We in India have done well, having delivered over 140 crore or 1.4 billion anti-Covid vaccinations. The pace of vaccination continues rapidly with the enhanced production of vaccine doses. However, we must be aware and alert since Covid has not been eradicated. We should not drop our guard but continue with our precautions for the foreseeable future, especially as Omicron variant is spreading rapidly across the world. The festival season did help in creating demand and consumption and this could and should continue.

The Indian economy is back on a high growth curve, and we are witnessing record GST receipts month after month. The Indian stock markets have seen a huge spurt in trading volumes, and the indices (BSE SENSEX and NSE NIFTY) are at historic highs. A record number of new demat accounts have been opened in the past 18 months, and there has been many high-value IPOs raising huge amounts of capital from retail investors. The government has successfully disinvested the ailing national airline, Air India, and the Tata Group are going to be the new owners. This success should accelerate the pace of disinvestment of other state-owned companies like BPCL, CONCOR, SCI, Pawan Hans and others.

The government has also announced a National Monetization Pipeline (NMP), which will monetize the infrastructure assets of the government through divestments to the private sector. There are plans to attract investments to the tune of Rs 6 lakh crores (about US$ 85 billion) over the next four years. This is one the biggest investment opportunities for the private sector and is going to give a boost to all infrastructure industries. Logistics is going to be a major beneficiary, as there are plans for investment in ports, roads, pipelines, warehousing, etc. Therefore, there are exciting times ahead for our businesses.

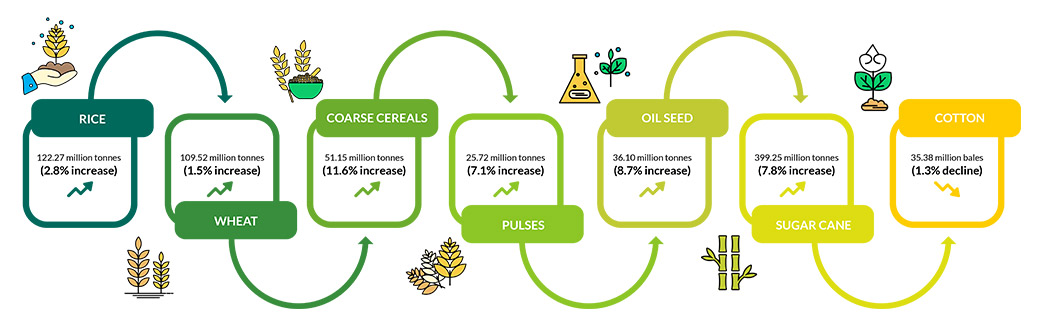

Agriculture is a major contributor to India’s GDP, with a share of 20% (compared to a world average of 6.5%). Farming in India is highly dependent on the rains, and we have been fortunate in having had good monsoons in the past few years. Agricultural production across all foodgrain categories in India has, thus, been rising. Here is the increase in the annual production of major commodities in FY21

We just experienced another late but very good monsoon in 2021 and our kharif foodgrain output this year is reached a record 150.5 MT, as compared to 149.56 MT a marginal increase compared to last year. Rice and pulses are again had a good harvest this season. This growth should provide a stable positive impetus from the rural areas also, which is good news overall.

Increasing spending and rising sales volumes, though, can lead to inflation, and we are already witnessing signs of rising prices in the retail sector. Retail prices for petrol and diesel are continuing to rise unabated. If not controlled, this inflation could become a big headache for the economy. The government has taken a few steps to combat inflation, including reducing the duty on petrol and diesel, which was announced in early November. Similarly, in October, the government announced a reduction in import duties on edible oils. Such proactive steps for the economy are welcome.

The last two years have also seen a huge spurt in price volatility across all commodities. By mid-2021, prices for most metals, iron ore, coking coal etc. were more than double the 2020 prices. Demand rose quickly, and many of the commodities were even reaching historic levels. However, as I write this, most of the prices have since come down and stabilised, which is another positive trend. Also, there has been news of shortages of thermal coal for power plants, shortages of urea for farmers and so on. However, the government has ensured that the supply chain is not being hampered, so all industries have been running with interruption.

Indian ports have reported high volumes across all cargo commodities. The 12 major ports, which handle 70% of India’s 1.3 billion tonnes annual throughput, had a huge increase in volumes in 2021. During the first nine months of the current financial year (April–December), the major ports experienced a 12.7% growth in volumes. Total cargo handled increased to 524 MT against 466 MT during this period last year. The maximum increase was for thermal and steam coal, which increased by 33% to 72 MT in the nine-month period. Also, POL volumes grew by 10.8% to 159 MT and coking coal by 6% to 37 MT, while iron ore shipments declined by 24% to 38.0 MT and fertiliser imports were down 39% to 5 MT. Container handling grew a whopping 27% in this period, from 6.4 million TEUs to 8.3 million TEUs.

Just to refresh memories, in early 2020, the price of crude oil went into free fall and was traded at negative costs in some transactions. Of course, this was followed by actions like massive chartering of VLCCs and Suezmax vessels for storage, etc. By May 2020, LNG spot prices had fallen to the lowest level in many years. Container lines pulled out tonnage in fear of a huge decline in demand for consumer goods and international trade. There were huge disruptions to trading, shipping and supply chains, which we are still living and coping with.

Now we seem to have come full circle, with crude oil prices not only having recovered but also beginning to touch high figures unseen in the recent past. VLCC freight rates, unfortunately, continue to hover around US$ 20k per day and spot rates are even down to US$ 4–5k. Dry bulk carriers did witness a spike in September, but that was very short lived and cape-sized vessels are once again available at US$ 25k per day. LNG vessels have been the biggest gainers this year, with spot rates quoted at US$ 260k per day in October. There is a similar story for the container market, as freight rates are the highest seen in decades. There is a huge shortage of shipping slots on major routes.

It is useful to analyse the implications of this sudden rise in crude oil prices. Will the inflationary pressure and rising prices lead to a slump in demand? Will the higher fuel prices force shipping companies to increase freight costs, with the resultant pain for traders? We have so many concerns about the effects of this sudden rise, and we hope that the international trading and maritime fraternity can restore the balance so that the negative impacts of these rises is avoided.

One of the biggest surprises has been container shipping. Hence, I’d like to give it a special mention. There have been continued shortages of slot spaces and the resultant rise in freight rates over the past year and half. All three major international trade routes, i.e. Asia– Europe, transpacific and transatlantic, are facing major disruption. These have occurred because many of the routes are congested and facing shortages of labourers, containers, and drivers for evacuating the containers from ports and so on. This has caused problem for voyages, with disruptions to voyage times, sailing schedules and feeder ship schedules as well as container availability mismatches and container pileups at the major trans-shipment points.

Disturbingly and unfortunately, this has affected India and India’s container trade and ports, as the major shipping lines have had to pull out some of their ships and containers to be deployed in other affected locations. Due to this, we are also seeing a shortage of containers. Despite these major problems and headwinds, EXIM trade is showing strong resilience and growth. Cargo is there and waiting for containers and slots. It is very likely that the major shipping companies will start new services or expand existing services. An exciting prospect is that Indian container ports will see the arrivals of larger ships, hopefully up to 14,000+ TEU capacity.

These are the positives, which we can all look forward to in the near future.

Dear friends and colleagues, we are entering 2022 with a lot more optimism and enthusiasm. 2020 and 2021 have been challenging, disruptive and confusing. Most likely, we all are going to refer to pre-2020 as the Pre-Covid era and 2022 onwards as the Post-Covid era. This phenomenon has been global and has affected everyone. During this period, we have developed closer partnerships with our customers and principals and have had many opportunities to provide critical assistance to them. Looking ahead, we are in a much better position to face the coming headwinds. We expect to see volume growth of at least 20% by the end of 2022. Yes, you read it right, 20%!

On this exciting and optimistic note, let me wish you and your family a happy, healthy and satisfying 2022 and let it be a year of sustainable and profitable growth.

Krishna B. Kotak

Chairman - J M BAXI GROUP