International Cargo Terminals (ICT), as a container train operator, strives to provide best in class train services from ports to various locations and serve its industrial base in catchment area.

ICT currently operates 20 rakes on Indian railway circuits. Till a few months back, ICT had primarily focused on connecting its ICD, DICT with the western gateways of Mundra and DICT.

As a container train operator, we were earlier operating between western ports and north Indian ICDs. Now we are expanding services by adding more ports for the sector and spreading the same to the eastern coast of India.

Currently serving Delhi NCR from DICT Sonepat and Ludhiana using Kila Raipur via Mundra and Pipavav, we have recently added eastern coast services and the Kandla North India service to our portfolio, witnessing a diversity of service areas as a container train operator.

- Eastern Coast Services

By starting a service between Vizag port and Jajpur, ICT is giving options to the Orissa industrial belt for the usage of the nearby port, which will bring down their cost and transit time in comparison with JNPT (currently used port by major industries).

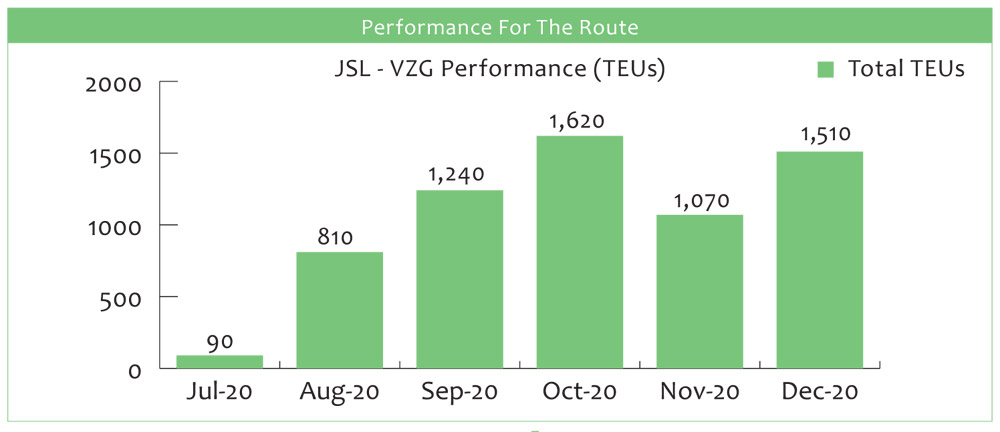

Movement was started from July 4th week with one rake for the route while the same has been increased to up to three services per week.

Odisha is the mineral hub of India and the largest aluminium, stee l and stainless steel producer in the country. It has the highest mineral production of INR 49,505.66 crore with 13.88% of India’s total value. Odisha’s rich min eral reserves constitute 28% iron ore, 24% coal, 59% bauxite and 98% chromite of India’s total deposits. Major companies like Tata Steel, Jindal Steel, V edanta, Hindalco, Raurkela Steel Plant, Visa Steel, Bhushan Power and Steel, Indian Metal and Ferro Alloys, National Aluminium Co., Balasore Allo ys, Tata Ferro Minerals are a few major industries of the state.

The state attracted Foreign Direct Investment (FDI) inflow worth US$ 605 million between April 2000 and March 2020 according to the data released by Department for Promotion of Industry and Internal Trade (DPIIT).

- The state can be divided into twelve industrially active zones / areas, namely:

- Rajgangpur (iron and steel, sponge iron, cement, secondary steel, melting and rolling mill and refractories and chemicals)

- Ib Valley (thermal power, sponge iron, refractories, and coal mines)

- Hirakud (aluminum and rolling mills)

- Talcher-Angul (thermal power, aluminum, coal washeries, ferro alloys, coal mines)

- Choudwar (ferro alloys, thermal power, pulp and paper, coke oven)

- Balasore (pulp and paper, ferro alloys, rubber industries)

- Chandikhol (stone crusher, coke oven)

- Duburi (integrated steel, ferro alloys, rubber industries)

- Paradeep (fertilizer, sea food processing, petroleum coke)

- Khurda – Tapang (stone crusher)

- Joda – Barbil (iron, sponge iron, ferro alloys, iron ore crusher, mineral processing)

- Rayagada (pulp and paper, ferro alloys).

Iron ore is abundantly available in the districts of Mayurbhanj, Sundargarh, Keonjhar and Jajpur. Chromite meanwhile is mostly available in Jajpur, Dhenkanal and Keonjhar districts, which are mainly in the central part of the state, which has an average distance of 600 km from Vizag port. With the upcoming railway line between Haridaspur and Paradip port, it will only be 82 km for Paradip port.

As customers of the area were mostly using JNPT port due to the availability of inventory and most frequent vessel slots, it was very tough to convince customers to try the new route via Vizag port, as major shipping lines started using the port but inventory and slots were still a problem for the route. Also, customers were using Vizag port only for road-bound movements as it was a faster way to move their cost and time-sensitive cargo.

Also, this model can provide store-to-door solutions for the customers of the region, which will be an add-on feature for customers to pursue for this service.

ICT, in coordination with Maersk Line, took it as a challenge and, after many discussions and an operational feasibility analysis, started the service between Vizag and Jajpur, where empty units were brought from Vizag to Jajpur area and loaded units were brought back to port. Maersk took an interest in this business proposition and jointly we provided an end-to-end solution to Jindal industries. This model is a success story now and, as a business partner, we may introduce this model to other customers in that area.

We are trying to explore other regions of the state for further expansion of rail services for Vizag port initially. Western zones, which covers Jharsuguda, Lapanga and Rourkela, have rich reserves such as aluminium and ferro alloys, and an average distance of 500 km from Vizag port, 400 km from Paradip port.

The southern part of Odisha, which covers Berhampur, Rayagada and Gopalpur, and has an average distance of 250 km from Vizag port and 280 km from Paradip port, has reserves such as aluminium, heavy minerals and ferro alloy, which need to be explored for movement.

Vizag port is also an ideal location for Hyderabad / Secunderabad, with an average distance of 650 km. Currently customers of the Hyderabad vicinity are using JNPT port for exporting and importing their cargo, but with regular shipping line inventory and services; this route can be explored and Vizag can be mapped as a major hub for the eastern coastal regions of India.

Vizag port is also suitable for handling cargo of other eastern states. Customers are currently looking for alternatives to Haldia port, as the port is having vessel berthing issues due to draft constraints. The draft at Halida port is 8 metres, which makes berthing of VLCC tough as the draft required by a VLCC is approximately 13 metres. The draft at Vizag port is 18 metres, which makes it more attractive for VLCC operators and shipping lines. Now Vizag has emerged as the major choice of shipping lines for handling EXIM shipments from the eastern coast.

Vizag port is handling cargo of Nepal by rake where CONCOR is currently handling rail movement between Vizag port and Birganj.

Paradip port is the ideal location for handling the cargo of Odisha and other catchment areas in eastern India, but services and slots for shipping lines needs to be worked on and materialized as Odisha is an export-driven market and from the shipping lines’ perspective JNPT port is still the more favorable choice due to the availability of vessel schedules and inventory for the sector.

At ICT we are striving to get these industrial areas on board with our state-of-the-art infrastructure at Vizag and Paradip ports, and to build a new business route together with industries and shipping lines for both infrastructure facilities.

- Kandla – North India Service

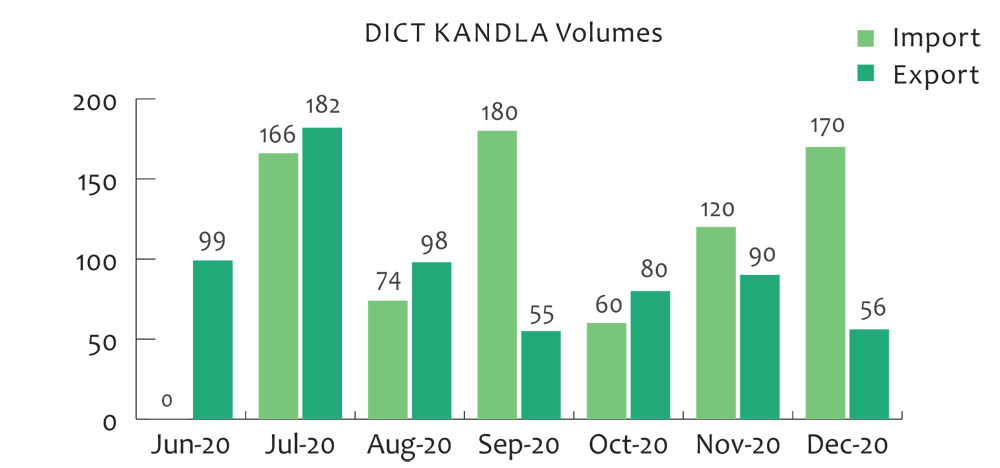

We started the DICT – Kandla service w.e.f. June 2020 and up to December 2020, DICT handled 770 TEUs imports and 660 TEUs exports for the route. Monthly volumes are as follows:Currently Prime Maritime, Win win and Radiant are using Kandla port for DICT-related movement. We are also having continuous discussions with other NVOCCs who are using Kandla port for their Gulf and Far East services.

We are also working on developing the Kandla–Ludhiana route, which might start w.e.f. April 2021, as a new route in the ICTs service arena.

At ICT we always try to build new routes and hope to add various new business routes during FY 2021–22.