To track the arrival of samebottom cargo on ships at all Indian ports and for the safety and surveillance, Customs in India issued a notification (38/2018 Customs (NT)) dated 11 May 2018 through the Central Board of Indirect Taxation & Customs (CBIC). This stipulated norms for Sea Cargo Manifests and Trans-shipments and was to be implemented from 1 August 2018. However, implementation was deferred as it involved a major amendment to customs regulations and replacement of "Export Manifest Regulation, 1976" and "Transportation of Goods through Foreign Territory Regulation 1965". Eventually, since the Prime Minister's Office was deeply concerned about the risks to national security from the shipping trade and container shipping, another extension was not granted. The implementation date for the SCMT regulation 2018 was 1 August 2019. CBIC issued an amendment notification 54/2019 Customs (NT), calling the regulation the Sea Cargo Manifest and Transshipment (Amendment) Regulation 2019. As per the amendment notification of the regulations implemented on 1st August 2019, there was inclusion of the clause of transitional provision under which, first 45days trade was advised to follow the procedures as per the ice-gate 1.5 version system and in the next 45 days, new regulations system on trial parallel with 1.5 version system. The 90days time was given for completing the entity registrations, upgrading and implementing of systems software to be used for filling of arrival and departure cargo declaration compliant with the new regulations and the time line given was up to 1st November 2019, with a privileged to file IGM/EGM as per the 1.5 version of Ice gate.

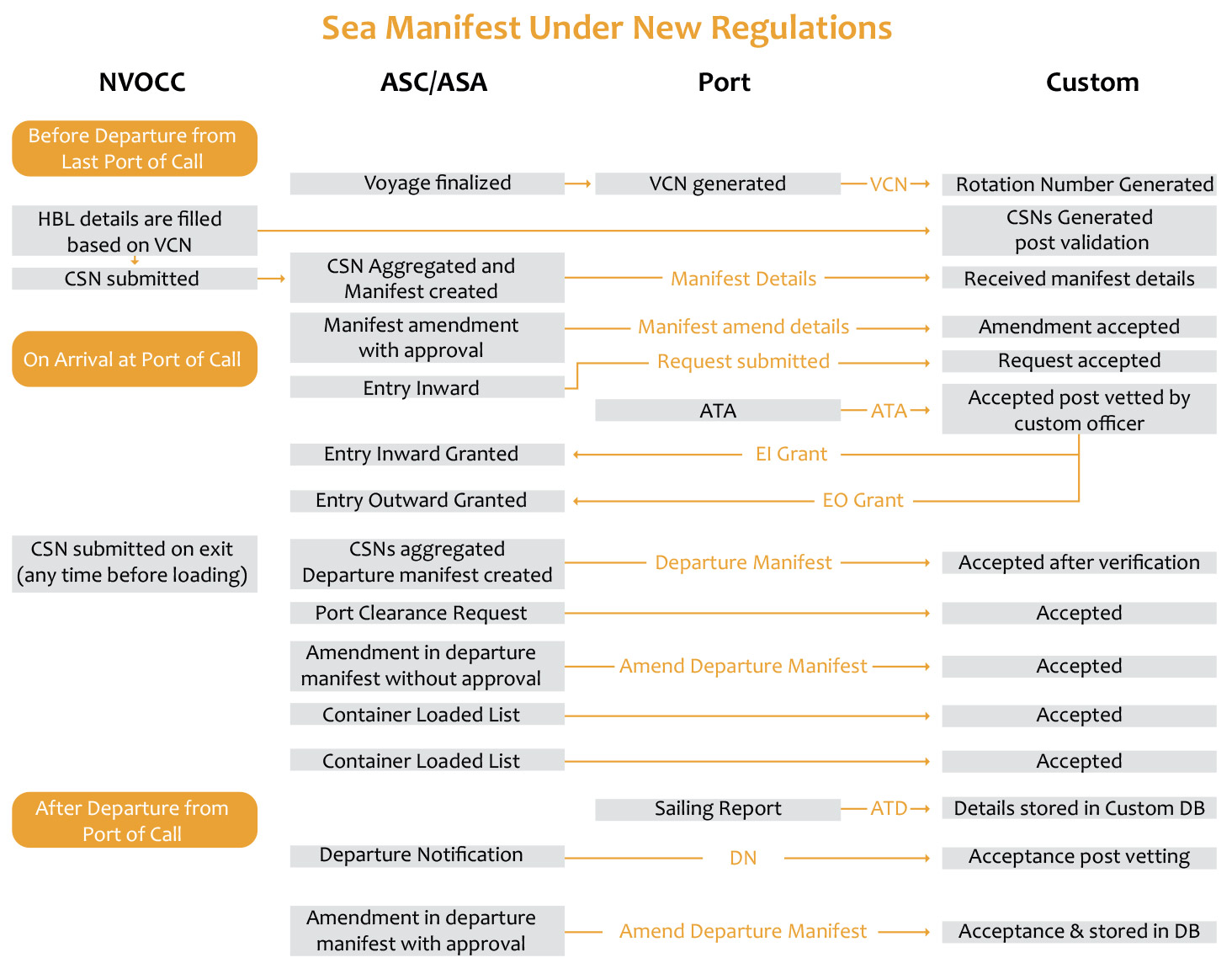

It is envisaged that the SCMT regulation 2018 as amended will produce a revolutionary change to the entire maritime industry within India, as well as for business partners all over the world in terms of business processes, the interactions between importers and exporters, reporting timelines and data requirements. All stakeholders will use a common platform, which will reduce transaction times and costs for handling goods. The advance intimation of arrivals and departures, the risk assessment as per the manifest declaration and the identification of all commodities with unique identifiers will enable end-to-end tracking. Vessels will need to declare details of imports, exports, same-bottom cargo, all cargoes in the vessel, passengers, crew, the ship’s store etc.

- SCMT Regulations 2018

All Indian Entities representing Master of the vessel or Authorised Sea Carriers or Authorised Sea Agents, The person acting as IEC Holders, Authorised Tran shipper, Custodian & Terminal operator before transacting the business under the new regulation, shall have to be registered under the new regulations & have to be approved afresh, by the proper officer, The approval is completely on-line and faceless , The application needs to be submitted on-line through ice gate portal and upgrade their systems as per the guidelines given in the new regulations within the time frame. J. M. Baxi & Co. has already registered all their branch offices at the respective ports with the Customs and shall be SCMT compliant prior implementation.

The website for IceGate (https://www.icegate.gov.in/ SeaManifestRegulation.html) has extensive information on how to register under the new regulation, on the user interface and on reporting cargo movements as well as technical guidelines and messaging guidelines

- To comply with the SCMT regulations 2018, the following basic processes must be followed :

- For imports, appoint an agent well versed with the new SCMT guidelines, prior to the vessel sailing from the load port, and file an arrival manifest well in time.

- For imports, send the information listed in Table 1 to the agent prior to the vessel sailing from the load port. Ideally, this information should be in the bill of lading, which also needs to be sent.

- For exports, send the information listed in Table 1 to the shipping agent at the Indian load port to facilitate filing of the sea departure manifest (SDM) with customs.

- For transit cargo or same-bottom cargo, send the information listed in Table 1 to the agent.

| Table 1. Information required | |

|---|---|

| Information | Notes |

| Shipper | Name, full address and contact details |

| Consignee | Name, full address, Indian GST no. and Indian PAN no. If the consignee is an Indian bank or a foreign company, the GST and PAN no. are not required. |

| Notify party | Name, full address, contact details, Indian GST no. and Indian PAN no. The IEC code of Importer, issued by the Indian government is mandatory for Indian companies. |

| Cargo | Description and quantity |

| HS code of the cargo | Mandatory, 6 digits |

| UNO & IMDG Code | Mandatory for HAZ and DGR cargo |

| Invoice value and currency code | Mandatory for Import and Export. Matter has been taken up with concerned authorities if submission of Invoice value can be exempted. |

| Crew list with personal details as prescribed with codes | If there are any passengers on board |

| List of crew personal effects with codes | |

| Ships Store as prescribed with codes | |

| Passenger list along with visa details | |

- Imports

This information is required prior to the sailing of the vessel from her last port. Presently, we can amend the details until the entry inwards (i.e. prior to customs boarding). Filing the manifest beyond the stipulated deadline could incur a penalty. The manifest may be called as SAM-Sea Arrival Manifest, SAM have to be filed at customs/port location where vessel has arrived, before sailing of the vessel from last port of call.

- Exports

Export documents have to be filed before sailing of the vessel from the port of arrival in India and may be referred as SDM( Sea Departure Manifest).

This implementation of SCMT 2018by CBIC is expected to enhance the ease of doing business and facilitate trade. Going forward, as the maritime world moves towards using a single digital platform this would make trade in India comply with international norms.