India is the sixth largest chemicals market in the world and the third largest in Asia. The industry has been growing at 1.3 times the country’s GDP in the past 10 years and the growth momentum is expected to continue in the near future. Rising consumerism in the domestic market as well as cost competition and proximity to many developing Asian economies are driving the increase of chemicals production in India. There is growing impetus from the government to make India into a production base for specialty chemicals and this drive has accelerated since COVID as Indian products have become accepted as high-quality chemicals in many Western economies. Exports of specialty chemicals such as dyes, pigments and various agro-chemicals have been growing at over 11% per year in the past 5 years and now account for over 50% of total chemical exports out of India.

India presently has a low per capita consumption of chemicals, which at US$ 103 is just one-tenth of the world average. In comparison, Singapore’s per capita is over US$ 3000 and China’s is US$ 1066. Improving the standard of living in India would mean unleashing demands for construction goods, consumer goods, automobiles and electronics, all of which would have a positive impact on the growth of the Indian chemicals industry.

This industry depends on up to 35–40% imports of feedstocks. Investments announced by various oil refineries and large petrochemical units may lead to this reliance on imports reducing to around 20%. However, it is expected that the Indian chemicals industry will grow from US$ 125 billion in 2018 to US$ 300 billion by 2025. This would mean India jumping from sixth to third position in the next 4 years. India’s port infrastructure is gearing up to handle this additional traffic of chemicals and other liquids. Liquid cargoes i.e. crude oil, petroleum products, LPG, acids, edible oil, chemicals etc are handled by most ports in India. There are 125 berths across all ports in India that can handle vessels up to the size of VLCCs, as listed in the table:

| PORT | NUMBER OF BERTHS |

|---|---|

| Budge Budge | 6 |

| Chennai | 9 |

| Cochin | 8 |

| Dahej | 3 |

| Deendayal | 6 |

| Ennore | 1 |

| Goa | 3 |

| Haldia | 10 |

| Hazira | 6 |

| JNPT | 5 |

| Kakinada | 2 |

| Karwar | 2 |

| Kolkata | 1 |

| Mangalore | 12 |

| Mumbai | 11 |

| Mundra | 4 |

| Paradip | 4 |

| Pipavav | 1 |

| Ranpar | 1 |

| Sikka | 13 |

| Tuticorin | 6 |

| Vizag | 11 |

| Total | 125 |

While some berths at large ports are dedicated to specific cargo types, like crude oil or petroleum products, others are multi-purpose berths and can handle most liquid cargo types, including oil, acids and other chemicals. Sikka with 13 jetties is the largest port for liquid cargoes and handles the highest volume of petroleum and other liquids. Deendayal Port (Kandla) handles the highest volume of chemicals. It has five jetties equipped to deal with edible oils and chemicals. Because of the petrochemical hubs in the states of Gujarat and Maharashtra, there is a high volume of chemicals passing through the ports in these two states. Already there are expansion plans for additional liquid cargo jetties at the ports of Deendayal and Dahej and JNPT in these states.

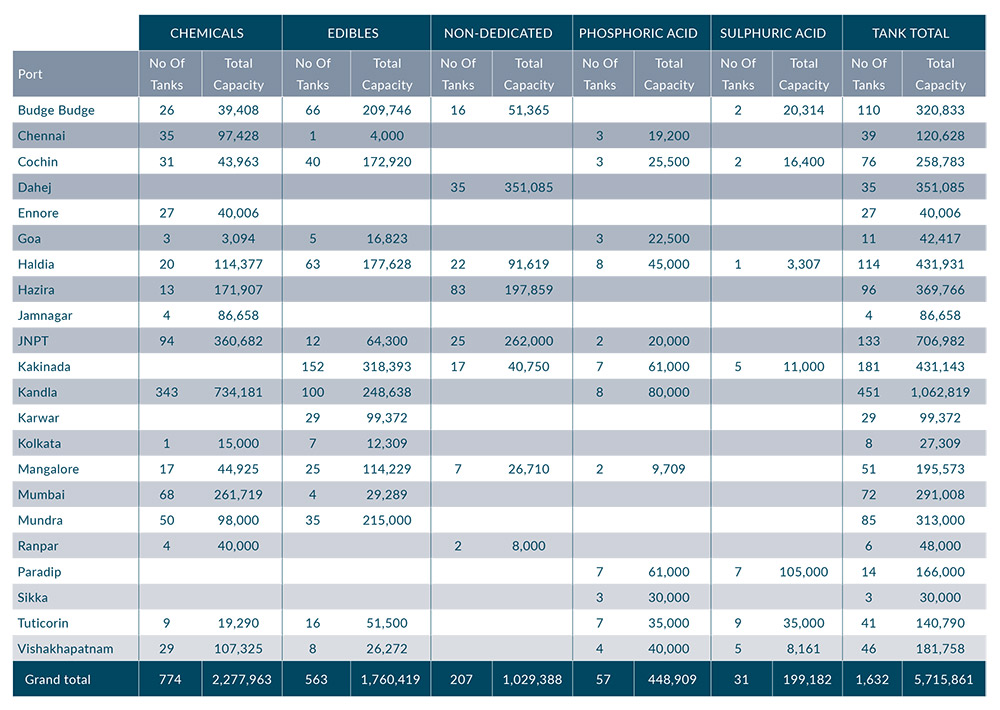

In addition to liquid cargo jetties, tanks at port locations are an important part of the supply chain. Limited availability of tanks for specialised chemicals can become a major bottleneck and there are numerous instances of vessels waiting for ullage or even suddenly changing port for want of adequate ullage. A summary of the tanks for edible oils, acids and other chemicals at all the relevant ports in India is as follows:

As can be seen from the table below, there is a total tankage of 5.7 million tonnes for these cargo categories, out of which 2.27 million tonnes is just for chemicals alone. Since another 1.02 million tonnes of tanks can handle multiple products including chemicals, the overall capacity in India for chemicals is about 3.3 million tonnes, which does not include crude oil or petroleum products.

Owing to its proximity to many chemical industries, Kandla has the most chemical tanks in India. It has 343 tanks with a combined capacity of 0.73 million tonnes for storing chemicals. These are operated by 17 different companies. The tanks around the country are managed by private companies with some built on private land in the proximity of a port whilst others are built on land leased by a port trust. All government ports in India have delegated the operation of tanks to private companies and there is healthy competition between them at most locations.

With the planned capacity expansion by many petrochemical units and chemical plants, there is a need for more tanks. Increased activity has already been witnessed in this sector. Some large international players have bought existing facilities at some locations. This trend is likely to continue as the demand for chemicals is going to grow in step with the growth of the nation’s economy. In addition to the tankage at ports, there are ongoing talks on building tanks in the vast hinterland of India. Presently most of the units in the deep hinterland have small, dedicated capacities and there are no common user facilities. Also many units prefer storing chemicals in ISO tanks owing to the smaller volumes as well as the flexibility offered by these tanks. However, this is an expensive mode of storage. With improvements to the logistics infrastructure in the hinterland, operating chemical tanks would be a viable business model at many locations.