PSA International has recently opened a new containerhandling facility at Jawaharlal Nehru Port Terminal (JNPT) called Bharat Mumbai Container Terminal (BMCT) at Nhava Sheva.

JNPT currently has five container terminals — one run by the port trust itself, two by DP World, one by APM Terminals and this new one by PSA.

All four of the private terminals operate under different rate regimes. Their rates were set by the Tariff Authority for Major Ports (TAMP) after the cargo facility was constructed, usually by adding a percentage to the actual costs. These tariffs are revised every three years.

Thus, there are differences in tariffs based on the start date for operations at these terminals.

Moreover, each terminal has to pay a royalty share to the landlord port, which rises every year.

For NSICT, the royalty paid to JNPT is allowed as a pass-through in rates only to the extent quoted by the second-highest bidder in the public tender.

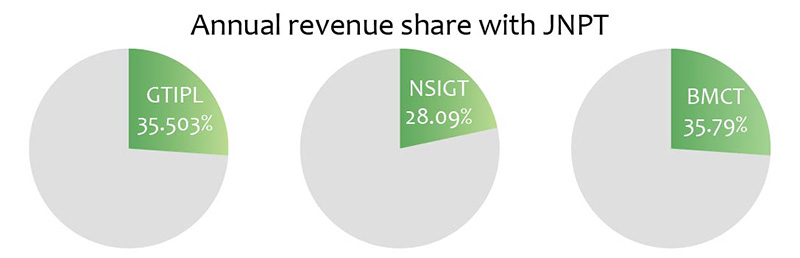

GTIPL, which started operations in 2006, follows the revenue-share model. It is contractually mandated to share 35.503 per cent of its annual revenue with JNPT and the revenue share is not allowed as a cost in setting rates.

In 2008, the government adopted a new rate regime for projects that were bid on from that date. NSIGT operates under the 2008 rate regime. It shares 28.09 per cent of its annual revenue with JNPT.

PSA’s BMCT will operate under this rate regime. It is contractually mandated to share 35.79 per cent of its annual revenue with JNPT.

Vessel-related charges are also different and are higher for NSIGT and BMCT.

IMPACT OF BMCT ON THE OTHER FOUR TERMINALS AND CFSs

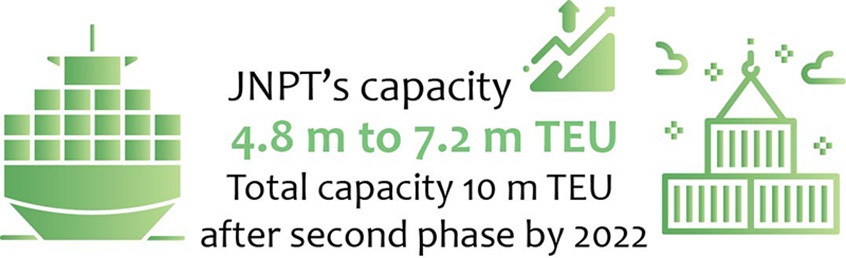

The opening of BMCT means there is more competition for the three existing terminal operators. Capacity had hit the ceiling before BMCT started operations, but now capacity has reached new levels. JNPT’s capacity will rise from 4.8 m TEU to 7.2 million TEU. On completion of the second phase by 2022, which will have a capacity of 2.4 million TEU, total capacity will be almost 10 million TEU. As of now, supply exceeds demand, but this positive side has its own challenges: demand must be built up to sustain and nourish the ecosystem.

Since there will not be a sudden surge in cargo, the impact as of now is that there are more options for trade and terminals cannot play a monopolistic role. The business and market dynamics will have to change and thus, terminals will have to reinvent the wheel to cater to the trade. Efficiencies will automatically kick in, since it will be a case of survival of the fittest. Strategic marketing activities will have to be undertaken by all the terminals at JNPT. Value adds will have to be devised to cater to the hungry trade. With Direct Port Delivery taking shape, terminals and CFSs at JNPT will have to be even more proactive to the market dynamics to gain longterm strategic customers.

BMCT is a comparatively a bigger terminal with a separate infrastructure and this will play a major role in decongesting the already congested Jawaharlal Nehru Port, which was a major hurdle for trade.

In fact, this is the right time for all four terminal operators at JNPT to turn the tables in their favour. Three of the current terminal operators have local experience and knowhow of local conditions, and BMCT will be learning and creating its own ecosystem.

It is over to the four giants to take it ahead.

There will not be a drastic increase in the volumes for the CFSs immediately, because the services that were calling at the other four terminals will start looking at BMCT to get better turnaround times for their vessels and thus, their cargo. Each main line operator will try to leverage this situation in its favour to cater to the trade.

Hazira

As per latest news, Essar Ports has said it will invest US$ 63 million (about Rs 4.5 billion) during 2018/19 in expanding the cargo-handling capacity of Hazira Port in Gujarat to 50 million tonnes, raising the company’s capacity to 110 million tonnes, a senior company executive said.

The current capacity of Hazira, an all-weather deepwater port, is 30 million tonnes. It serves the landlocked northern and northwestern regions of the country. The current operational capacity of the company's port terminals in India is 90 million tonnes per annum.

Hazira, 16 km from Surat, was just like any other village until a few years ago, but today Hazira is one of the most sought-after destinations for setting up industries.

Surat itself is a fast-developing city, but the development in Hazira has been phenomenal. At present, Hazira is home to several major corporate houses, including Reliance, Essar Steel, Essar Power, L&T, NTPC, Kribhco, ONGC, GAIL, IOC, HPCL, BPCL, IBP amongst others.

The oil and gas giant Shell recently established an LNG terminal at Hazira. Cairn Energy has also started operations here. Several other multinational companies have shown interest and are likely to set up facilities in Hazira in the next two to three years.

Investments worth of billions of rupees have been made in the area in various industries and the amount is likely to go up, as many more corporates are eyeing the region. Hazira is becoming the hub of industrial activity in the state.

Hazira's strategic location, with its proximity to both Surat and Mumbai, the two major trade centres of the country, has played an important role in its development. Hazira container throughput continues to grow steadily and new feeder and main lines have already started operations or are in an advanced stage of deploying. Hazira Port has been witnessing a positive trend with a steady growth of approximately 22 per cent.

Since Hazira has its own catchment area and an ever-growing industrial base, it will be difficult to shift its cargoes to Nhava Sheva. Thus, Nhava Sheva will have to come up with its own advantages and value adds to cater to the ever-growing west coast and more specifically the Mumbai market.