It costs India roughly $10.5 billion in annual forex outgo, yet Edible Oil hardly attracts the kind of attention that crude oil, gold, mobile phones, coal and other big-ticket import items do. Just like petroleum, it is also shipped in tankers — typically Handymax/ Supramax vessels of 15,000 to 50,000 tonnes in capacity — and processed in giant refineries. But unlike regular “commodities”, it has strong regional patterns and preferences dictating its consumption. And most importantly, it’s indispensable to any meal even after being a rare food article that has a record of modest price rise in the recent times.

According to data of Euromonitor International, the Edible Oil category which had overtaken Dairy to become the largest packaged food segment a few years ago, has now grown to 25.6 per cent to cross the Rs 1.3 trillion mark in 2017. This is the first time any packaged food category item has crossed the mark. However, Edible Oil is largely imported in India; out of 20-21 million tonnes of annual consumption (next to China’s 34-35 million tonnes) about 14.5-15.5 million tonnes, i.e. over 65 % of it is imported.

Introduction

Traditionally, Indians have broadly used two types of edible oils. The first was ‘vegetable’ oil obtained from crushing local oilseeds — mustard in northern and eastern India; groundnut in Gujarat, Maharashtra, Karnataka and Andhra Pradesh; sesame and groundnut in Tamil Nadu; and coconut in Kerala – in what was known as “Kachchi-ghanis” (bullockdriven cold presses). The second cooking oil medium was ‘animal’ fat, mainly desi-ghee prepared from milk.

India’s monthly requirement is about 1.9 million tonnes and operates at 30 days stock against which currently holding stock of 2.662 million tonnes, equal to 42 days requirement.

Industry and Process

The first major market revolution came in 1937 when Hindustan Unilever (then Lever Brothers) launched ‘Dalda’. This was essentially vanaspati or hydrogenated vegetable oil. The purpose behind hydrogenation by adding hydrogen to convert unsaturated liquid fats into saturated solid fats was to harden and raise the melting point of the oil, which yielded a product mimicking desi-ghee. The higher melting and smoke point (at which the molecules start breaking down) made vanaspati better suited for deep frying than normal vegetable oils. The samosas and vadas fried in vanaspati were crispier. Cooking in vanaspati also extended the shelflife of food, which was a huge deal when only a few homes could afford refrigerators. Above all, it was cheap; even today vanaspati retails at under Rs 80 per kg, as against Rs 350 plus for ghee.

By the 1950s, many others from DCM (Rath) and the Sahu Jains (Hanuman), to Wipro (the company was originally Western India Vegetable Products Limited) had their hydrogenated oil brands. They all marketed it as “vanaspati ghee”, only to technically distinguish it from the desi-ghee (a la vegetable-fat based “frozen desserts” versus “real” ice-cream). The second major breakthrough revolution happened with the emergence of solvent extraction and refining. These processes, unlike normal expellerpressing and filtering, involved use of chemicals. While with mechanical pressing, only 85 per cent of the oil from groundnuts could be recovered, the use of a solvent (edible-grade hexane) could take it to 99 per cent by squeezing out even the residual oil in the expeller cake. The raw edible oil was further refined, i.e., de-gummed (to remove gums, waxes and other impurities), neutralised (to remove free fatty acids), bleached (to remove colour) and de-odourised (to remove volatile compounds) by treating with sodium hydroxide and other chemicals.

The first-ever solvent extraction plants came up during the late 1940s, mostly in Gujarat’s Saurashtra region, for extracting oil from groundnut cake. By the early 1950s, Ahmed Umar Oil Mills in Mumbai had also introduced refined groundnut oil under an iconic Postman brand. In 1962, a company called Foods Fats & Fertilisers Limited established a solvent extraction plant to produce oil from rice bran, a by-product of paddy milling. This was at Tadepalligudem in West Godavari district of Andhra Pradesh, considered a rice bowl. But the real solvent extraction boom took place much later with the extensive soybean cultivation in Madhya Pradesh, Rajasthan and Maharashtra from the late-1970s onwards. With this technology, you could process even low oil-bearing materials like soybean, rice bran and cottonseed cake, which wasn’t possible with mechanical pressing.

Market Take-off

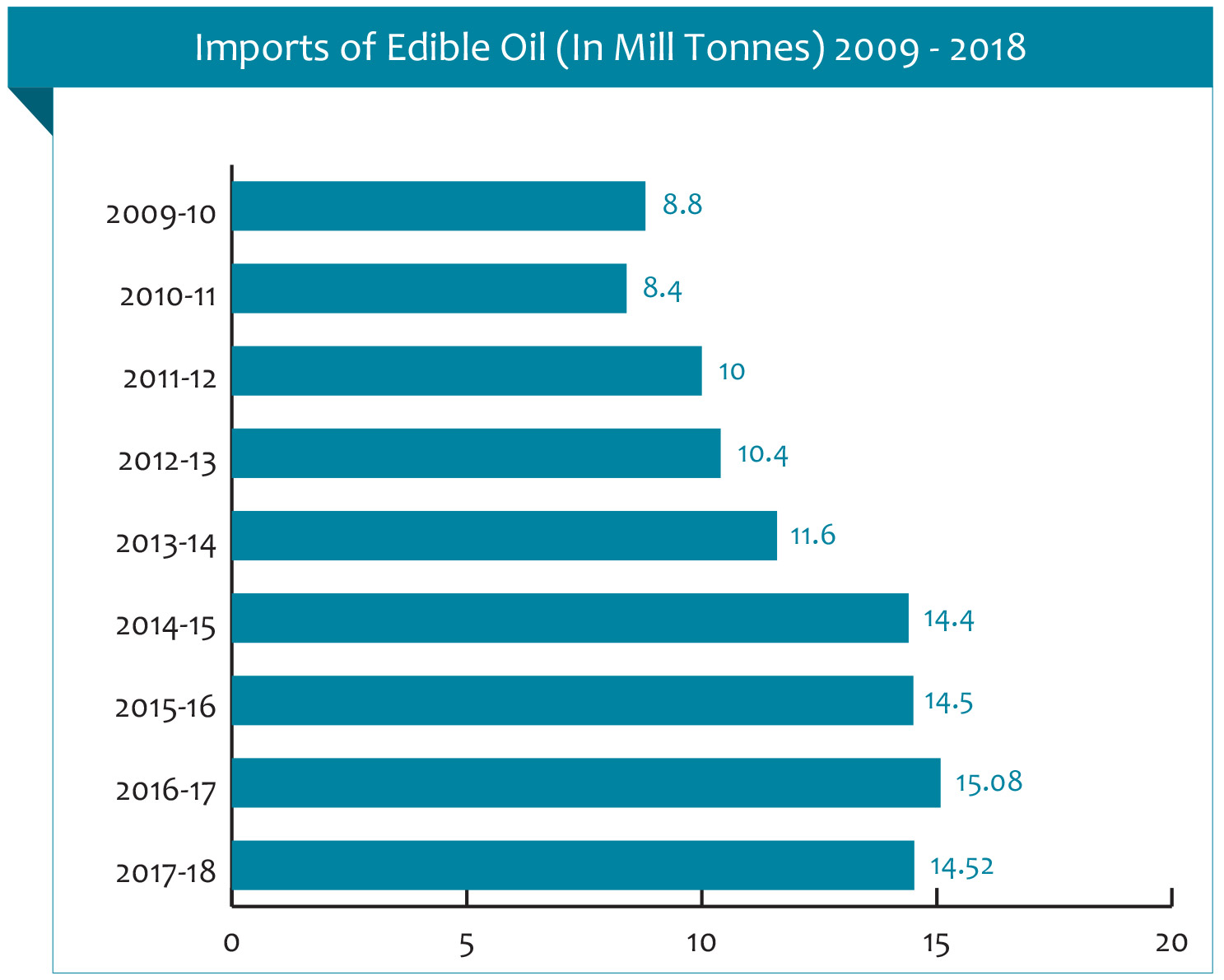

This period also coincided with the “Yellow Revolution” spearheaded by the National Dairy Development Board (NDDB). Acreages under mustard, groundnut, soybean, and also other oilseeds like sunflower and safflower rose considerably. Refined sunflower oil particularly saw an explosion of brands: ITC’s Sundrop, Hindustan Lever’s Flora, and Sweekar of Bombay Oil Industries (which also sold Saffola refined safflower oil). The NDDB too, had a range of both filtered and refined groundnut, mustard and sunflower oil, marketed in tetra-packs under the Dhara brand. In the early to mid-eighties, India was importing some 1.5 mt of edible oils a year. With domestic oilseeds production climbing from 12.65 mt in 1987-88 to 21.50 mt in 1993-94, the country became near self-reliant. However, all that changed with liberalisation. The third phase of the Indian edible oil saga is coterminous with the surge in imports, from just over 0.1 mt in 1993-94 to 4.2 mt at the turn of the century and 8.4 mt by 2010-11. In October 2018, oil imports totalled 14.52 mt, mainly comprising palm (8.50 mt), soybean (3.05 mt) and sunflower (2.52 mt).

Till April 1994, the import of edible oils was canalised through STC, largely as a matter of Government of India policy for catering to the consumption needs under the Public Distribution System (PDS) and for supplies to the domestic industry. The import of RBD Palmolein was placed under OGL, followed by the placement of the other varieties in March 1995. The volume of import started increasing rather rapidly thereafter. The nature of the industry itself has changed as a result of this huge shift to imported oils. Much of it today comprises not expeller or solvent extraction units processing domestically grown oilseeds, but mere refineries importing crude palm, soybean or sunflower oil. There are many corporates now - Ruchi Soya, Adani Wilmar, Cargill India, Bunge India, Liberty Oil Mills, Emami Agrotech and JVL Agro - each with annual refining capacities exceeding 0.5 mt and plants near ports such as Mundra, Kandla, Mangalore, Chennai, Krishnapatnam, Paradip and Haldia.

Evolution of Trends

While all this massive quantum of imports in tanker vessels may have turned edible oils into a “commodity” business, what is interesting is that it has not totally obliterated regionspecific consumption patterns and even local oils. Soybean oil, for instance, is predominantly consumed in the North and the East, but in both regions, mustard remains the first choice. Sunflower oil, by contrast, is popular mainly in the South. In the West, sunflower and soybean have become the major oils, yet not eliminated groundnut and cottonseed. Sunflower was already being grown in Karnataka, Andhra Pradesh and Maharashtra, just as soybean was in Madhya Pradesh. Consumers south of the Vindhyas and MP upwards, therefore, knew about the two oils. Imports only expanded the markets that domestic production had initially seeded.

That still leaves the mystery of palm oil: where is all the 9.5 mt going? Although some of it gets sold as palmolein through the public distribution system (especially in the South and states like Odisha), not even a third of the palm oil is directly consumed in home kitchens. “It is predominantly used by the food industry - for everything from mithais, namkeens, bread and biscuits to noodles - and quick-service restaurants. It is the cheapest oil and, moreover, amenable to deep as well as multiple frying. Vanaspati manufacturing, too, is now entirely based on palm oil” as pointed out by Mr. Chaudhry, who worked at Cargill’s vegetable oil trading desk at Geneva. Being cheap, palm oil makes an ideal choice for adulterating other oils, from mustard and groundnut to sesame. “It is a neutral oil, with no aroma of its own and can easily mingle with other oils. Whenever prices of other oils go up, you’ll see a spurt in palmolein sales, much of which is for so-called blending,” admits a refiner.

(to be continued in Issue XXV)