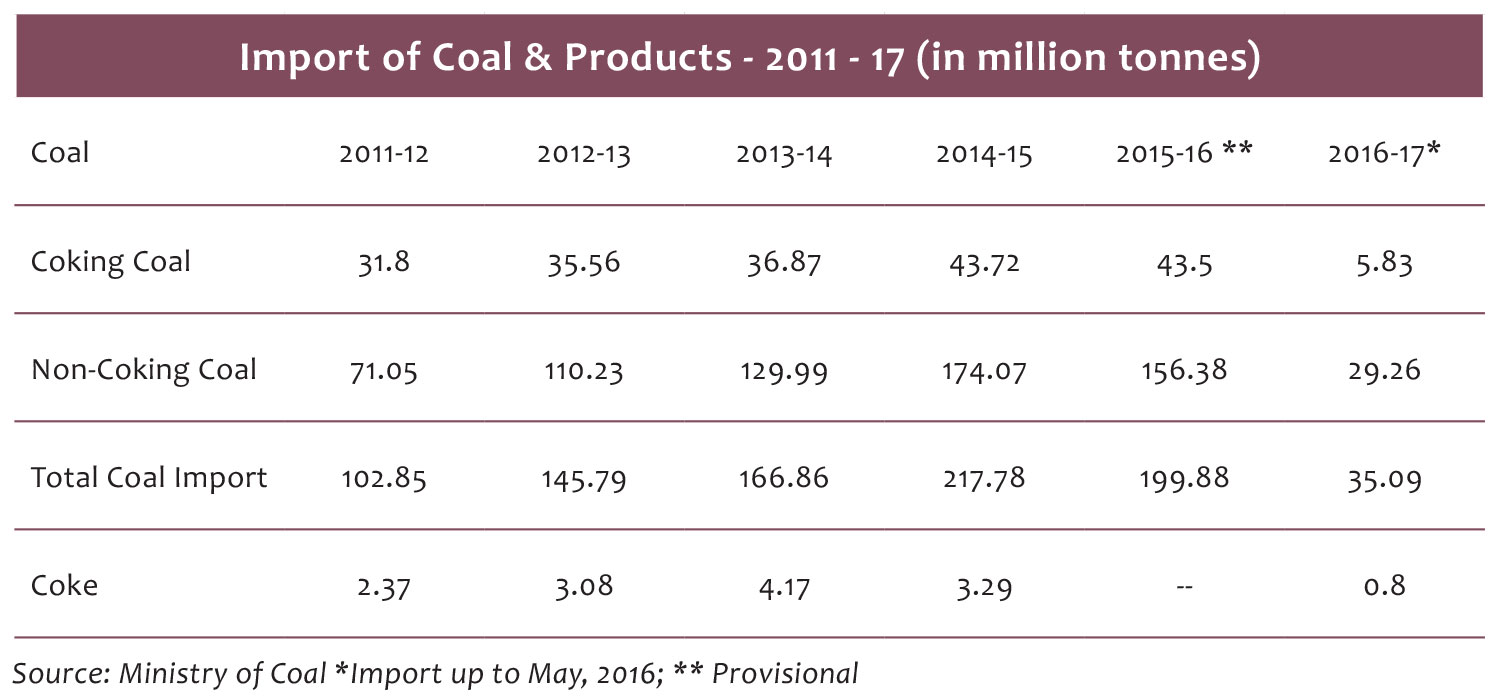

India’s coal imports have traditionally sought to satiate the humungous consumption appetite for this fossil fuel by user industries - thermal power plants, steel, cement, fertiliser, etc. that have seen rapid growth, from low threshold levels in the past. Growth of consumption demand for coal, as also coal import volumes, have surged and been quite substantial at about over 800 million tonnes. India’s coal imports had peaked in 2014-15, when it stood at a high of 217.7 MT and worth over Rs 1 trillion, almost making up a quarter of India’s total coal consumption. However, the quantum of coal imports has more recently, begun to shrink, despite increasing domestic coal consumption. In fact, India’s coal consumption has been the highest in the world in 2014 and still growing higher at a fast rate of 11.1 percent, as per 2015 edition of the BP Statistical Review of World Energy. The report noted that average global consumption of coal, in contrast, grew only by 0.4 percent and was lower outside the OECD countries, at just 1.1 percent.

To be sure, India’s coal imports have been declining in the last three years. After attaining its peak level in 2014-15 at 217.78 million tonnes, it has declined to 203.95 million tonnes in 2015-16 and further shrunken to 190.95 million tonnes in 2016-17. A number of factors have been impacting India’s coal import volumes, among them - the main one being the economic viability of sustained large-scale import of coal given its high global price. The price deterrent is particularly evident for India, as substantial shipping and logistics costs to end users make it even less competitive to import. Higher landed prices of thermal coal is also unviable for the coal users, as the largely government- controlled thermal power sector, also the largest of thermal coal user, is governed by regulated tariff and endemically suffers from an inefficient generation of power at low plant load factor (PLF). This is giving rise to a number of mixed trade and policy signals - including from the government, international coal suppliers, coal user industries and other stakeholders like Coal India, the state monopoly in domestic coal and largest coal producer in the world.

India’s economic case for coal imports has been fairly well established since long. India’s domestic coal production had lagged behind the growth rate in coal consumption demand - both at initial low thresholds of consumption in the past as also at substantially higher consumption level. For instance, India has a large fleet of coal-fired power plants and since 2011, the power generation capacity has increased from 100 GW, and now crossed the 300-GW mark, including 42 GW of renewable energy sources, i.e. solar and wind. India's total power generation capacity was 3,03,118.21 MW as on June 30, 2016, which includes 42,848.43 MW of non-conventional energy production, approaching 165 GW.

The persistent demand-supply gap of coal apart, a key driver of country’s coal imports have also been necessitated by the lower thermal efficiency of domestic coal, as also high ash content of domestic thermal coal, that present new environmental challenges. Diseconomies in “pit- hole to plant” logistics in India - both in terms of cost and transit times - large quantities of domestic coal having to be moved by rail or coastal ships, - further erode end user advantages in domestic coal.

Restructuring Coal Demand

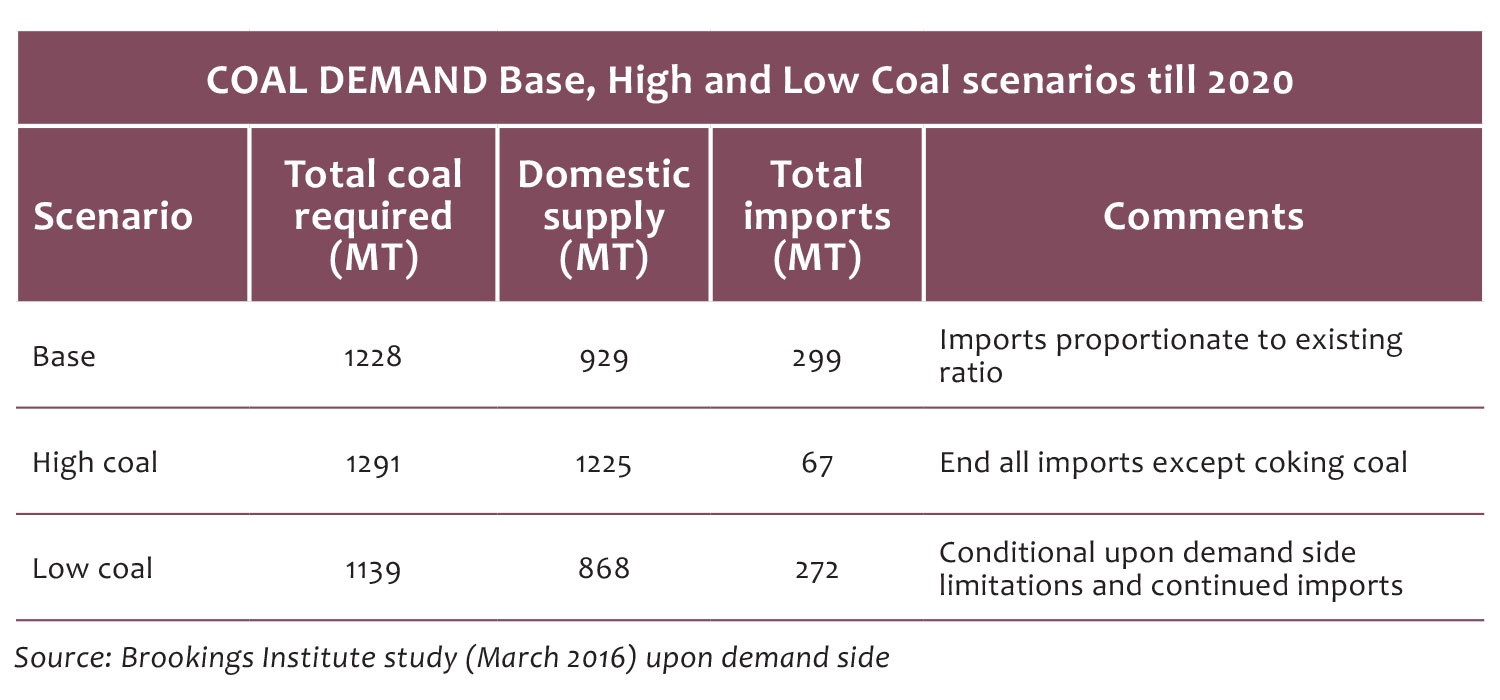

Over the past few years, a comprehensive policy effort is being underway to substantially transform and improve the working of the domestic coal sector. Raising the level of domestic coal output by Coal India and its subsidiaries (the target output fixed at 660 million tonnes for 2017-18 had been lowered to 600 million tonnes, due to poor offtake by the users) improving the quality of delivered coal through coal beneficiation (by adding on new coal washery facilities. Coal India and Bharat Coking Coal for instance, have recently agreed to set up 12 new coking coal washeries by 2019-2020) and revamping the conventional coal distribution system - from the erstwhile discretionary system of allocating coal linkages to now signing long-term Fuel Supply Agreements (FSAs) , following contractual bdding, incorporating timely delivery clause, at the user location - now form an important element of the sectoral reform exercise. Besides, deliberate structuring of the domestic coal demand - in terms of differentiating sourcing of coal by the hinterland coal users through Coal India Ltd. and coastal ultra mega thermal power plants from overseas suppliers, have helped optimise the distribution system, endemically affected by the poor railway network and timely rake availability.

Further as a part of energy security and environmental concerns on reducing the carbon footprint of the economy, an “energy mix” policy that seeks to tap and encourage fresh non-fossil based generation of electricity, through investments in solar and wind power projects have been initiated. Even while initial estimates of growth in coal consumption and quantum coal imports by India had been somewhat overstated; given the rapid-fire growth of private power sector and its substantial dependence on coal, relative advantages in terms of availability and price, coal will continue to play a significant role.

Indian Coal: Poor thermal efficiency and high ash content

Many of India's coal-based power plants are way below global standards in efficiency and several of them violate air pollution norms and are struggling to dispose of fly ash generated by them, a study by a leading NGO working in the environment sector has claimed. Centre for Science and Environment (CSE), in its two- year-long study 'Heat in Power', analysed and rated 47 coal- based thermal power plants on nearly 60 environmental and energy parameters and found that the sector scores poorly overall. The study claimed the average efficiency of the plants, it assessed, was 32.8 percent, one of the lowest among major coal- based power producing countries. It claimed that average CO2 emission was 1.08 kg per kWh, 14% higher than that of China. The study had found that plants were operating at 60-70% capacity only and if capacity utilisation is improved, the sector can meet additional power requirement without emphasising too much on building new plants.

Neither the gap between demand and supply of coal, can be bridged completely, as domestic availability particularly coking coal and demand from the large coastal power plants designed on imported coal feedstock will continue to keep importing coal.

India’s problems on coal front are however, largely vitiated by a number of supply-side issues. The international coal trade too has been experiencing great deal of churn, with the development of natural gas and other non-conventional sources of energy. The upcycle in the resources market, had further led to international coal prices peaking to an unrealistically high level of over USD 140 per short ton in 2011 while coking coal prices have shot up to USD 200 per tonne. These developments invited varied industry responses leading to industry and market consolidation and renewed global interest in coal, including by major users like China and India. In India, coal users have sought to reinvent their sourcing and trading strategies, including exploring new investment opportunities in coal mining overseas, Essar Group currently is venturing into Mozambique for hard coal and the Adani Group is expected to start work on its $16.5 billion Carmichael coal project in Australia. While these overseas forays are seeking to address the long-term supply issues, in the near term, India is seeking to also broad base its coal imports by tapping into more supply sources, to supplement major ones like Australia, Indonesia and South Africa.

One of the major factors that has affected the Indian coal buyers is the freight rates. Now with the freight rates so low, traders are trying out different coals from different origins, including long-haul sources like the US and South America. As a result of Columbian coal too has of late made inroads into the Indian market, as it's cheaper compared to the South African coal. While India's dependence on imports is particularly heavy on coking coal, which is an important ingredient in the steel- making process, there are signs of new trade being firmed up in pet coke as well from the US Gulf.

to be continued in Issue XX