- India’s total trade with Bangladesh in FY17 was approximately 80 million tonnes, the majority of it carried by sea. The trade characteristics of Bangladesh are highlighted below:

- Approximately 92 per cent of the total seaborne trade passes through Chittagong Port.

- In FY17, the total volume handled at Chittagong Port was approximately 73.1 million tonnes (MMT) of cargo. About 60% of this was handled at anchorage and moved through IWT.

- The total cargo handled at a berth in Chittagong Port was 29.33 MMT, of which 23.80 MMT (approximately 81%) was in containers.

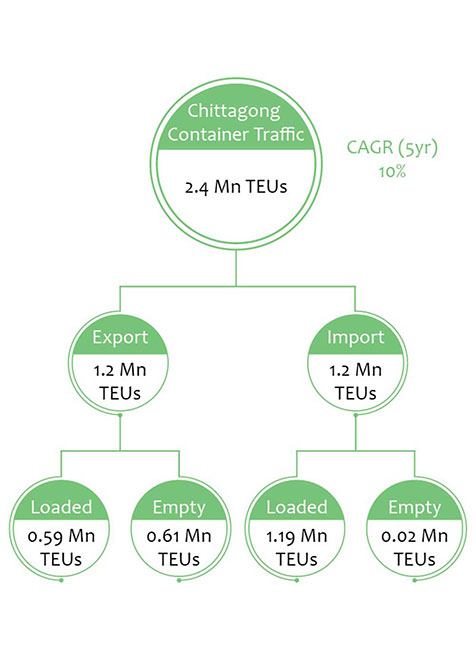

- This translates into 2.4 million TEU of containerised cargo. The total amount of container imports was approximately 1.2 million TEU and the total amount of container exports was approximately 0.59 million TEU, resulting in a negative trade balance.

- In Bangladesh, approximately 86% of exports were through 40-foot containers and 65% of imports were through 20-foot containers. As a result, huge numbers of 20-foot containers need to be repositioned.

- No direct-line calls are made at Chittagong, so the entire trade is routed through Singapore or Colombo ports.

Chittagong Port has not been able to keep up with the rapid growth of transport demand, resulting in delays and poor services to port users. The volume of containers handled has increased by over 10 per cent over the last decade and a similar or faster growth rate is projected for the foreseeable future. The port has not been able to respond effectively to the growth, resulting in heavy traffic congestion and delays.

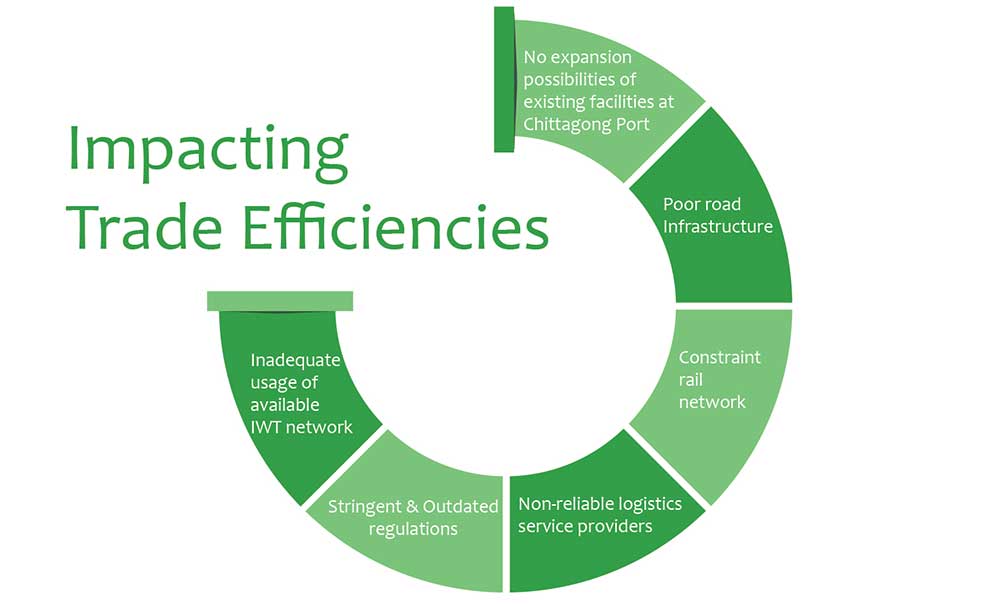

- The trade with Bangladesh is affected due to various system failings and an inefficient logistics infrastructure, as highlighted below:

- Chittagong Port faces challenges in terms of space and expansion possibilities, leading to inefficiencies.

- Approximately 70% of the containers handled at Chittagong Port originated from or are destined for the Dhaka region. The distance between Dhaka and Chittagong is only about 260 km and the N1 is the only highway that connects Chittagong with Dhaka.

- The N1 is four-lane single carriageway road and it takes a minimum of 8 hours to complete the journey. During the peak season, this time increases to more than 24 hours. Mr Tapan Chowdhury of the Bangladesh Textile Mills Association informed our team that due to a lack of certainty in road transportation, sometimes exporters miss the intended vessel and as a result they need to transport their cargo via air, which increases their costs many times.

- There is only one ICD in Kamlapur. Near Dhaka, it connects Chittagong Port via rail. However, the ICD at Kamlapur has been running close to its full capacity of around 70,000 TEUs for the last 5 years. No new expansion has taken place to increase the rail share.

- Mr Ruhul Amin Sikde, secretary of the Bangladesh Inland Container Depots Association, informed our team that ‘there are about 16 CFS located near Chittagong Port to support and decongest the port. However, all CFSs are running at more than 90% capacity utilisation. No new CFS are coming up because of the changes in regulations.’

- Bangladesh has a good river network, yet it has not been used efficiently till date for container transportation. Pangaon is the only inland container terminal near Dhaka. In FY 2017, it handled only around 11,000 TEUs, well below its capacity.

Dhaka based Ready Made Garments (RMG) Industry is keen to transship cargo via Haldia using IWT

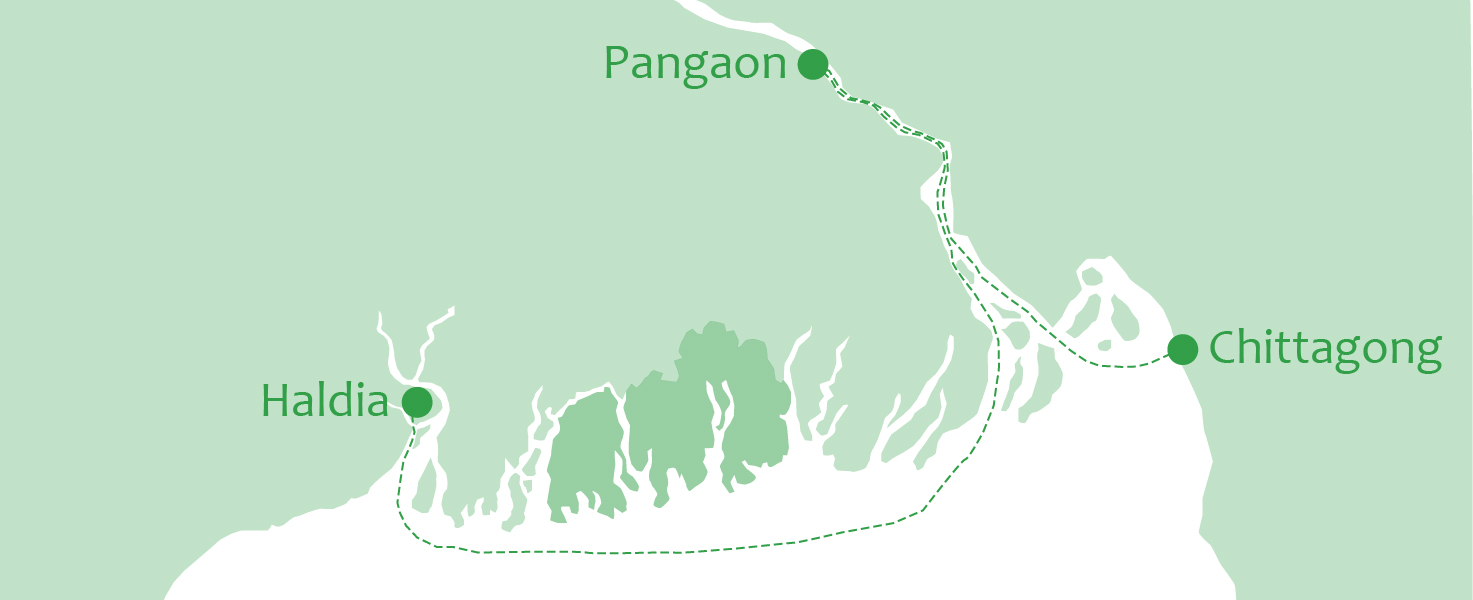

Our discussions with various Dhaka- based entrepreneurs indicated that the ready-made garment (RMG) industry is keen to solve the congestion issues by making use of the Indo-Bangladesh Protocol on Inland Water Transit and Trade (PIWTT). This agreement allows the direct transportation of cargo between Dhaka and Haldia through coastal vessels. Many of the entrepreneurs have shown an interest in sending or receiving containers through coastal routes to neighbouring India. Cargo can be trans-shipped from Haldia Port, as the port is well connected by reliable feeder services to and from Vizag, Colombo and Singapore.

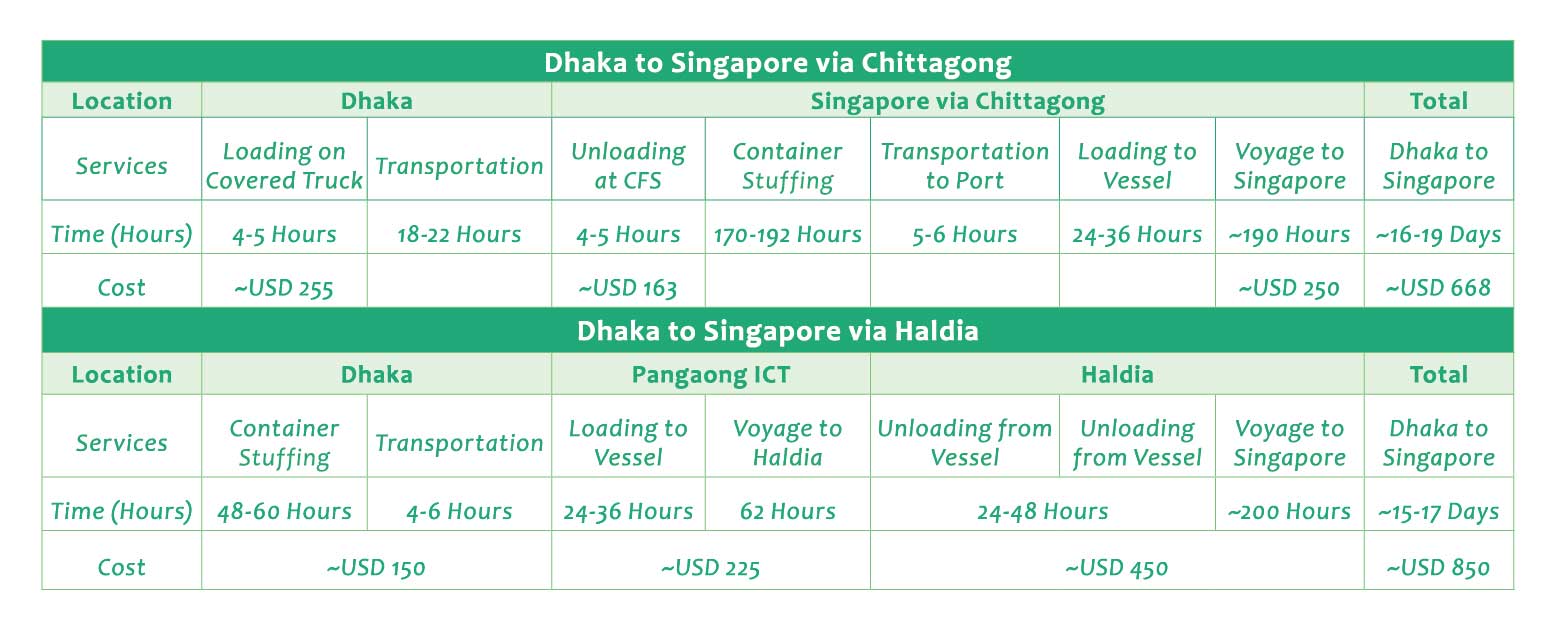

The following table compares the costs and times of sending containers from Dhaka to Singapore via Chittagong and from Dhaka to Singapore via Haldia.

Sending a container from Dhaka via Haldia increases the transport cost by around $160 but saves a significant amount of time. Mr Chowdhury told us that ‘saving two to three days is a big help for apparel makers who always lack lead time.’ The cost difference can be overcome through scale and the diversion of more feeder services. Apart from saving time, routing the trade from Bangladesh through Haldia can provide many efficiencies:

- The empties that are repositioned through Singapore can be directly shipped to India, thus reducing the cost of transportation.

- The Indo-Bangladesh trade through land stations can be routed by sea, thus reducing the total cost and time.

- The road and rail connections between Chittagong and Dhaka would become less congested and new capacity can be created.

Thus, using Haldia to trans-ship Bangladesh-bound cargo opens up new possibilities. HICT, a terminal operated by the J M BAXI GROUP, presently has a service every 10 days to Bangladesh. The terminal has a 432-metre-long jetty equipped with two Panamax rail-mounted quay cranes. The total area of the container yard is 45,000 sq metres (1436 ground slots). It is equipped with four rubber-tyre yard gantry quay cranes, three reach stackers and 16 internal transfer vehicles. HICT can provide scheduled services, better delivery lead times and a reliable service for the RMG trade with Bangladesh.

At present, Pangaon ICT is operational and there is service every 10 days between Pangaon and Haldia via MVKSL Pride, which has a capacity of 186 TEUs. So far, the industry has shown significant interest in the facility. There is still a need, however, to make more river terminals near Dhaka operational and to remove the few remaining administrative obstacles.